A financial plan is like a business plan of your finances designed to help you control, plan, analyze and prepare plans for your future financial situation. It will help you to identify and manage risks, plan for success and minimize the effect that unexpected events can have on your life.

Business planning is the art of formulating a strategic plan for a start-up or existing business. It consists of estimating the nature and scope of activities, selecting appropriate strategies and tactics, preparing an implementation plan, and making provision for monitoring and reviewing progress. Creating a business plan is also a crucial activity because it will allow you to raise money by attracting independent investors such as financial institutions, venture capitalists or angel investors.

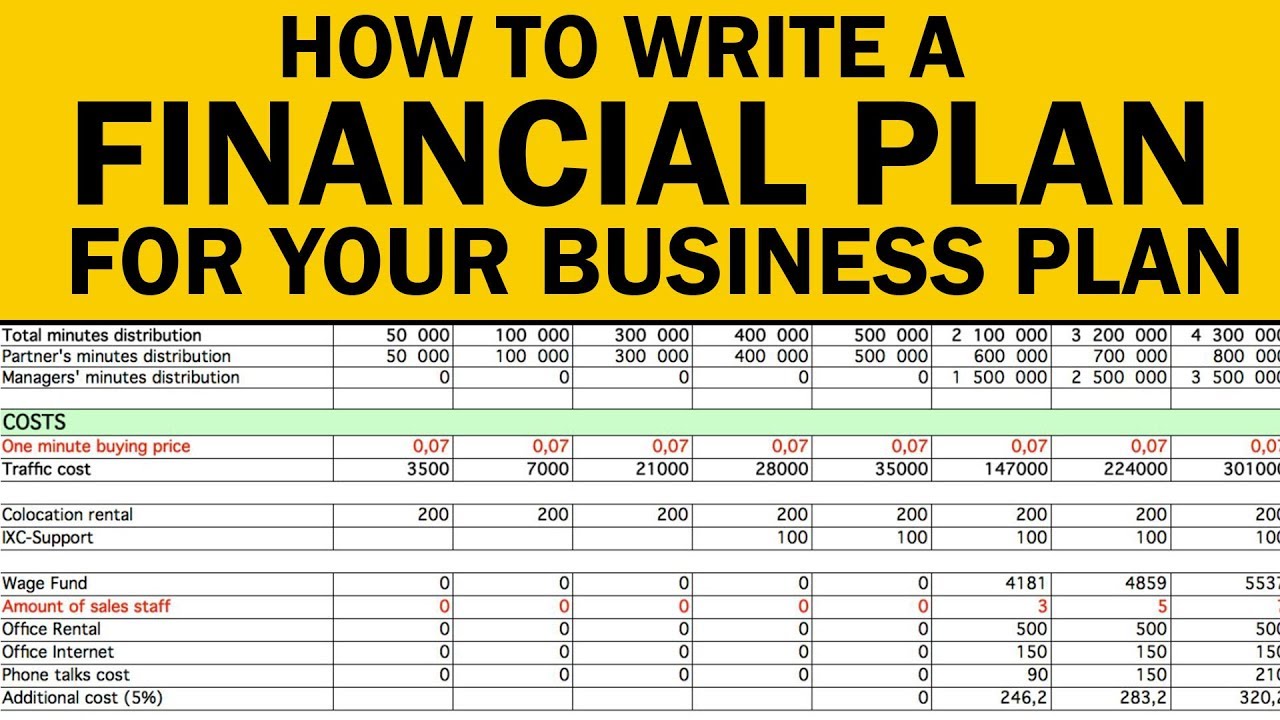

Simple financial plan for business plan

A financial plan is a document that describes how you intend to finance your business and lists the sources of funding you expect to use. It can be a short as three pages or as long as 100 pages.

The purpose of a financial plan is to:

Financial plan for new business

The financial plan for new business is a document that describes how you intend to finance your business and lists the sources of funding you expect to use. A good financial plan includes details about your estimated costs, projected revenue, cash flow and other important aspects of your business. It should also include a list of assumptions made in creating the forecast.

Financial plan in business plan example pdf

A financial plan provides an overview of your company’s current position and future goals. It outlines how much money you need to start up, run and grow your business over time. Financial projections show how much money you expect to make in sales, costs and profits over time based on your current sales forecast.

Financial Plan Example

Financial Plan for New Business

Financial Projections in Business Plan Example PDF

Financial plan for new business is one of the most important part of business plan. The financial plan is a forecast of your anticipated finances for a period of up to five years, depending on the type and complexity of your business. It should include both income and expenditure forecasts, as well as a cash flow statement which shows how much money you are likely to have in the bank at any given time during this period.

A detailed financial plan will show:

Income and expenditure forecasts – This includes gross sales figures, net profit estimates and fixed costs (including rent).

Cash flow projections – Shows how much money you are likely to have in the bank at any given time during this period.

An example financial plan for new business has been provided below:

Financial Plan

An investor will look at your financial plan to determine if your business has the potential to be profitable. This is a crucial part of any business plan because it can make or break your chances for getting funding.

The first thing you should do is create a balance sheet and an income statement. These two documents will give you a clear picture of your current financial situation, so that when you go to raise money, investors will know what they’re getting into.

You also need to show how much money it takes to run your business on a monthly basis and where it comes from. This is known as a cash flow statement. It shows how much money is coming in and going out each month, so that the investor can see if there’s enough cash flow to keep the business running smoothly (and profitably).

A financial plan is a comprehensive document that outlines the future of your business. It’s a tool you can use to track your progress and make decisions about how to grow and expand.

Financial planning allows you to create a solid foundation for your company. You can use it as a strategy for developing new products, increasing sales and marketing efforts or making organizational changes.

A good financial plan will give you a clear picture of where your business stands today, where it needs to be in the future, and how much money it will take to get there.

In this article, we’ll take a look at an example of how to build an effective financial plan for small businesses. We’ll also discuss how this type of document can help you make important decisions about running your small business.

Financial Plan Example

The key to a successful business plan is a solid financial plan. Your financial plan should include a balance sheet, income statement and cash flow statement, which will help you determine the viability of your business. Each section should be completed with projected figures for three years into the future.

Balance Sheet: The balance sheet shows your assets, liabilities and equity at a specific point in time. It’s important that you keep accurate records of your business’ transactions so that you can refer back to them when completing this section of the financial plan.

A sample balance sheet appears below:

Balance Sheet – December 31, 20xx

Assets Cash $10,000 Accounts Receivable $7,500 Inventory $9,000 Total Assets $26,500 Liabilities Accounts Payable $5,000 Notes Payable $2,500 Total Liabilities $7,500 Equity Retained Earnings ($18,000) Total Equity ($18,000) Total Liabilities & Equity ($26,500)

A financial plan is a document that outlines your business’s finances. It shows how much money you will need to start your business, what kind of revenue you can expect and how much profit you will make. It also includes information about cash flow, which is the movement of money into and out of your business.

In this section, you can find a financial plan example for a new business that will help you to create your own. It is important to remember that this is just an example, and you need to modify it according to your specific needs. A good financial plan is one that is realistic and achievable.

The following are some of the most important parts of the financial plan:

1) Income statement – This section shows how much revenue and profit your business will generate in different years. It also shows how much money you will spend on wages and other expenses during these years. You can use Excel or QuickBooks to create this part of the plan;

2) Balance sheet – This part shows the difference between assets and liabilities at different points in time;

3) Cash flow statement – This part explains how much cash will be available at different times during the year;

4) Projections – This section shows how much revenue and profit your business will generate in future years;

5) Financial ratios analysis – This part compares different aspects of your business with industry standards;

Financial Plan

The financial plan is one of the most important and complex sections of any business plan. It is an outline of how you will fund your business and what you need to do to achieve your goals. The financial part of your plan should include:

Financial statements – income statement, balance sheet, cash flow statement. These are the three most important financial statements in a business plan. They show how well your company is doing financially over a period of time. You should be able to produce these statements for at least the last two years if possible, but certainly for the last year.

Financial projections – three-year projection of sales, expenses, and profits; five-year projection if more than two years old; 10-year projection if less than two years old. These are also known as “what if” or “scenario” projections because they show what could happen under various scenarios such as increased sales volume or decreased sales volume or increased wages paid out by the company or decreased wages paid out by the company etc… The main purpose of financial projections is to see where revenue will come from in future years so you can see if it’s enough money to keep going!

Budget – monthly budget (if appropriate). A budget shows how much money

Financial Plan Example

Before you start writing a business plan, you need to know your financial situation. This includes your current assets and liabilities and how much money you need to borrow.

The following information can help you to create a financial plan:

Financial Situation Analysis

How Much Do You Need?

How Much Is Available?

Income Statement Estimates

Cash Flow Projections

This financial plan example will help you prepare a detailed business plan. It includes some common elements, such as cash flow projections, a break-even analysis, and an income statement. You can use this financial plan example as a starting point to develop your own plan.

This financial plan example is based on the information provided in the form above.

Income Statement: Sales Revenue Gross Profit Total Costs & Expenses Net Income Working Capital Current Ratio Debt-to-Equity Ratio Return on Assets Return on Sales Return on Equity Return on Investment Payback Period Break-Even Analysis: Sales Volume Required Income Statement: Sales Revenue Gross Profit Total Costs & Expenses Net Income Working Capital Current Ratio Debt-to-Equity Ratio Return on Assets Return on Sales Return on Equity Return on Investment Payback Period Break-Even Analysis: Sales Volume Required.