Search engine optimization isn’t just for small business owners. It can also be used to increase visibility of a website, or blog, for one specific industry. There are a lot of mortgage companies in the U.S. today that are missing out on potential business because they don’t understand the ins and outs of search engine optimization. The purpose of this article is to provide these companies with some information they can use to improve their website rankings so they can get more customers through the doors.

No one likes paying high mortgage interest rates month after month or having a hard time finding the right mortgage loan, affordable seo services for small businesses, most searched mortgage questions. This is especially true if your credit score isn’t the greatest.

Seo for mortgage companies

We are a seo company that provides affordable seo services for small businesses and mortgage brokers. We also provide most searched mortgage questions and mortgage broker

We provide the following:

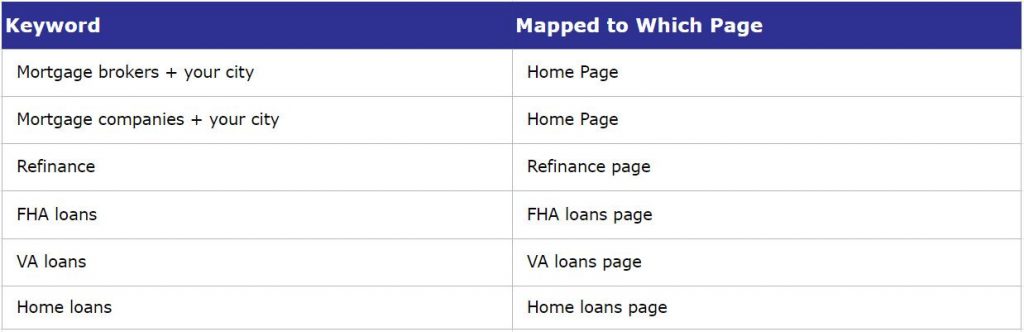

– Keyword analysis and research

– Competitor analysis

– On page optimization (Title Tags, Meta Descriptions, URL structure)

– Off page optimization (Link building campaign)

The mortgage industry is a competitive one. If you’re a mortgage broker, lender or real estate agent, chances are you’re looking for ways to stand out from your competitors.

What’s more, you probably want to attract more customers and close more sales.

That’s where SEO comes in.

SEO (Search Engine Optimization) is the process of getting your website or blog listed on the first page of search results when someone searches for your products or services. In other words, it helps people find you when they’re looking for what you sell.

SEO for Mortgage Companies

SEO is a relatively new concept to the mortgage industry. The majority of mortgage companies are still using old strategies to get their business in front of people. SEO has been around for years and it’s no wonder why some mortgage companies have been slow to jump on board.

What is SEO?

Search engine optimization (SEO) is the process of improving the visibility of a website or webpage in search engines, such as Google, Yahoo! and Bing. This can be done by incorporating keywords into relevant content, building backlinks, or creating high quality web pages that target specific keyword phrases.

Mortgage companies are in the business of helping people buy homes and mortgages.

Mortgages, like any other loan, are a means to an end. Mortgages are designed to help you achieve your financial goals.

The most common goal is to purchase a home, but they can also be used for other purposes such as refinancing or debt consolidation.

Mortgage companies provide a variety of services related to buying a home or refinancing an existing mortgage loan. These include:

Loan origination: The process of obtaining a new mortgage by submitting all the required documentation in order to receive approval from the lender and establish the terms of the loan agreement.

Loan servicing: The process of managing and collecting payments on existing loans that were originated by another lender or servicer (i.e., after closing). This includes communicating with borrowers about their finances and advising them on how best to use their money wisely so as not to default on any payment obligations (e.g., budgeting advice).

Most searched mortgage questions

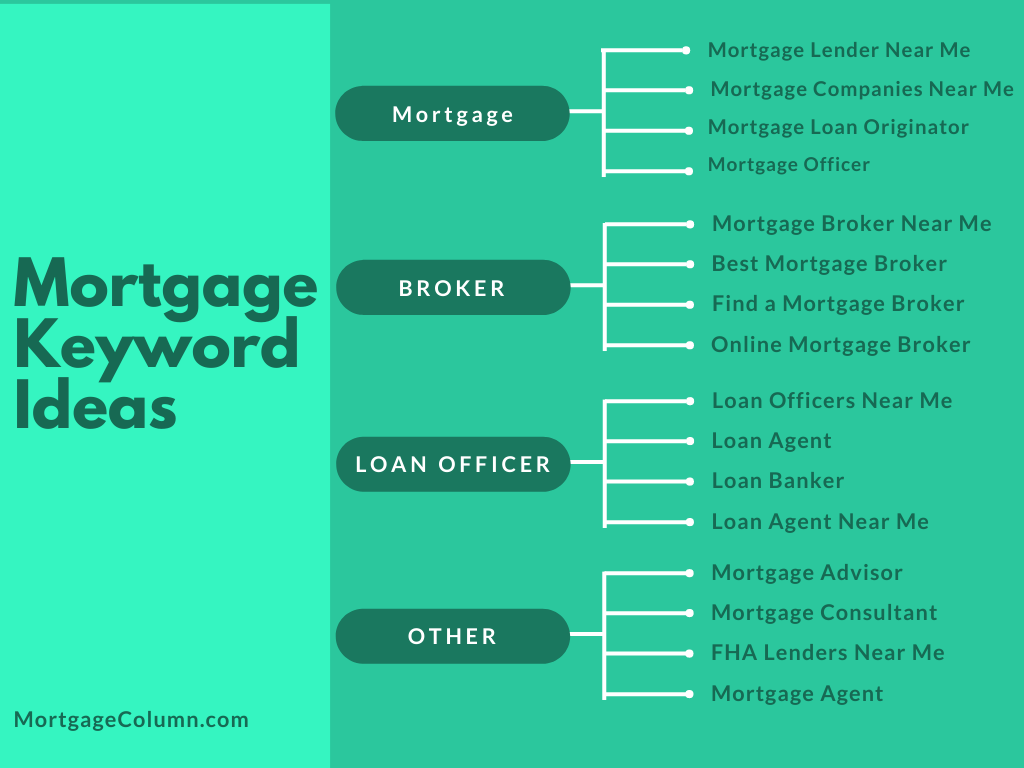

Mortgage Broker: The mortgage broker is a person or company that works with lenders to find the best possible loan for a client. Mortgage brokers typically work with multiple lenders, which allows them to compare rates and terms. Mortgage brokers do not normally provide the funding for a loan; they act as the liaison between borrower and lender.

Mortgage Rate: The rate that you pay on your mortgage loan is called your mortgage rate. Your mortgage rate is based on several factors, including your credit history, income, debt-to-income ratio and other factors such as housing costs in your area.

Adjustable Rate Mortgage (ARM): An adjustable rate mortgage has an interest rate that changes over time based on market conditions. Adjustable-rate mortgages typically have lower initial rates than fixed-rate loans, but the interest rate can increase after five years or so and reset periodically based on current market conditions.

FHA Loan: A Federal Housing Administration (FHA) loan is guaranteed by the federal government through FHA insurance programs. FHA loans are available to borrowers who meet FHA guidelines for creditworthiness, down payment requirements and property values.

Mortgage brokers are licensed lenders who represent both the borrower and lender. They help you choose a loan, then connect you with a mortgage lender who can provide it.

Why do I need a mortgage broker?

Mortgage brokers are licensed to help you find the right mortgage for your situation. For example, some brokers specialize in fixed-rate mortgages while others focus on variable-rate mortgages.

A good mortgage broker will ask questions to understand your needs and goals, then recommend the best products and services for your situation.

What’s the difference between a mortgage broker and a bank?

Banks offer loans directly to borrowers, but they aren’t always eager to sell new products or compete for business on price alone. Mortgage brokers work with multiple lenders who compete for their business every day — so they can shop around for the best deal for you.

What is the best mortgage calculator?

What is a fixed rate?

How do I get the best mortgage deal?

What can I afford to borrow?

Can I save money by refinancing?

What are the benefits of refinancing my mortgage?

What is a mortgage broker?

What is a mortgage broker?

A mortgage broker is someone who works as an intermediary between home buyers and lenders. Brokers are not employees of the banks or other lending institutions; they work for themselves or for agencies that employ them. Mortgage brokers generally charge borrowers a fee (generally 1%-3% of the loan amount) for their services, which means that they can offer qualified borrowers lower interest rates than they would have received without the broker’s help. Mortgage brokers can also help borrowers with the application process, which can be complicated and time-consuming without expert assistance.

How do I choose a good mortgage broker?

Mortgage brokers will usually tell you what kind of service they provide, but you should still ask questions before agreeing to work with one. For example:

– What kinds of loans do you specialize in? You’ll want to know if your lender offers only FHA loans or whether he also offers conventional mortgages so that you don’t waste time applying for something he doesn’t offer. If he does specialize in FHA loans, find out how long he’s been doing so and how many loans he’s closed recently; if he doesn’t specialize in anything specific, ask him why not