This blog is going to cover advanced SEO strategies that operators in the financial services industry can leverage to better compete in their space. This post will look at various off-site strategies such as link building, content creation and development, and guest posting.

The digital space is a growing part of the financial services industry, but not just for online brokers and discount investment services. Financial advisors have websites too. This can be a great marketing tool for growing trust, maintaining relationships, personal finance keywords, finance charges, finance keywords for linkedin, finance charge example

generating more revenue and ultimately growing your business. Just like you keep your office well decorated and well organized, you should also have a well-optimized website that reflects the quality of your financial advising services.

Seo For Financial Advisors

Personal finance is one of the most important aspects of your life. It’s a topic that everyone should be educated on and understand fully. If you’re an advisor, then it’s even more important to make sure that you’re providing the best service possible to your clients.

In order to do this, you need to know what they are looking for when they are searching for information online. This means knowing the latest trends in personal finance and making sure that your website is up-to-date with those trends.

There are several ways to create content for your website or blog that will help you reach these goals:

1) Write about topics that are trending on Google Trends like debt, credit cards, mortgages or home loans.

2) Write about specific questions people have about their finances based on what they search for online (ie: how much should I save each month?).

3) Create lists of resources related to personal finance topics such as books or blogs that can be used as references for clients.

In the financial services industry, you’re competing with a lot of other companies. The best way to stand out is by putting your focus on SEO. You can use the following strategies to get started:

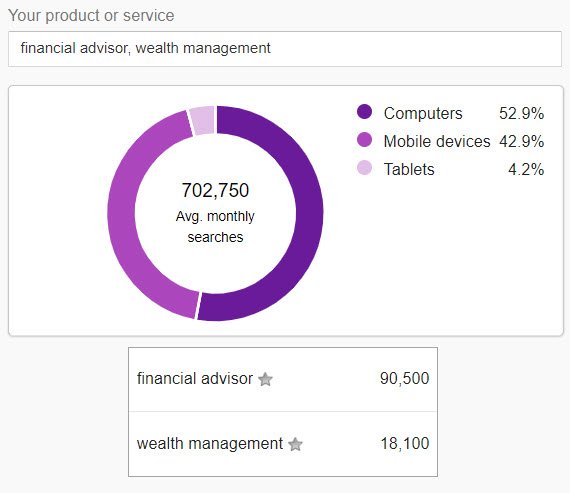

Keyword research – Use tools like SEMrush and Google Trends to see which keywords are most popular in your industry. Then, create content around those keywords.

SEO copywriting – Write articles that include keywords and phrases that people would search for when looking for advice about money management or retirement planning. Make sure to include these keywords in your titles and meta descriptions as well.

Social media marketing – Share your content on social media channels like Facebook, Twitter and LinkedIn, where it will be seen by more people who might need financial advice from a professional service like yours!

Local SEO – Make sure that your website is listed on local business directories such as Yelp and Foursquare so that people can find you near them!

Finance Charges

Finance charges are the fees you pay to use credit. They include interest and any other charges that may be associated with the amount you borrow, such as late fees or over-limit fees.

Finance charges are typically disclosed on your credit card statement, but they can also be found in the terms of a loan contract. If you have questions about finance charges, contact your lender or check out our guide to understanding your credit card statement.

Personal Finance Keywords

Personal finance is a term applied to the management of money and other valuables. It includes budgeting, saving and investing. Most people start their financial lives with little knowledge or understanding of personal finance. By the time they reach adulthood, they have accumulated many years of experience in managing their finances.

Personal financial planning is a process that involves setting financial goals and implementing strategies to achieve those goals. A personal financial plan is an organized approach to managing your finances that helps you achieve your goals and build your wealth. Financial planning helps you determine what you want to accomplish with your money and how much time it will take to get there.

Financial Planning Includes:

budgeting – creating a spending plan; knowing where your money goes and how much is left over at the end of each month

investing – putting money into stocks, bonds, mutual funds or other investments so that it grows over time (hopefully)

insurance – protecting against loss through policies such as life insurance or disability insurance

Personal finance is a broad term that refers to saving and spending money. It’s a way of budgeting and planning how you’ll use your money.

Personal Finance Can Be Divided into Three Categories:

1) Financial planning: This includes making sure you have enough money to live on when you retire, plan for major purchases like buying a home and car, and save for college tuition.

2) Investing: This includes buying stocks and bonds through mutual funds or exchange-traded funds (ETFs). Mutual funds are managed by professional fund managers, who decide which stocks to buy based on market trends and research. ETFs are similar but trade like a stock on an exchange; they’re more flexible than mutual funds because they can be bought or sold at any time during the day (as opposed to once per day).

3) Budgeting: This involves putting aside money each month for future needs or expenses so that you don’t spend it all now.

Finance Keywords For Linkedin

Finance is the science of money management, borrowing and lending. The word finance comes from French financer, which means “to make funds available”. Finance can be defined as the art of money management or a system of payment.

In finance, there are two basic types of loans — secured and unsecured. The secured loan is backed by some kind of collateral like a house or car. It’s called a collateralized loan because the bank has collateral in case you don’t pay your bill. An unsecured loan is one that doesn’t have any collateral backing it up. This type of loan is riskier for the lender because there’s no security to collect if you don’t pay back what you owe.

There are three basic types of financial institutions: commercial banks (which accept deposits from individuals and companies), investment banks (which raise money by issuing securities such as stocks and bonds to investors), and central banks (which control the money supply).

Finance Charge

The finance charge is the cost of borrowing money for a loan. It is usually expressed as an annual percentage rate (APR), and it includes both the interest rate and other fees. For example, if a borrower pays $500 in interest on a $10,000 loan with an APR of 10%, the finance charge would be 5%.

Interest Rate

The interest rate is the amount charged by the lender for lending money to a borrower. The interest rate can be expressed as a simple percentage or as a compound interest rate. The simple percentage is calculated by dividing the annual interest rate (APR) into 1, whereas the compound interest rate is calculated by multiplying 1/1+i (where i represents the APR). For example, if your APR is 10% and you pay $100 in interest on a $1,000 loan, then your simple annual interest rate would be 10% (because 100/1000=0.1). However, if your APR were 10% and you paid $100 in interest on a $1,000 loan while also making monthly payments of $50 over one year’s time (12 months), then your compound annual interest rate would be 9% ((1+0.1)/(12*52)) because your monthly

Finance Charge Example

A finance charge is an interest rate that is not included in the annual percentage rate (APR) of a loan. The finance charge may be expressed as a simple dollar amount or as a percentage of the principal amount borrowed. The concept of a finance charge was developed by the Consumer Financial Protection Bureau (CFPB) to prevent consumers from being misled by lenders who advertise low APRs on loans that carry high finance charges.

Finance Charges Can Be Calculated in Two Ways:

To determine the simple finance charge, multiply 100 by the result of dividing the loan’s principal by the loan’s term. If you borrow $10,000 for 24 months at 10% APR, your simple finance charge will be $100 times 24 months, which is $2,400. To put it another way, the interest rate on this loan is 2% per month.

The monthly compounding of the simple finance charge over the loan’s term constitutes the compound finance charge. If you borrow $10,000 over two years and pay it back at 2% interest per month, your total compound finance charge will be $6,000 ($100 * 24 * 5).