If you have an idea for a business, then you will need to write a business plan. Your business plan needs to be well thought out, organized and thoroughly presented if it’s to impress investors or persuade a bank to lend you money. I’ve helped many sources like yourself write a winning SBA loan business plan. The best way that I can help you is by showing you what goes into an effective business plan, which is exactly what this page does.

The SBA loan is a great resource for small business owners. You can use an SBA loan to purchase new equipment, renovate your building or make other improvements. You can also use one to acquire an existing business. This article explains how to write a business plan, free business plan template, how to write a business plan for a SBA loan.

How to write a business plan for a SBA loan

Writing a business plan is a great way to help you get your head around the important aspects of your business. It’s also an excellent way to make sure you have all the information you need for lenders, investors and others who may be considering working with you.

A business plan is a comprehensive document that can help you clarify your goals and direction, and outline how you’ll achieve them. By writing down your ideas, it will also help ensure that you don’t forget anything important, such as unforeseen costs or obstacles that might arise during implementation.

If you’re applying for funding from a bank or other financial institution, having a clear plan will give you an advantage over competitors who don’t have one. A good business plan will show that you’ve put serious thought into every aspect of starting your company and are prepared for whatever comes along in its future.

Startup Business Plan Template

A startup business plan is a document that you write to convince investors that your startup has a viable business model. It focuses on the goals of the company and its strategy for achieving them.

Startup business plans typically include a market analysis, financial projections, management team bios and other information that will help investors understand how the company will operate.

The following are some tips for writing a successful startup business plan:

• Be specific about your target audience and product or service.

• Describe your competitive advantage over others in your industry.

• Outline risks and opportunities that may affect your business’s success.

• Keep it short — one page or less if possible.

Free business plan template

A business plan is a written document that describes your business’s goals, capital requirements and operating procedures. It’s often used as a reference when applying for loans or grants or raising capital from investors.

If you’re starting a new business, writing a business plan will help you organize and present your ideas to potential investors and lenders. The process of creating the plan itself can also help you clarify your thoughts on what it takes to make your idea successful.

The most important part of writing a business plan is following the outline provided by the SBA (Small Business Administration). This outline includes sections on industry analysis, marketing/sales strategies, management team, financial projections and more.

The SBA recommends that all businesses create at least three versions of their plan: one for internal use only, one for external use with potential investors and one for lenders (if applicable). In addition to following their guidelines, here are some tips on how to write an effective business plan:

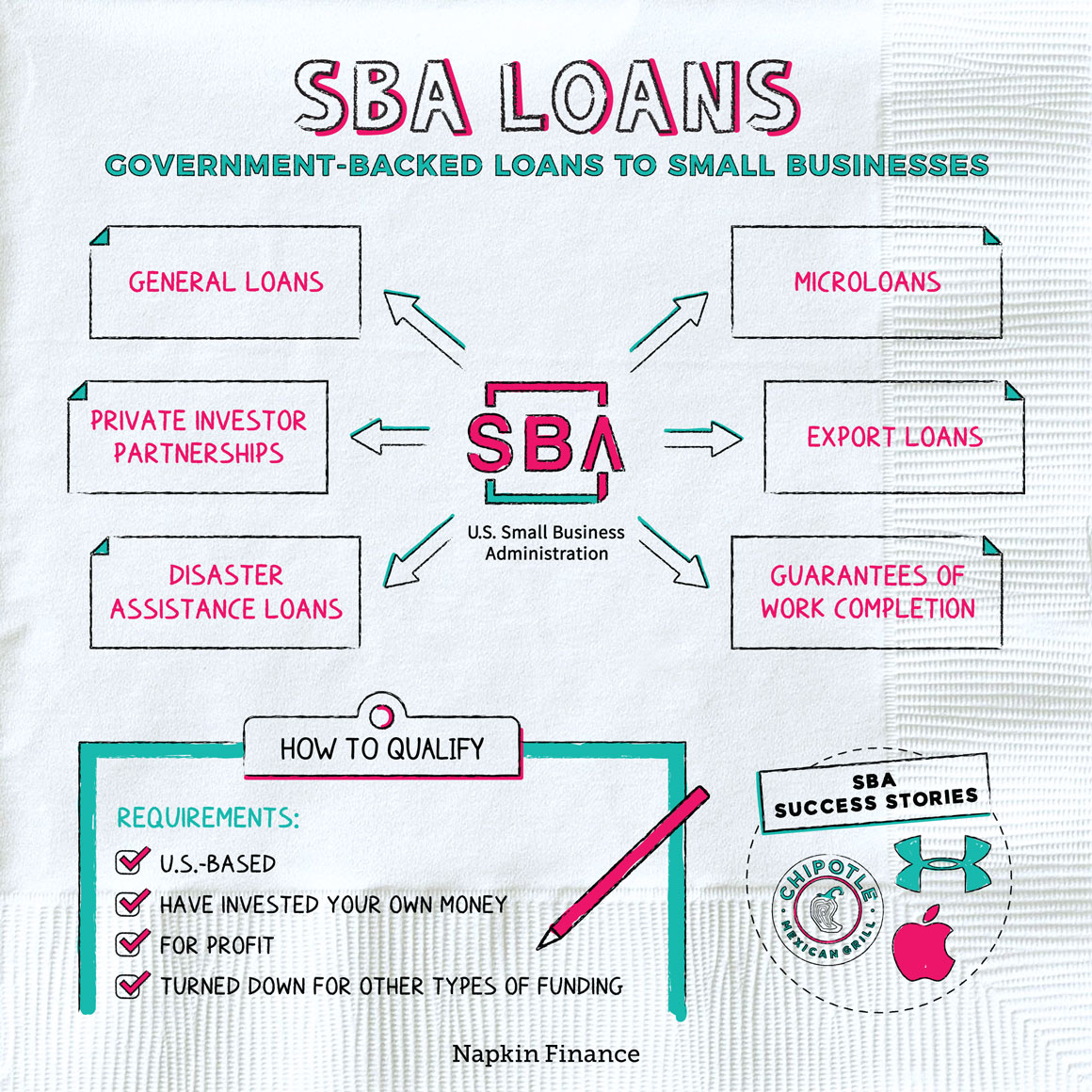

The SBA is the government agency that makes loans to small businesses. To be eligible for an SBA loan, your business must meet certain requirements. One of those requirements is having a well-written business plan.

If you’re applying for an SBA loan, here’s what you need to know about writing a business plan.

What Is an SBA Loan

The Small Business Administration (SBA) provides many different types of loans to small businesses in need of capital. These include:

Microloans: These are short-term loans with low interest rates and flexible repayment terms that help entrepreneurs start or expand their businesses.

Business Development Loans (BizDev): These provide long-term capital for working capital needs, fixed assets or real estate acquisition. BizDev loans typically have longer repayment periods than Microloans.

Express Loans: These are quick turnaround funds for small businesses that have no collateral and need cash quickly — say, to fix equipment damaged by natural disaster or fire damage. Express Loans are available nationwide through participating lenders and brokers who have negotiated special rates and terms with the SBA’s lender partners. The maximum amount available is $2 million per borrower per project; however, most projects range between $

The SBA provides many types of loans, including 7(a) loans, 504 loans and Microloans.

To apply for one of these loans, you need a business plan. It is important to have a well-written business plan when applying for an SBA loan. This is because it will help you understand your business better and make sure you’re putting together a solid application packet.

Here are five tips to help you write a good business plan:

1. Make sure your financials are accurate. The SBA requires accurate financial statements for each year in the past three years, including balance sheets and income statements. You must also include projections for the next five years. Having accurate financials will help the SBA understand how much money you need and how well your business is doing financially.

2. Write a detailed description of your product or service that includes who needs it most and why they need it most? Also include how much you charge for each unit sold, what competitors are doing with similar products or services, and how you’ll expand into new markets if demand increases significantly in the future?

3. Describe your management team’s expertise in marketing, sales, operations and finance (if applicable). Include resumes of key executives who can lead

How to write a business plan

A business plan is a road map for your company’s future. It describes your company and its products, markets, customers and competitors. It also outlines the strategies you will use to meet your goals.

A good business plan can help you get financing from banks or investors, attract employees and partners, win customers and make your dream of running a successful business come true.

Writing a business plan is not easy. It takes time, research and commitment to create a document that clearly states what you want to accomplish with your new venture. However, the effort is worth it because writing a plan can help you avoid costly mistakes and make sure that all aspects of your business are in sync with each other.