If you contact investors for venture capital startup funding, you need a business plan. This is an in-depth step-by-step guide to creating a business plan from scratch – from choosing a name and mission statement to finding investors. Along the way, we’ll share our advice on business strategy and how to communicate your value proposition. We’ll use our sample business plan template as framework for how to put together your own sample business plan.

This is a guide to making a good basic business plan. There are many different kinds of business plans including sales and marketing, for example. However, this article is about business plan for vc funding ppt, sample business plan for investors, the kind of business plan that VCs want you to use when trying to get them to invest in your venture.

How to make a business plan for venture capital

A business plan is a document that describes the company, its products and services, its market position, its finances, and its strategy. It helps you to raise capital, identify potential partners, and attract customers.

The first step in raising venture capital is to write a detailed business plan. This will help you to organize your thoughts about your company and also convince investors that you know what you’re doing. A good business plan should be clear and concise, with no wasted words or sentences.

Business Plan for Venture Capital Funding

Many entrepreneurs think that writing a business plan is an unnecessary waste of time because they don’t have enough information about their business yet. But the fact is that even if you don’t have all the details about your company yet, not having a clearly laid out plan can hurt your chances at attracting investors because it shows them that you aren’t organized enough to handle this much money responsibly; it also shows them that you haven’t thought through all the possibilities of what could go wrong with your idea before starting up.

There are many different types of plans available for different purposes: sales plans, marketing plans, financial plans etc., but they all have one thing in common – they describe how an organization intends to achieve its goals in

If you’re looking to get venture capital funding for your business, you’ll need a strong business plan that shows investors your company’s strengths, weaknesses, opportunities and threats. A business plan can help you clearly define your goals and objectives for the future of your company.

Choosing a Venture Capital Funding Strategy

You have several options when it comes to getting venture capital funding. You can go after angel investors or venture capitalists who provide seed money or early stage funding for startups. You can also ask friends and family members for money early on in your business’s life cycle — as long as they have enough money to give — or try crowdfunding platforms like Kickstarter or Indiegogo to seek out small investments from people around the world who want to support your idea and product development efforts.

Equity is one way to get venture capital funding, but there are other ways too. If you’re not interested in giving up part of your company’s ownership in exchange for money, consider taking out a loan from a bank or other financial institution.

Venture capitalists want to see that you’re capable of running a successful business before they agree to invest any money in it

When you are seeking investment from a venture capitalist, you will need to provide a detailed business plan. If you have already written your own plan, this is the time to polish it up and make sure it is ready for presentation.

If you are not familiar with how to write a business plan, there are a number of resources available to help you prepare one. You can find sample plans on the Internet or at your local library. There are also many books on writing business plans that can give you guidance and direction in creating one that meets the requirements of investors.

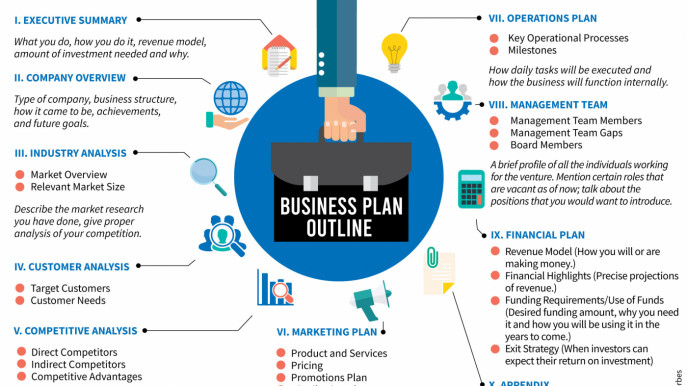

A good business plan should include:

The mission statement – What do you want to accomplish? What is your goal? This statement should be concise and straightforward. Use words that convey the meaning of your venture in as few words as possible. A good example might be “To provide customers with quality products at reasonable prices”

The product description – What kind of product or service will you offer? How unique is it? How will it benefit consumers? How much market share do you expect to capture within five years? What type of competition do you expect from established firms or from upstarts?

The marketing strategy – How will you sell your product or service? Will it be sold online only,

Venture capital funding is the lifeblood of any small business. It can be a source of capital for growth, expansion and even survival, but it’s not easy to get.

The best way to increase your chances of getting venture capital funding is to create a detailed business plan. This will help you understand the market, identify your target customers and set out how you will make money from them.

Here’s what you need:

A market analysis – You need to show that there is demand in the market for your product or service. You can do this by looking at competitors, analysing their products/services and identifying gaps in their offerings.

A SWOT analysis – This stands for strengths, weaknesses, opportunities and threats. It helps you identify your key strengths and weaknesses as well as any opportunities or threats in the marketplace.

An executive summary – Your executive summary should be short but informative enough that someone can read it and immediately understand what you do! Think of it as an elevator pitch – “In one sentence or less tell me what does my company do?”

A business plan is a written document that outlines the strategy and direction of your company. It’s a tool that can help you get funding, manage your business and grow.

A business plan is not just an idea or a wish list. It’s a concrete set of goals and specific actions that define how you will achieve these goals. It helps you establish priorities, monitor progress and make adjustments as needed.

Business Plan for Investors

Introduction

Investors are looking for businesses that can generate substantial returns on investment (ROI). The following business plan for investors is designed to show you how you can use the services of an investor who will help you build your business.

The purpose of this plan is to demonstrate how a large ROI can be achieved by using an investor’s capital as working capital. This plan is based on a real life example in which I used my own personal savings as capital and generated an annual ROI of over 300%. This plan shows how the same results can be achieved with the right strategy, knowledge, and tools.

Business Description

This business is designed to help investors make money without ever having to physically work in their business. The goal of this type of business is to attract investors who want to earn passive income without having to do anything more than provide startup capital. I will refer to these types of investors as “money makers”. They are NOT interested in doing any actual work themselves because they are too busy with other things like family or career goals. Their only requirement is that they get their money back within 3 years so they can use it again for another investment opportunity or retirement savings plan. In addition

A good business plan should include:

Problem statement — A problem statement should describe the need for what you are trying to provide. For example, if you are starting a small business selling organic dog treats because there aren’t enough options for dog owners who want healthy treats for their pets, your problem statement might read: “There are no local stores selling organic dog treats in our area.” This tells investors what problem you are trying to solve by creating this new product or service.

Product/service description — In this section, describe what makes your product or service unique from other similar products or services already on the market? What sets yours apart from others? What will make people want to buy it? How much will they pay for it? Will they be able to find it easily at their local store?