Aspiring entrepreneurs often write business plans, but many of them don’t realize that they may be eligible to submit their plan to a service like Marginized. Marginized is an online funding assistance company. It provides opportunities for advancing businesses by connecting companies with potential investors. There are companies willing to invest in your plan.

Would you like to submit your business plan for funding? Or maybe it’s already been rejected by various funding firms. The case could be that you’re just not presenting it correctly. We will look at why you are getting rejection and learn how to get the funds you want for your business. Learn how funding requirements and source of funds business plan example, funding requirements for business plan, to create a great business plan, tailor it right and present it so that investors line up to fund your dream.

Where can I submit my business plan for funding

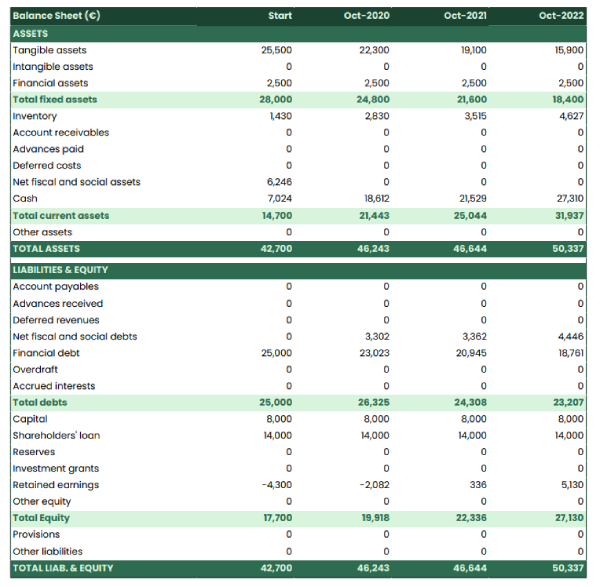

The financing section of your business plan should include information about the capital you need, who will provide it and how much they will invest. Your plan should also address potential sources of capital such as banks, angel investors and venture capitalists.

Funding requirements and source of funds business plan example

The funding requirements section of the plan is where you estimate how much money will be needed to get the project off the ground, and how you plan to raise that money.

If you’re seeking outside funding from investors or lenders, this section will likely contain a detailed breakdown of how much money is needed for each stage of development. If you’re self-funding, this section may include a general estimate for how much capital will be required to get your business up and running.

The funding source section shows exactly where those funds will come from and why this source is preferable over others.

You may also want to include an explanation of any risks associated with these sources in order to help convince investors that they are making an informed decision before committing capital.

This is a sample funding requirement and source of funds section of a business plan.

The company will require funding to purchase equipment and real estate, and to hire employees.

The following is a list of the specific items that are needed:

Equipment: $200,000 worth of manufacturing equipment

Real Estate: $75,000 for a small office space and warehouse location

Employees: Four new employees will need to be hired at an average salary of $35,000 per year.

A business plan is a written document that describes your business and its future direction. It details the products or services you intend to offer, your financial requirements and how you will use the funds you receive.

A well-written business plan is essential for any small business owner seeking external funding, be it from a bank or venture capitalist. It will also ensure that you have a clear idea of the direction in which your company will be heading, enabling you to make better decisions regarding product development and market expansion.

A good plan should include:

An executive summary – This should give an overview of what the rest of the document contains. It should also include information about key personnel involved in running the business, as well as other relevant background information about the product or service being offered by the company.

Business description – This section should include details about who your target audience is and why they would want to buy from you rather than from one of your competitors. You should also describe how much money you intend on investing into your company and how this investment will benefit both yourself and your target market. A description of any previous experience involved in starting up a similar type of business would also be useful here, along with a brief history on how quickly it grew over time (if applicable).

If you’re looking for a business loan, the first step is to write a business plan. A good business plan will help you get funding for your startup and keep investors informed of your progress. But it’s more than just an application. It’s a roadmap for your company’s future, so it needs to be well-written, professional and persuasive.

The best way to write a solid business plan is by following these steps:

1. Write down your goals. This is the foundation on which all else in your plan will be built.

2. Research your market and competitors to determine whether there’s demand for your product or service — and if so, how much?

3. Determine how much money you’ll need to get started and how much revenue you can generate over time (the break-even point).

4. Develop strategies to reach those goals — whether through marketing or sales efforts or both — with specific timelines attached to each one (and explanations of why those strategies are realistic).

5. Identify the resources needed to carry out those strategies: people, equipment, premises and so on (and where they’ll come from).

If you are looking to start a new business and need some capital, then you may be wondering where to start. While there are many different sources of funding available, it is important that you do your research first so that you understand the process and requirements for each source of funds.

You can search for various sources online or through local government agencies such as the Small Business Administration (SBA). The SBA offers a variety of services including low-interest loans, grants and counseling programs.

Funding Requirements for Business Plan

The following is an example of a Funding Requirements section from a sample business plan: Funding Requirements – The initial capital required to get this company up and running is $500,000. This amount covers all startup costs from initial website development to marketing materials. After that point, our goal is to reach profitability within 12 months. At this point we will begin paying back our investors with a 10% interest rate on their investment amount.

In order to get funding, you will need to write a business plan. A business plan is a document that describes your company’s goals and how you plan to achieve them. It also includes information about the products or services your company will offer and how they will be priced.

Business plans can be used for many purposes, including:

1. Raising capital (funding)

2. Getting financing from banks or government agencies

3. Marketing your business’s products or services to customers