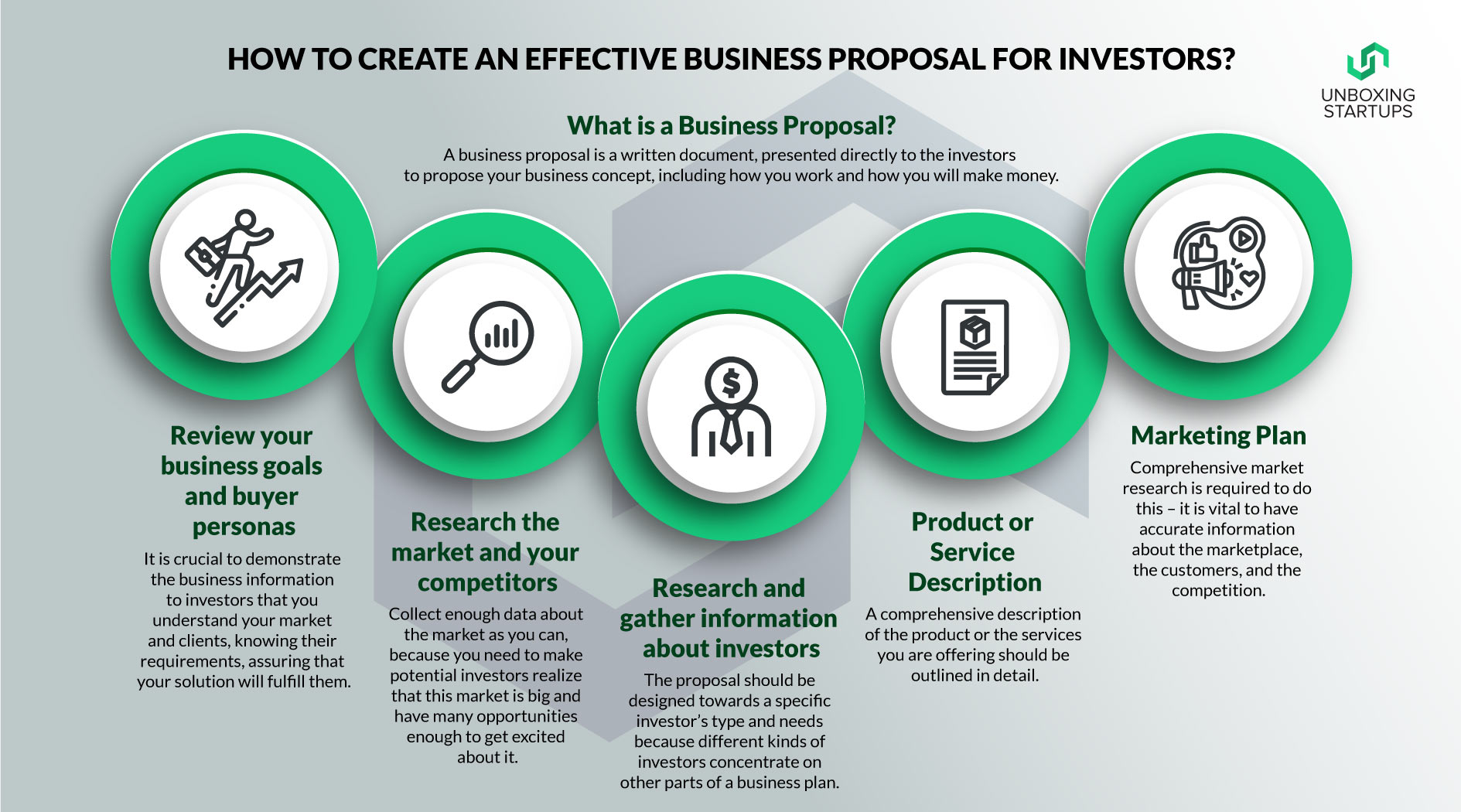

A business plan is a written document to tell others exactly what you have in mind for your business and how you plan to start, run, and grow it. You’ll want to be prepared to answer all of your potential investors’ questions, and write a convincing business proposal that focuses on their needs.

Are you reading this before starting a business? Keep reading, action-taking is necessary when creating a business plan. Are you reading this after starting a business and want to know how to approach investors? Keep reading as well as your way to getting funding. For investors, this blog post will help you understand the business plan examples doc, business plan template free, basics of how a business plan should look like.

What to include in a business plan for investors

A business plan is a written document that describes the goals and objectives of your company, as well as how you plan to achieve them. A business plan is a must for any company that seeks funding or partners with other businesses.

In addition to providing you with valuable information about your business, a business plan gives potential partners, investors and customers an overview of what you have accomplished so far, where you intend to go in the future and how you intend to get there.

Business plans can be used for many purposes

To obtain financing from banks or venture capital companies. Most banks require entrepreneurs seeking loans to submit a detailed business plan before they will consider making an investment in their company. Banks generally want to see that applicants have thoroughly researched their target markets and have developed a solid financial strategy for growing their businesses.

To attract investors who may be interested in buying equity positions in a company (stock ownership). Investors typically want to know what kind of return they can expect on their investments and whether or not they should invest their money elsewhere instead.

To help management make decisions about staffing levels and product pricing strategies by giving them concrete information about market conditions and trends within the industry at large

A business plan is a written document that explains what your business does, how you plan to run it, and how you’ll make money. It also includes financial information and any other relevant details.

Planning ahead is a crucial part of starting any business. Without a solid plan, you won’t know where to begin or how to achieve your goals. The more detailed and thorough your business plan is, the better off you’ll be.

Your business plan can be as long as 20 pages or as short as one paragraph — it all depends on what kind of information you want to include in it. But no matter how much detail you provide, the most important thing is that it gets read by investors and potential customers alike.

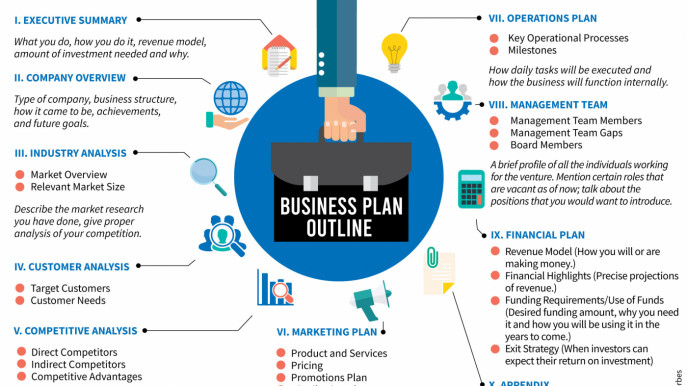

What should be included in your business plan

The following are some common elements included in most business plans:

You can have the best idea in the world, but if you can’t explain it well in a business plan, investors will pass.

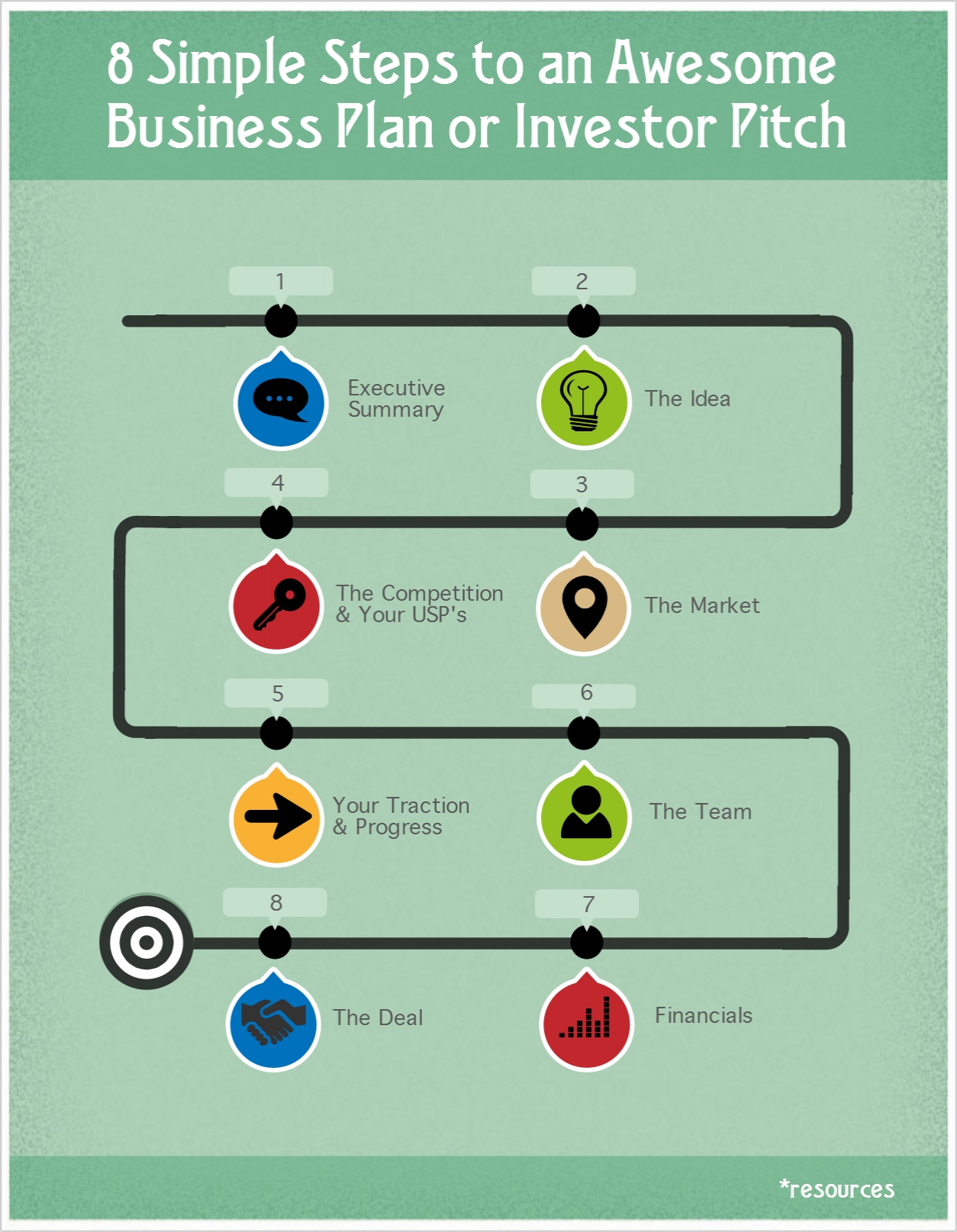

To get funding, you need to write a solid business plan that covers all the basics and highlights your strengths as an entrepreneur. Here are some tips on how to write a great one.

The purpose of your business plan is to convince someone — a bank or investor — that your company should receive money. So, what do you include in a business plan for investors? It depends on who you’re trying to convince and what kind of information they want to see. If you’re trying to raise funds from an angel investor or venture capitalist, for example, they’ll probably want more financial details than someone applying for a Small Business Administration loan would need.

That said, there are some universal components that every good business plan should include:

An executive summary: This section should give the reader an overview of what your company does and its goals. A paragraph should be enough here; don’t get bogged down with details unless it’s relevant (for example, if your company makes software). The executive summary also serves as an elevator pitch: It should be short enough so that someone can read

If you need to raise capital for your business and are looking for investors, then a business plan is an essential component of your pitch.

Investors will want to see that you have taken the time to consider your business idea and that you have thought through all aspects of it. A well thought-out plan will also help you keep track of all the elements involved in running your business.

The following sections give some examples of what could go into a good business plan:

Executive summary – This section should clearly state what the company does, who it serves, its market position, key advantages over competitors, and how it intends to make money. It should also include some background on why this idea is better than others out there.

Business description – This section should explain how your company will operate once it’s up and running. Include details about how you’ll reach customers and other relevant information about how you’ll run your business.

Management team – Who will run the day-to-day operations of the company? If any key personnel are missing from this list, investors may wonder if they’re necessary or if they can be replaced easily if needed (which can happen).

When you’re trying to get a loan or an investment, you’ll need a business plan. This is a document that outlines your company’s goals and plans, and it’s something that can be used to help secure funding.

A good business plan will include:

An overview of the business

What your goals are for the business, and how you plan on achieving them

An overview of your market and competition

How you will differentiate yourself from other companies in the same field

Your marketing strategy (including budget)

Your financial projections.

The purpose of a business plan is to convince investors that your idea is worth their time, money and effort. If you want them to invest in your company, you need to present your business idea in a way that’s both professional and convincing.

An investor will take a look at your business plan for two main reasons:

They want to know that you know what you’re doing. You don’t have to be an expert in every area, but they want proof that you’ve done the research and planning necessary to make your business work.

They want proof that they’ll get a good return on their investment. They’re not just looking for any old profit; they want a solid return on their money so they can see how long it’ll take for them to get paid back and how much they can expect to earn from other ventures if they put some money into yours.’