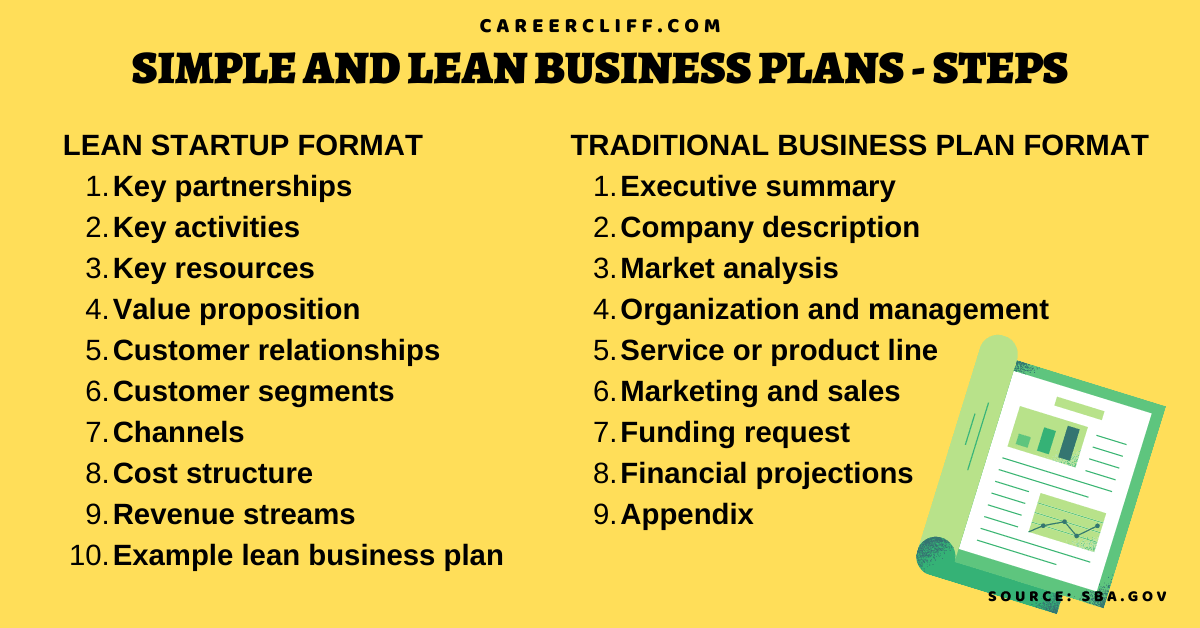

A basic business plan outline is presented. It proposes the generic structure of a business plan with explanations and examples of what steps are included and how to complete them. The purpose is not to tell you the exact format of a business plan but rather to introduce you to the components of a good plan so that you can draft your own based on whichever specific approach you choose.

The most common mistake in business plan writing is the attempt to include too many details at the outset. You don’t know all of the things you want to say until you have completed a considerable amount at the task. For example, sometimes it’s easier to start with a rough financial projection because this indicates whether or not your business will work, and you can fill in subsequent sections based on this result. Using the information generated by your structure, you can begin to build a narrative through which you can tell your story.

Simple business plan for startup

The first step in creating a business plan is to clearly define the purpose of your business. It’s important to know what you want your business to do, where you want it to be located and how many employees you’re planning on hiring.

Once you have this information, it’s time to create a mission statement. This can be as simple as “I want to sell custom t-shirts online.” Once you have this statement, you can use it in your marketing efforts or when talking with potential investors.

Next, create a section called “The Competitive Environment” where you list all of the competitors in your industry or market segment. This allows you to determine how your company will compete with others and what strategies might be most effective for reaching customers and increasing sales volume over time.

The third section of a small business plan should include financial projections for the first five years of operation including projected revenues, expenses and cash flow projections for each year of operations as well as a summary financial projection for the entire five year period. You also need to include a list of assumptions that were used in preparing these projections such as growth rates for revenue and expenses along with estimates for things like inflation rate

A business plan is an essential tool for any startup. It provides a roadmap for the future, and helps you to keep your eye on the ball.

A good business plan doesn’t just describe what your business will do, but also how it will do it. It should be detailed enough that anyone in your industry can understand it and use it as a reference point when making decisions about their own business.

If you’re thinking about starting your own business, then this article is for you. We’ll take you through what makes a good business plan, how to write one and how much time it should take to create one.

What is a Business Plan

A business plan is essentially:

An outline of your business idea.

An explanation of why your idea will work (and not fail).

A guide for how you should run the company in order to make money from customers who want to buy from us because of our unique value proposition.

The startup business plan is a great way to gain investor confidence. It’s important to have a strong plan when asking for money because investors want to see that you’re serious about your business.

Startup business plans should be short and sweet — around six pages in length. You can find examples of good startup business plans online, but remember that it is still up to you to make sure that the plan fits your needs and goals.

Here are some tips for writing a killer business plan:

1) Know who your audience is

2) Keep it simple

3) Don’t forget why you’re writing the plan in the first place

A business plan is a written document that outlines the goals, objectives and strategies of a company. It helps entrepreneurs to stay focused on the bigger picture, rather than getting bogged down in day-to-day tasks.

The most common type of business plan is the three-year plan. It allows you to look ahead at the next 12 months and beyond, while giving you plenty of time to adjust your strategy if things go wrong.

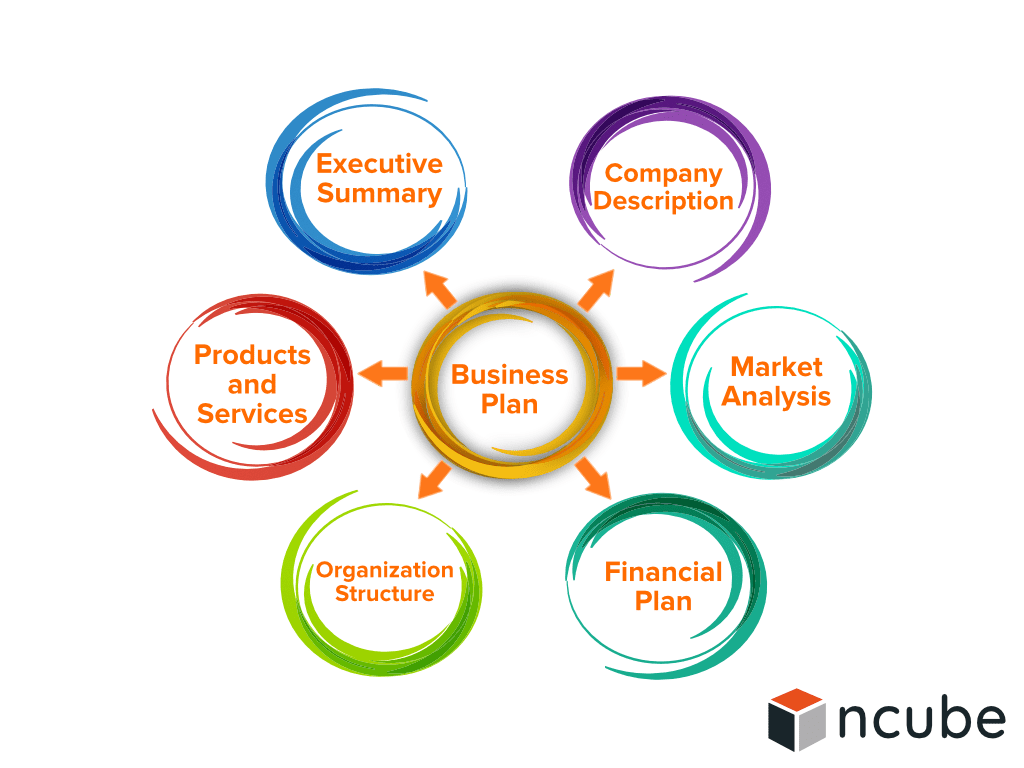

A good business plan should include:

An overview of your business idea or product. What do you want to sell? Who are your customers? How much will it cost to start up? What are your long-term goals?

An analysis of your competition – what does their business model look like? How do they price their products/services? What marketing strategies have they used in the past? How successful have they been in reaching their target audience (in terms of sales volume and profitability)?

A marketing strategy for your business – who are your main customers? How do you reach them (online, offline etc.)? What promotions will help build awareness about your brand among this target audience?

Financial forecasts for at least three years: how much money will be needed; where it

Start your business plan with a compelling executive summary. Your executive summary is the first punch you throw in your business plan. It’s the initial opportunity to show investors, customers and other stakeholders what makes your business special.

Startup ideas are everywhere. The best way to start is by identifying a problem in your industry or community, then finding a way to solve it. Are there too many people waiting for service? Can you make their wait more enjoyable? Are certain products overpriced? Can you offer them for less? Is there no place for people to work out of their home office? Could you open an office that allows them to do so? Is there no place for teenagers in town after school? Could you open an after-school program where they can hang out until their parents get home from work?

Small Business Plan Examples: How To Write Your Own In A Few Simple Steps

The following steps will help you create a small business plan example that will help get you started on your path to success:

1) Write down all of your ideas and goals

2) Brainstorm with others who know the industry or market better than you do (this is especially important if you’re looking at something new or different).

Small startup business plan example

A small startup business plan is a document that describes how you will create and grow your business. It should be written in a way that attracts investors and lenders, but it can also help you to decide whether your idea is worth pursuing. A good small business plan should include these sections:

Executive Summary – The executive summary is the first part of your plan, so it should summarize what other sections of the plan will cover. The goal of this section is to get investors interested in reading more about your business. You don’t have to write it last because it comes first, but it should be one of the first things you write.

Market Analysis – This section describes how big your market is and how profitable it will be for you. It also covers competition, customer needs and how they choose products or services like yours over others.

Operations/Management Plan – This section describes what resources are needed to run your company and how well each department performs its duties (such as marketing).

Financial Projections – Financial projections show what kind of sales revenue and expenses you expect for each year for at least five years into the future (the longer the better). You can use any reasonable assumptions about costs or sales volumes that make sense for

Small businesses are the backbone of our economy. According to the Small Business Association, more than half of all American workers are employed by small businesses. In fact, small businesses employ some 53 percent of all workers in America.

In other words: If you want to start a business, you have thousands upon thousands of options available to you.

And while starting a business is certainly not easy, it’s not impossible either. With just a bit of planning — and maybe even more than that — you can make your dream a reality.

Your first step should be developing a plan for how you’ll get your startup off the ground. To help with this process, we’ve compiled this list of seven things every new business owner needs to know about how to write a small business plan:

A startup business plan is a written document that describes how you intend to start and grow your business. It should include all the information needed to raise money from investors and other sources.

Startup businesses are often small operations with limited capital, but they can still be successful if they have a good business idea and the right marketing strategy.

The first step in creating your startup business plan is to define your target market. Once you know who will buy your product or service, you can determine what price to charge for it. To find out if there’s enough demand for your product or service, conduct market research through focus groups or surveys of potential customers.

Once you have determined that there is a market for your product or service, create an outline for the rest of your startup business plan based on the information gathered from the survey results.

For example:

How much funding will be needed? How much time will be required before any profit is generated? What kind of marketing strategies should be used? What kind of equipment will be needed?

If you’re thinking of starting a new business, you’ve come to the right place. Whether you want to start a small business or a large company, our free resources will help you get started.

We’ll help you with:

Starting a new business

Starting a small business

Starting up ideas

Business plan template

Startup companies are often born out of an idea for a product or service, but most don’t have the capital to start up. If you’re trying to get a business off the ground, it’s important to know what options you have when it comes to funding.

Startup Funding Options:

1. Bootstrapping: Bootstrapping is when you bootstrap your own company without outside funding, using personal savings and credit cards. You can also use equity investment from friends, family members or partners.

2. Crowdfunding: Crowdfunding is when you raise funds directly from potential customers who want your product or service enough that they pay in advance — before it’s even built! You can use platforms like Kickstarter and Indiegogo to reach a large number of people at once.

3. Personal Loans: Personal loans are great if you need quick cash for anything from equipment purchases to marketing costs. The catch is that these loans usually have high interest rates and repayment terms that last for five years or more — so be sure you’re ready to repay them quickly!

4. Angel Investors: Angel investors are wealthy individuals (or groups) who put money into startups in exchange for equity (ownership).