Life insurance is a sensitive topic. Consequently, finding the right life insurance company to insure your life can be difficult. It can be challenging to know how to select the right policy and which companies are safe to purchase insurance from. Some companies even commit fraud in order to get your money! How do you find out whether the policies they’re offering are actually worth it? That’s where we come in. At SeoForLifeInsurance.com, we’ll gladly walk you through all of the steps in order to find you a great life insurance policy and you won’t have to spend time researching for yourself. If you’re interested in protecting your family and being able to provide for them after you’ve passed on, this blog post is just what you needed.

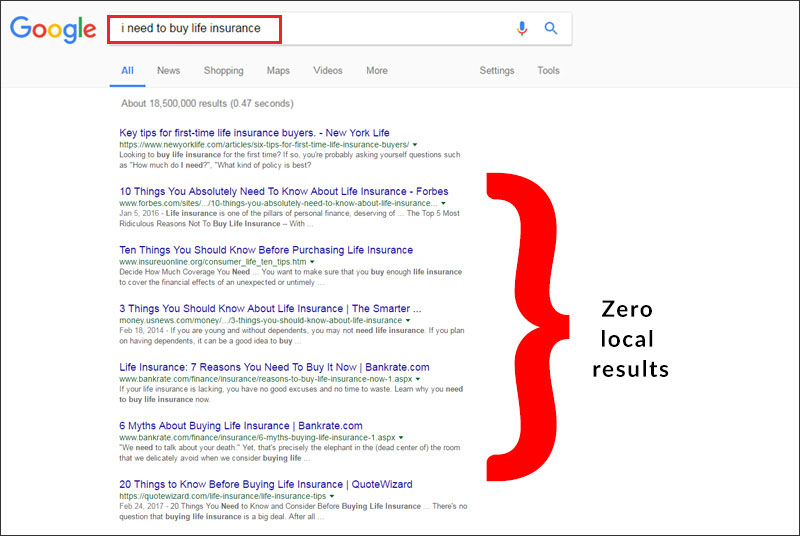

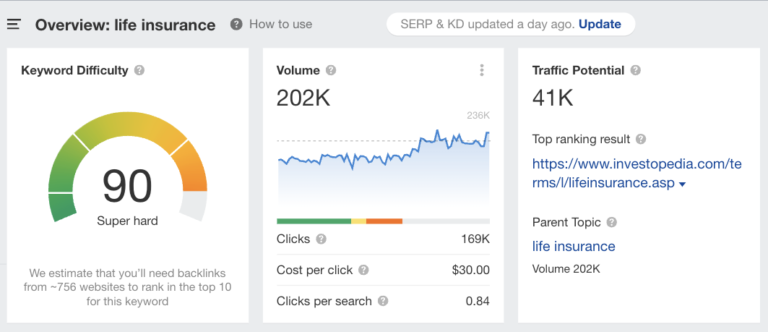

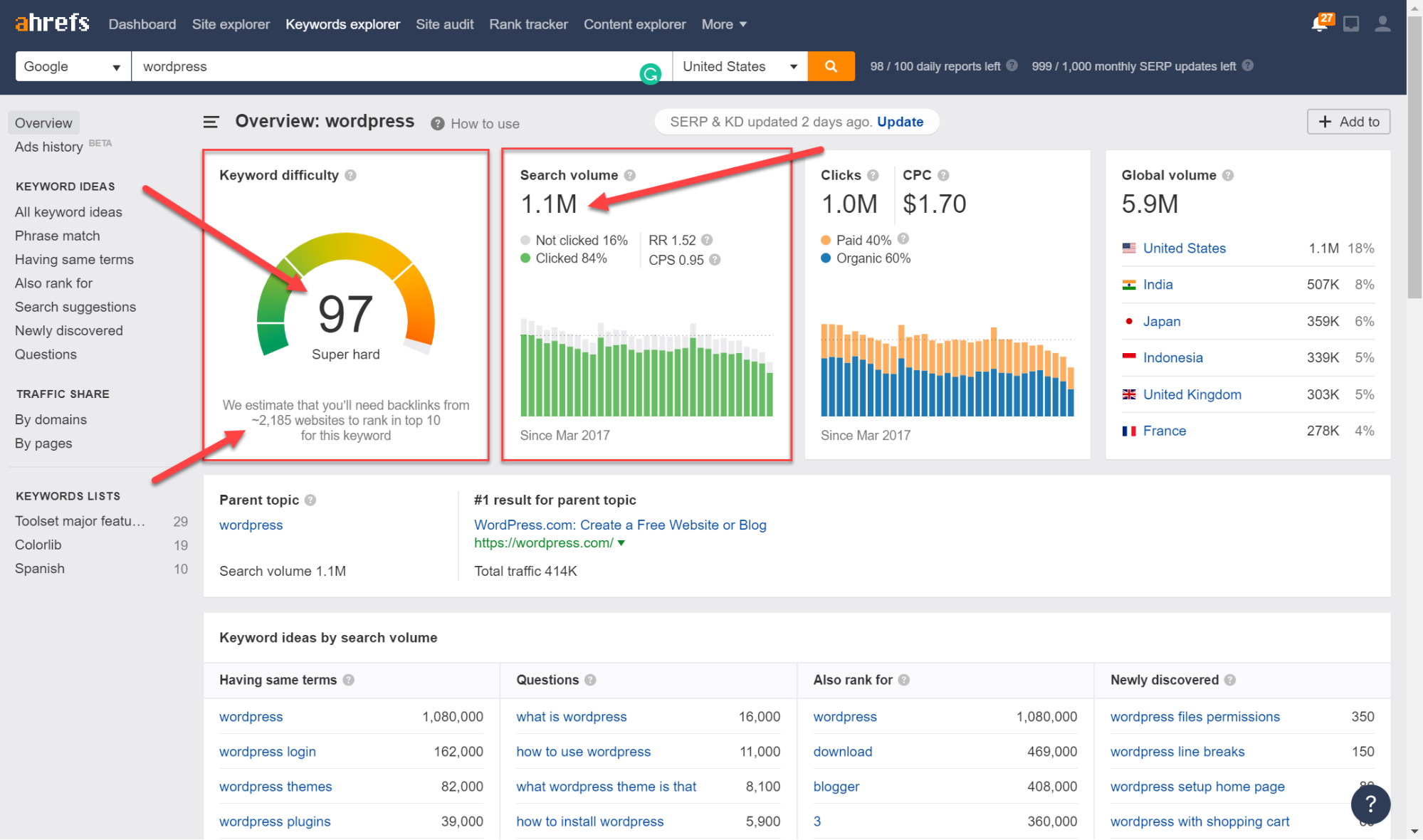

How to get higher ranking on Google search results. There are many ways to do it but we need look no further. In this regard, seo keywords for life insurance, best script for selling life insurance, we will look at the widely-applicable lessons from the insurance industry. The first lesson is to use long tail keyword phrases and other strategies.

Seo for life insurance

SEO is the best way to find new customers for life insurance. The best keywords for SEO are “life insurance quotes”.

Life insurance companies want to sell more policies and make more money, so they will pay you if you can help them do that.

The best way to sell life insurance is through cold calling. This means calling people who have never heard of your company before, and trying to convince them to buy a policy. With cold calling, you don’t need any website or social media presence at all!

If you’re not sure how to get started with cold calling, here are some tips:

1) The first thing you need is a list of potential customers who want life insurance. You can get this from an insurance agent who sells policies through the phone, or from an online broker like PolicyGenius.com (my favorite). If you don’t know how to use these websites, ask someone else on your sales team to show you how it works.

2) Next, go through the list and pick out some people who would be good targets for cold calls. Look for people who have no kids yet (to avoid selling whole life policies), and whose income seems high enough that they might spend $1k or more on

SEO for life insurance is a very important part of your marketing strategy.

There are many reasons for this. First and foremost, it will help you to rank higher in the search engines for the keywords that people are searching for when they are looking for life insurance.

When you rank higher in the search results, you get more traffic to your website. As a result, you will be able to convert more visitors into leads and eventually sales.

In this article we will look at some of the best ways to use SEO to drive traffic to your life insurance website and increase sales.

When it comes to life insurance, you want your search engine optimization (SEO) strategy to focus on the words and phrases that people are most likely to type into Google when they’re looking for information about your product.

While there are many ways you can use SEO to drive traffic to your website, none is more effective than writing content that resonates with your target audience. If it doesn’t resonate, people won’t read it — much less buy from you.

Here’s what you need to know about SEO for life insurance:

1) Decide what keywords you want to target in your content.

2) Create blog posts around those keywords.

3) Optimize those blog posts for search engines using the right tags and meta descriptions.

Life insurance is one of the most popular financial products in the US, but also one of the most misunderstood. I’ve worked with a lot of people who want to know how they can sell life insurance, but they don’t know where to start.

Here are some tips on how to get started with selling life insurance:

1) Know your audience

The first thing you need to do before you start selling anything is to do some research on your target audience. The more specific your research is, the better off you’ll be. If you’re trying to sell life insurance policies, then you need to know about these things:

What do they do for a living? Are they male or female? What age range are they in? Do they have any children? What other financial products do they use (credit cards, mortgages). Do they have any pets? Etc…

2) Understand their pain points

In order for someone to buy something from you (whether it’s a product or service), they need to feel like there’s something that needs fixing or improving in their lives, otherwise why would they pay money for what you’re offering? Life insurance is no different – people buy life insurance because

Life insurance is a contract between you and an insurance company. You pay the insurance company a set amount of money each month or year, and the company agrees to pay you a certain amount of money if you die.

Life insurance is for people who want to protect their family from financial hardship in the event of their death. When you buy life insurance, you’re also protecting your loved ones from medical bills and other expenses that might arise from your passing.

The best way to find the right term length for your needs is to ask yourself how long you think it will take for your family to recover financially after your death. If you have young children or other dependents who are still in school, you may want to consider purchasing coverage that lasts until they graduate — or at least until they’re out of college.

You can also choose how much coverage you want by choosing an amount per $1,000 of face value that’s appropriate for your situation. The higher the amount per $1,000, the more expensive the policy will be — but it’s also likely to provide greater peace of mind because it provides more protection against financial hardship or loss of income due to disability or death (and thus provides more financial security).

Best script for selling life insurance

The best cold call script for life insurance will help you to close a deal.

The best cold call script for life insurance is a powerful tool that will help you close more sales. It will also make your cold calls more efficient and effective.

In this post, I am going to show you how to write an effective cold call script for selling life insurance.

These are some of the things that we will cover:

What is a cold call? – A cold call is when someone calls on a prospective client without any introduction beforehand. The purpose of making a cold call is to introduce yourself and your company, ask if they need your services, and if they are interested in buying your product or service.

The best cold call script for life insurance sales is an important tool to use when you are in sales. It should be used to guide you through the process of making a call and allowing you to get through your pitch without hesitation.

The best cold call script for life insurance should include the following:

A greeting that is friendly and welcoming.

An introduction of yourself and what company you are calling from.

A brief explanation of why you are calling them. This can be as simple as saying, “We have a policy that we think would be perfect for you!” If they ask how they got on your list, tell them that it was purely random and that there was no selection process involved in choosing them as a potential client.

Ask if now is a good time to talk about their needs and explain what type of policy you have available to offer them. If they say no, thank them for their time and ask when would be better to call back at (a time when they might be more receptive). If they say yes, ask if it would be okay if we went ahead with our presentation now or if there would be any other time that might work better for them?

Best Script for Selling Life Insurance

In life insurance, it’s all about the numbers. If you can present a great set of numbers to a client, then they will be more likely to buy life insurance with you than with someone else. This is where the best script for selling life insurance comes in handy.

Here are some of the best selling scripts for selling life insurance:

1. The “why do they need it?” script – this is one of the most powerful scripts that anyone can use when trying to sell life insurance to someone else. Instead of focusing on how much money people are going to make, focus on why they need it and what happens if they don’t get it! This will help them realize how much they need it and how important it is for them to get coverage from you today!

2. The “life insurance quiz” script – if you want to get a good idea about whether or not someone should buy life insurance, give them this quiz! In this quiz, there will be different questions that test their knowledge about insurance and their level of risk when it comes to losing something important in their lives. It also gives you an idea of what kind of

Sell life insurance with a cold call script that works.

Cold calling is the most effective way to get new clients, but it’s not easy. You need a good script that will help you stay on track, keep your client interested, and close the deal.

If you want to learn how to sell life insurance with cold calls, check out this article by Jonathan Fields. He offers an excellent cold call template that will work for any type of insurance sales position.

This script is designed for two reasons:

To help you stay focused during the conversation so you don’t lose your train of thought or get off track

To make sure that you ask for the sale at the end of the call

Life insurance cold calling has been around for decades, and for good reason. Even with all the changes in the industry over the years, it’s still one of the most effective ways to get new business.

Life insurance cold calling is a great way to build your book of business. It allows you to speak with people who are actively looking for coverage, which means they’re more likely to buy from you than if they were just responding to an ad or other marketing piece.

Cold calling can be intimidating, but it doesn’t have to be that way. You just need a script that works! Here are some tips and ideas on how to make your life insurance cold calling more effective:

Have answers ready for objections. Prepare a list of common objections and come up with responses that will help you overcome them. This will make you feel more confident as you talk with prospects on the phone, because you’ll know exactly what to say if someone raises an issue or concern. If you don’t have time to prepare your own responses ahead of time, check out this blog post by our friends at Top Sales Pro on how to handle common objections during sales calls. It’s full of helpful tips like using “yes” statements instead of “no