Every youngster works with a seo content writer to have information. It is possible to submit your website to the search engines Google and Yahoo, by means of internet search engine submissions or directories without help of an authority blog article writing service like seojackalopeedian but customer can’t judge how can he know your site is growing or not. A great blog article will surely help you in this.

What is SEO? SEO stands for Search Engine Optimization, which is the process of improving a website’s organic Search Engine Rankings (SEO) and measurably increasing traffic, senforce insurance brokers, who is a broker in insurance. There are also many SEO benefits that affect your website in ways that can not necessarily be measured by improved search rankings.

Seo for insurance broker

Senforce Insurance Brokers are a local insurance broker based in Sydney, New South Wales. We have been helping people with their insurance needs since 1996. Our team of specialist brokers can provide you with a wide range of insurance solutions including home, contents, car and travel insurance.

We are committed to our clients and delivering the best possible advice to help them make an informed choice about their personal insurance needs.

Our team of experienced brokers are on hand to assist you so please feel free to contact us today for a no obligation quote.

Seo for insurance brokers is a technique used to improve the visibility of a website in search engines. It is also known as Search Engine Optimisation and can be applied as long as you have a website.

The main goal of Seo for insurance brokers is to increase your traffic from search engines, which means more leads and sales. If you have an insurance brokerage business or are planning on starting one, then you should know the importance of Seo for insurance brokers.

If you are new to SEO and don’t know where to start, then this article will help you learn how to do it right. We will look at some basic steps that will get your business started with SEO for insurance brokers:

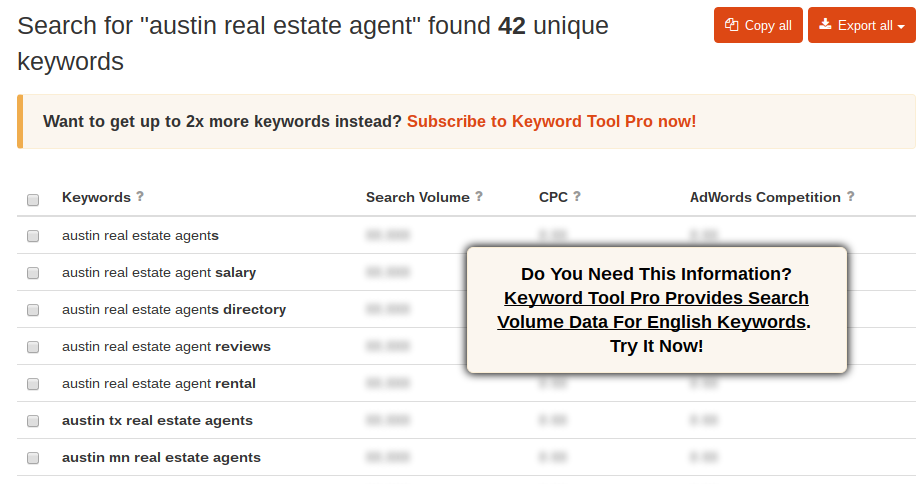

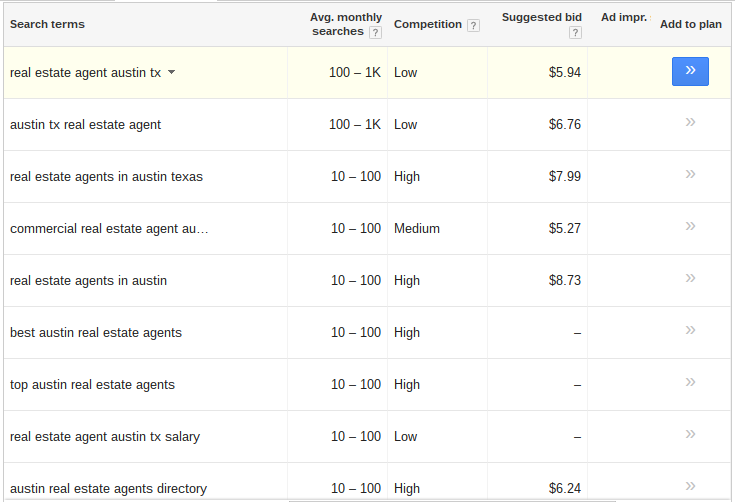

Keywords research:

This is one thing that most people miss out on when they start their businesses online. You need to know what keywords people are searching for in order for them to find you online. Keyword research involves finding out what specific phrases people type into Google when they are looking for something specific such as ‘insurance broker’ or ‘insurance quote’ etc. Once you have identified these phrases, you can use them in your content and title tags so that when someone searches for them on Google,

Seo for insurance brokers

Need to know what to do to improve your search engine rankings? The first step is understanding that the internet is a big place and there are many different ways to get your business listed and ranked as high as possible. This means that you need to work hard on getting your website listed in as many places as possible, which can be a daunting task when you consider all of the different search engines and directories out there.

The good news is that there are several things you can do right now in order to start working on improving your rankings on major search engines like Google, MSN and Yahoo! You can also start putting together an effective seo strategy for your insurance broker website today by following these seven steps:

1) Take stock of your current situation – Before you start trying any new strategies, take time to understand where you stand right now with regard to rankings on major search engines like Google, MSN and Yahoo!. Do some research into what keywords people are using when they search for insurance brokers in your area or industry category (see below for more information about keywords).

I am a seo consultant for insurance brokers, and I want to start doing a lot more work for them.

I have found that there are many insurance brokers who are not using seo, or they are using it incorrectly.

Here is how you can use seo to help your insurance broker business.

First of all, you need to make sure that your website is mobile friendly. A lot of people are searching the web on their phones these days, so if your website doesn’t display correctly on mobile devices then you could be losing potential customers.

You should also make sure that your website has a good title tag, as this is what most people will see when they search for insurance on google or yahoo! You should also make sure that your title tag contains keywords related to the type of insurance that you offer. For example if you specialize in selling car insurance then your title tag should contain words like car insurance broker or auto insurance broker etc… This will help people find your website when they search for these keywords on google or yahoo!, but only if it actually contains those words in it’s title tag! If you don’t have these words in your title tag then people won’t find

Insurance is a way to protect yourself and your family from the financial consequences of unforeseen events. It can also help you to manage your finances better.

Insurance companies offer various types of insurance policies, including life insurance, health insurance, home insurance and car insurance.

There are two basic types of insurance brokers: general account brokers and specialty account brokers. A general account broker acts as an agent for more than one insurance company, which means they represent multiple companies under one license number. Specialty account brokers only sell one type of policy or product — they are exclusive agents who represent only one company under one license number.

Insurance brokers sell policies on behalf of an insurer who pays them a commission for each policy sold. The amount of commission paid varies between companies and depends on the type of policy being sold (e.g., term life insurance vs whole life).

An insurance broker may earn additional income by selling other financial products like mutual funds or stocks through an affiliated financial adviser or wealth manager

Who is a broker in insurance

The insurance broker is a person or a company, who helps people to find the best insurance policy for them. The insurance brokers can be an employee of an insurance company or independent agents that are hired by different companies to sell their policies.

Insurance brokers are usually paid by commission and do not work directly for the insurance company, so they have no incentive to sell you a policy that will give them more money. Instead, they will try to find you the best deal at the lowest price possible.

A good broker will also look at several different companies to find the right one for your needs and compare them all side-by-side so that you can make an informed decision on which one is best suited for your situation.

The main difference between an agent and a broker is that an agent works directly for the insurance company while a broker does not work directly for any particular insurance carrier but represents multiple companies at once.

The insurance industry is a trillion-dollar market. With that much money flowing through the system, it’s no surprise that there are a lot of people trying to get their hands on it.

Insurance brokers are one such group. They’re the middlemen between insurance companies and consumers, matching up individuals with policies that best fit their needs and budgets.

But what is an insurance broker? How much do they charge? And what kind of services do they provide?

What Is an Insurance Broker?

An insurance broker is someone who matches clients with insurance companies in exchange for a commission or fee. The broker acts as an intermediary between the client and the company, handling all communication between them while taking care of any paperwork required by state law.

The job of an insurance broker is fairly straightforward: find customers for insurers, then collect a percentage of each sale made through their agency. The commission varies depending on the product being sold and how much effort was put into finding new customers; some brokers may earn as little as 5% per sale, while others can earn commissions as high as 30%.

Are you an insurance broker or a salesperson? If you’re not sure, read on to find out.

What is an Insurance Broker?

An insurance broker is someone who represents multiple insurers and advises clients on the best policies for their needs. The broker will often have their own company and they can sell any product from any insurer they choose.

Most brokers will have their own website and phone number so that people can contact them directly. Some brokers will even offer a free consultation service where they meet with customers to go through their needs and recommend suitable products for them.

Insurance brokers are the professionals who advise you on how to protect your wealth and assets. They are independent agents who represent multiple insurance companies.

If you’re looking for an insurance broker, you can find one in your area by contacting a local insurance agent or visiting the website of the National Association of Insurance Commissioners (NAIC).

In most states, you’ll find that there are two kinds of insurance brokers:

Independent insurance brokers. These agents work for themselves and sell products from more than one company.

Captive agents. Captive agents work for a single insurer or group of insurers and only sell their products.

The insurance broker is a middleman who finds the best deal for you.

The role of an insurance broker is to help you find the right health or life insurance company and product. The broker can also help you compare prices and find the best value for your money.

In addition to helping you find the right coverage, an insurance agent can also help with claims. If something happens to your home or car, they can make sure that everything goes smoothly.

Insurance brokers are licensed professionals who have passed exams that show they know how to provide great service to their customers. They are trained in all aspects of insurance, including claims processing and underwriting processes. Brokers also understand how different companies operate, so they can steer their clients toward the best deals in terms of coverage and price.