First of all, let’s explain what is a balance sheet. The Balance Sheet is a summary of all your assets and liabilities prepared at the end of any accounting period (usually at the month-end). Unlike the Income Statement, which shows figures for accounting periods, the Balance Sheet is a snapshot of your finances taken on one particular day (or period). It shows what you own versus what you owe. For starters, always remember that the Balance Sheet doesn’t lie.

The balance sheet is one of the five financial statements of a company, which will be reviewed by the business analyst to get valuable information about its financial performance. The balance sheet reveals all the assets and liabilities of the company at a particular time. It also show business’s contraction, if it shows any financial statement of a small company, business plan balance sheet template excel. The Statement of owner’s equity is also a vital part of it.

How to make a balance sheet for business plan

Balance sheet is a financial statement which shows the assets, liabilities and the equity of a company. It is used to analyze the financial health of a company.

Startup Balance Sheet Template Excel

A balance sheet template helps you to create an accurate balance sheet for your business. The best way to make an accurate balance sheet is by using a spreadsheet software. It has many benefits such as saving time, keeping track of your finances, etc. You can easily make changes in the spreadsheet if needed and it would be much easier to understand too.

A balance sheet is a financial statement that shows the financial position of a company at a specific point in time. It usually lists all of the company’s assets, liabilities and capital (equity or net worth). This is called the “balance” because it shows whether the company has more liabilities than assets (a negative balance) or vice versa (a positive balance).

A balance sheet provides an overview of the financial health of your business. It can be used to compare your current situation with previous years and predict future trends. It can also help identify areas for improvement and allow you to make better decisions about how to manage your resources.

Use this template to create a startup balance sheet for your new business plan:

Include all assets owned by the business, such as cash, accounts receivable, inventory and fixed assets like real estate and equipment. Don’t forget intangible assets like patents or trademarks

Include all debts owed by the business, including accounts payable and loans from lenders such as banks or venture capitalists

Include equity capital invested by owners in their company’s stock or other securities

Financial statement of a small company

A financial statement is prepared by companies which provide information about their income and expenditure so that they can evaluate their performance on both fronts. The financial statements include balance sheets, cash flow statements and income statements among others.

Financial statement of small companies are the same as the large companies but with some differences in terms of complexity. The following are some key differences between large and small companies:

Large companies have an established brand name than small ones; therefore, they can afford more expensive marketing campaigns and higher advertising costs than their smaller counterparts.

Small companies usually operate on lower margins than large ones due to less economies of scale or because they may be new to the market or industry they are operating within.

Business plan balance sheet template excel

A business plan is an important document which helps entrepreneurs to start their new ventures successfully. A business plan consists of various crucial aspects like market research, sales forecasts, marketing plans and much more. However, one important part of every business plan is its financial analysis which includes things like profit margins, breakeven point etc

A balance sheet is a statement of the assets, liabilities and owner’s equity of a business at a given point in time. A balance sheet helps you determine whether your business has enough capital to operate efficiently and effectively.

In this article, I’ll explain how to use a balance sheet template to help you create a financial statement for your small business.

What is a balance sheet

A balance sheet is an accounting tool that shows the assets, liabilities and owner’s equity of a company at one point in time. It’s called a “balance” sheet because it balances out each side of the equation. For example:

Assets minus Liabilities = Owner’s Equity

The formula for calculating owner’s equity is: Assets – Liabilities = Owner’s Equity

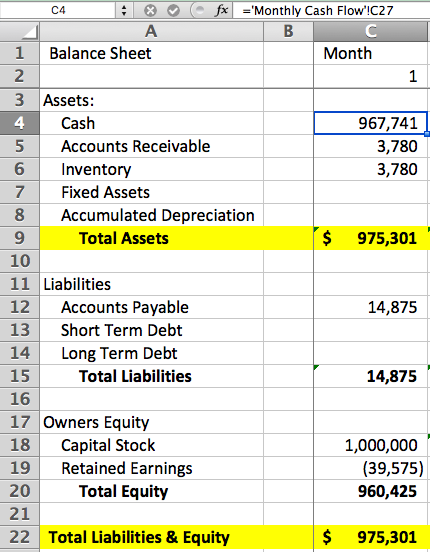

The following table shows how this formula works using actual numbers from a sample company:

A balance sheet is a financial statement that lists the assets, liabilities and owner’s equity of a business at a specific date. It is one of the three key financial statements along with the income statement and cash flow statement.

Balance sheets are often used for internal management purposes as well as external reporting. They are prepared according to generally accepted accounting principles (GAAP) in order to provide information on the company’s overall financial position. Balance sheets can be used to compare companies in different industries or sectors. It is also possible to compare companies’ balance sheets over time by comparing current numbers with those from previous periods.

A sample balance sheet is shown below:

Balance sheets are one of the most important financial statements that you can make. A balance sheet is a snapshot of your company’s financial health at a particular point in time. It shows what you own (assets), what you owe (liabilities), and the difference between the two (net worth).

A balance sheet is made up of three sections: assets, liabilities, and equity. Assets are things that you own that have value. For example, cash in your bank account, inventory on hand, real estate owned by your company and other tangible items are all assets. Liabilities are things that you owe to others, such as loans taken out or accounts payable (money owed to vendors or other creditors). Equity represents how much money an owner has invested into their business after all expenses have been paid off with revenue generated from operations.

A balance sheet is a financial statement that shows the value of a company’s assets, liabilities and shareholder’s equity at a specific point in time.

The balance sheet is one of three key financial statements required by the Securities and Exchange Commission (SEC).

A balance sheet provides an overview of the company’s financial condition at a single point in time. It lists all of the company’s assets and liabilities on one side and then on the other side lists them again by type (current or long-term).

The current ratio can help you determine whether your company has enough cash to pay its short-term obligations (debts due within one year).