Most startups out there will at some point need to get the attention of investors, whether to finance their business or to buy them out completely. They will need to get professional advice and help regarding the planning and structuring of their business affairs. The problem is that many entrepreneurs are unaware that they need such a plan until it’s too late. Some might feel too small or simply don’t know how to create a business plan for investors. It can feel overwhelming because it’s usually not a simple task and you don’t want to mess up. So how exactly do you go about writing a good plan?

As an entrepreneur, creating a business plan is an important milestone on your journey to success. While creating a business plan can help you secure funding, it should also keep you accountable for your goals. In this article, we’ll explain the importance of business plan to investors, business plan examples doc, purpose of creating a business plan and present helpful examples.

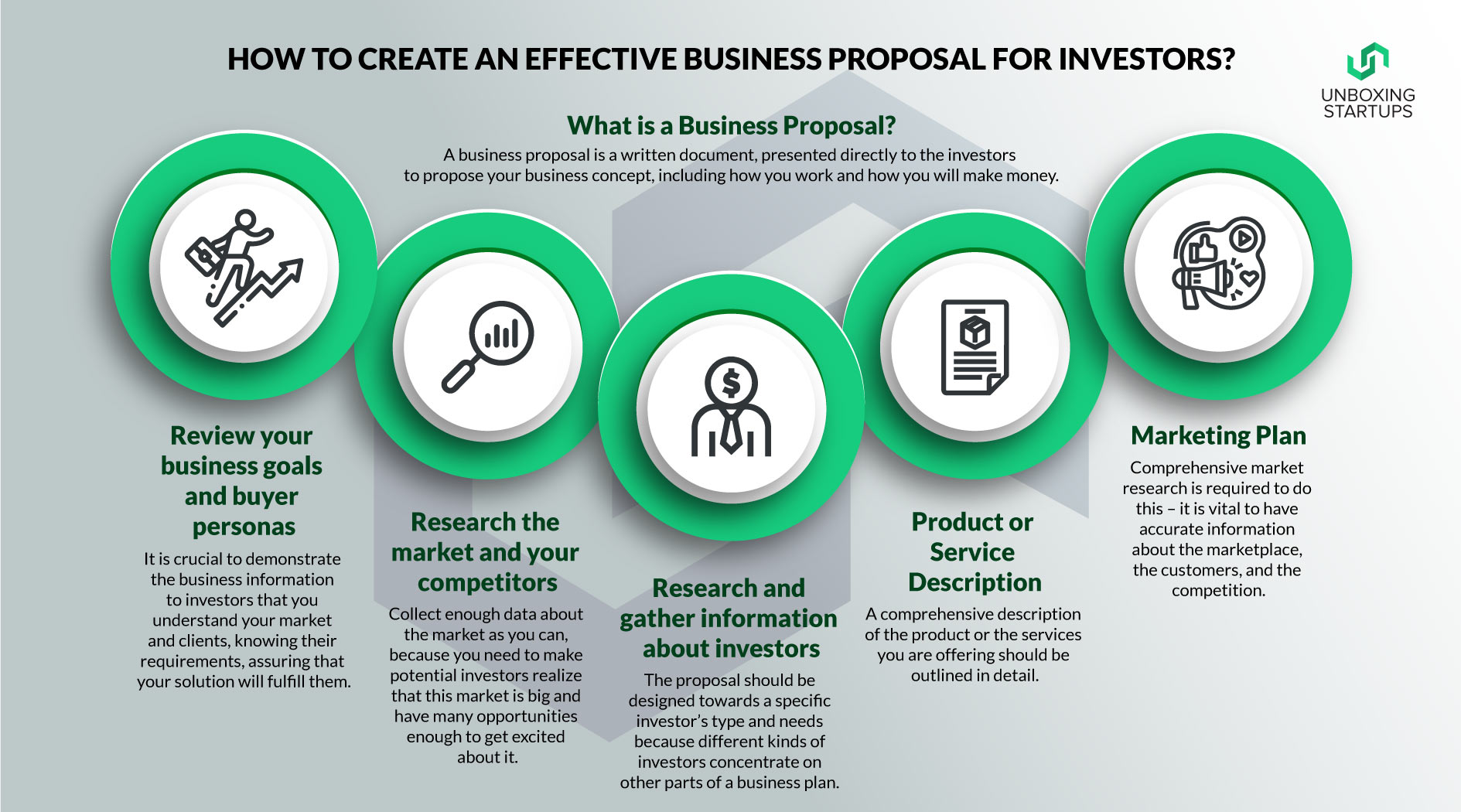

How to create a business plan for investors

You can use our free template for your business plan. It’s easy to customize and free of charge. To get started, simply click on the button below and download our free template. You can also save it directly to Google Drive from here.

If you’re not sure where to start with your business plan, we’ve got your back! We’ve put together some tips on how to write an effective business plan and what information should be included in it. The first step is understanding what goes into a good business plan before you even begin writing one.

A business plan is a written description of your business idea and how you intend to operate it. A good business plan will help you create a clear vision for your future and guide you as you take action to achieve it.

A solid business plan can convince investors, partners, and other stakeholders that your idea has merit. It should be well thought out, thorough, and professionally presented.

In this guide, we’ll walk through all the key components of a good plan: why they’re important, what they’ll look like, and how to write them.

How to create a business plan

A business plan is a written document that outlines your business goals and strategies. It should include information about the market you want to enter, the products or services you intend to offer and how you plan to make money. A well-written business plan can help you attract investors, obtain financing, manage cash flow and set up a budget for your company.

The planning process will help you define your goals, define your target customers and determine how much money you need to start your business. It’s also important to get feedback from potential investors before drafting the final plan.

Investors want to see that you’ve thought through every aspect of your business before asking them for money. Here are some tips on how to create a successful business plan:

Identify Your Target Market

The first step in writing a business plan is figuring out who your customers are going to be. This might seem obvious — after all, if you don’t know who will buy what you’re selling, how can you expect someone else to invest in it? But this isn’t always as straightforward as it sounds. For example:

If you’re opening a restaurant or bar, who are your customers? They might be people who live nearby or people who

The first step to writing a business plan is to get clear on the purpose of your business. The purpose of your business is often described as its mission statement or vision statement.

The purpose of your business is about who you are and what you stand for.

It’s also about what makes you different from other businesses in your industry.

Importance of business plan to investors

A business plan is a written document that describes in detail how you intend to start and run a successful business. It should cover the purpose of your business, what you want it to look like and how it will operate, who will be involved, how much money you need and where it’s coming from, how much profit you expect to make, and more.

A good business plan can help convince investors and other interested parties that your idea is viable. It also helps focus your efforts on things that matter most to the success of your business.

To maximize the benefits of a written plan, follow these five steps:

1. Write down what you need from others — customers, suppliers, employees — in order to be successful.

2. Make a list of all the things that must happen before you launch or move forward with your idea.

3. Create an action plan for each item on your list (how will you get customers? How long will it take?).

4. Assign deadlines for each action item (“By March 1st I will have completed my website”).

5. Review your plan regularly as new challenges arise during the start-up process

Once you have clarified your purpose, it’s time to build on that by defining other elements of your business plan:

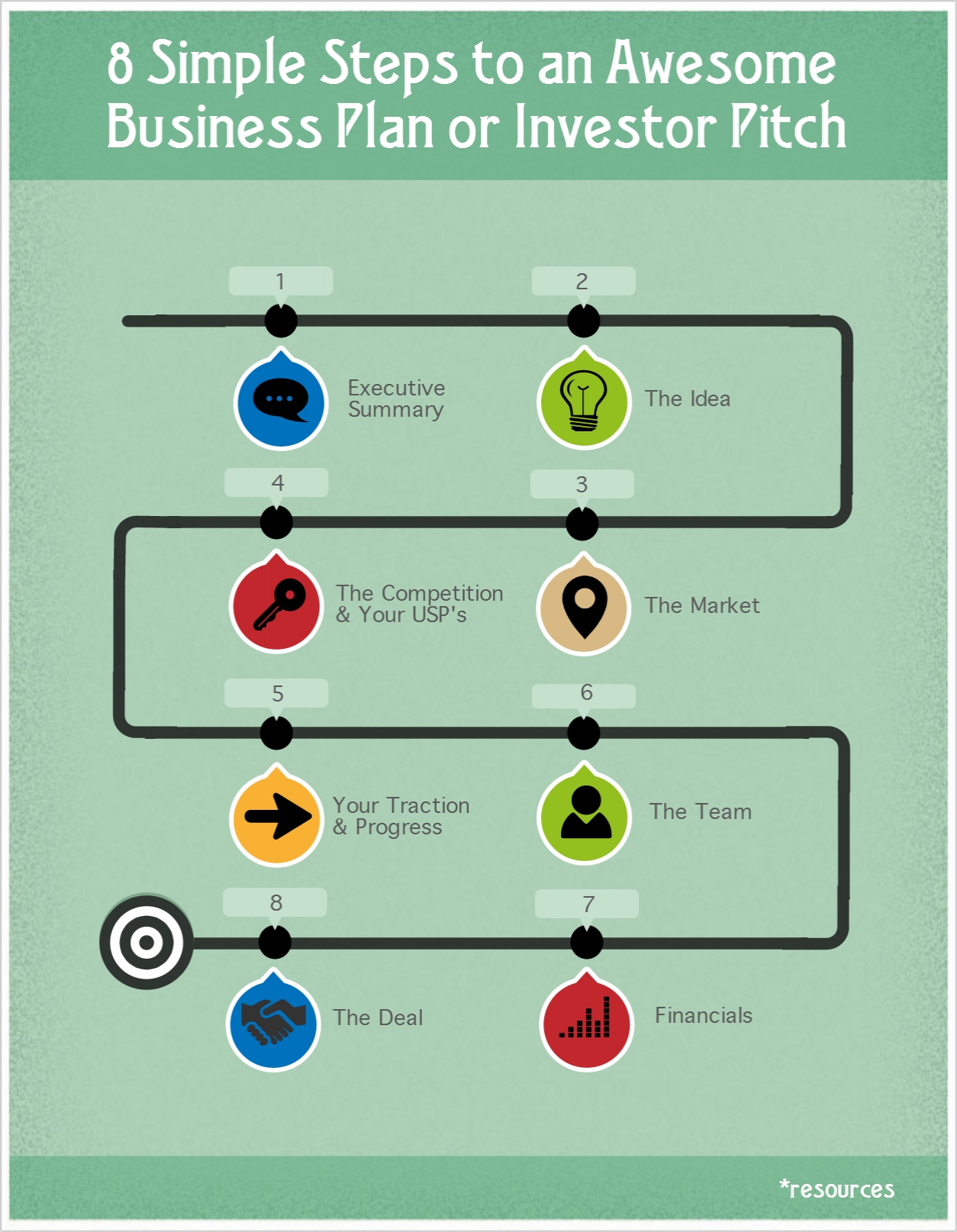

Executive summary: an overview of the rest of the document and a quick snapshot of why your company is unique and how it will succeed.

Market opportunity analysis: an assessment of market size, trends, competition and customers. This section should include information about how much money there is to be made in the industry and how big companies are doing in this space currently. It should also include information about key players in the industry (competitors) and their strengths and weaknesses relative to yours as well as any current trends in spending/purchasing habits among consumers or businesses (this could be anything from a new technology trend like mobile payments through credit cards or debit cards.) It might also include some demographic info like age range and sex

A business plan is a tool to help you develop and grow your business. It can be used to secure financing from investors, lenders, or banks and to help you get started on the right foot.

A business plan is a written document that describes the mission, vision, and strategy of your organization. The plan is not a legal document but rather a comprehensive overview of the business’s background, market conditions, management team, financial forecasts and much more.

Business Plan Template

One of the most important aspects of creating a business plan is having a template to follow. It can be difficult to find one that suits your needs as an entrepreneur because there are so many options out there — but luckily we’ve created our own free template for you!

A good template will provide all of the key elements necessary for developing your plan:

Executive Summary: This section provides an overview of your company’s competitive advantage; it should also include any new products or services that have been launched within the last year.

Company Description: Describe your company’s history; explain how it got started and what makes it unique from other competitors in its industry. Include information about any patents or trademarks owned by.

Business plan examples doc

The business plan is a document that describes the background, mission and goals of your company. It is essential to create a good business plan because it can help you achieve your business goals by providing a clear set of instructions to follow.

It should be written in a way that makes it easy to read and understand. The best way to do this is by following a simple format that explains each section clearly and well. There are many different formats that you can use, but they all include the same basic elements:

An executive summary at the beginning of your plan. This should provide an overview of your entire plan. It should also highlight any major risks or challenges that your company faces.

A background section explaining how your company came about and its mission statement (if applicable). This will show investors why they should invest in your company.

A strategy section that outlines how you plan to achieve your goals over time; this will include information on how much revenue you expect to make, what kind of clients or customers you want to target and how you plan on reaching them (e.g., through marketing campaigns).

Financial projections for one year, three years and five years into the future; these should include both income statements and balance.