Learn how to build your credit history fast. Stop checking “do not apply for credit”. Build credit from scratch. Increase your score 100 points in 7 days. Apply for bank loans and get approved.

When you’re trying to build credit, you want to get started right away. It doesn’t feel right to sit back and do nothing. It’s in human nature to want to get things done – and fast!

How to build a credit history

Credit scores are used by lenders to decide whether or not they’ll approve you for loans, mortgages and other types of credit. If you don’t have a lot of credit history — especially if you haven’t had any recent accounts — your score will be lower than someone who has more.

Building up your score can help you in the future when applying for things like credit cards, car loans and mortgages. Here are some tips on how to build your credit fast…

Secured cards require an upfront deposit that serves as collateral. In most cases, this deposit matches the amount you’re approved for in terms of spending power — $200 in this case. In exchange for the deposit, you receive a line of credit that works just like any other credit card account would, but you won’t owe interest payments on purchases until after using the card for about six months and paying off at least half of what was charged during that time period.

Having a credit card is a great way to build your credit history, but what if you’re just starting out? Here are some tips for how to build credit fast, including how to get a credit card without a job, and how to build a good credit score.

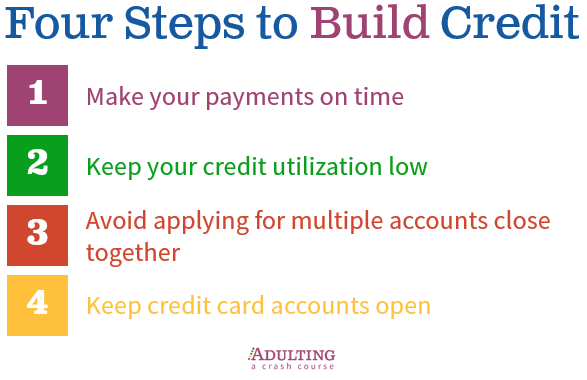

If you’re in the process of building your credit history, here are some tips to help you get started:

1. Get a secured credit card with your bank or financial institution. These cards require you to put down a deposit as collateral on the account. The deposit will be equal to your available line of credit, so it’s important that you choose the right amount. For example, if you want to open an account with $500 in available funds and plan on making payments on time each month, then it’s best to select an amount that will allow you to pay off the balance within two months or less.

2. Pay off balances in full every month (or pay more than minimum payment). If you have any outstanding balance left over at the end of each billing cycle, it will appear as an unpaid balance on your credit report and lower your overall score by affecting what’s known as “utilization ratio.” This is especially important for those who have no established credit history yet because high utilization

If you’re new to credit and want to build a credit history, there are two main ways to go about it:

Get a secured credit card. These cards require you to deposit money in an account as collateral for the amount of your credit line. You can then use that money for purchases and pay off the balance each month, which will help establish your credit history.

Apply for an unsecured card. If you don’t want to be required to put down collateral, apply for a traditional unsecured card with no minimum deposit requirement. This is the better option if you don’t have enough money saved up to cover your deposit.

If you’re just starting out in life and don’t have any credit history, it can be difficult to get approved for loans or even a job. However, there are ways to build up your credit history.

Credit bureaus allow you to request your credit report once per year for free. This is the best way to check if there are any mistakes on your report that need to be corrected.

You can also sign up for a service like Credit Sesame which will monitor your credit score and alert you when there is something suspicious going on in your account (such as someone trying to open an account in your name). This is especially helpful if you live with roommates or family members who may not always be honest about their spending habits (or lack thereof).

You can also ask family members or friends who do have good credit if they would be willing to add you as an authorized user on one of their credit card accounts. This will help build up a positive payment history on record for both of you!

There are a number of ways to build your credit score, but one of the most effective is to open up a credit card account. Before you do that, however, there are some things you need to know about how credit cards work and what they can do for your financial health.

Credit cards are powerful tools for building credit because they give you a way to track your spending and make payments on time. But it’s important to understand that not all credit cards are alike and some have more benefits than others.

Here’s what you need to know about choosing the right card for your needs:

Know Your Credit Score: The first step toward getting approved for any type of loan is knowing what kind of rating you have — whether it’s good, bad or somewhere in between. A high score will make it easier for you to get approved and qualify for lower interest rates on loans like mortgages or car loans. You can get two free copies of your FICO score at www.myfico.com each year; otherwise, a low-cost option is through Credit Karma (www.creditkarma.com).

How to Build a Credit History Fast

Building a credit history can be difficult for many people. While it’s easy to get a credit card and start spending, it takes time and patience to build up a good credit score. If you’re trying to build your credit history from scratch, here are some steps you can take:

Apply for a Secured Credit Card. Secured credit cards are one of the easiest ways to establish credit history because they require you to deposit money in an account as collateral against any potential risk. The amount of money you’ll have to deposit depends on the issuer, but most secured cards require at least $200-300. Some cards will give you access to higher limits if you use them responsibly over time.

Pay off your balance in full each month and avoid carrying debt month-to-month. Paying off your balance in full every month helps improve your utilization ratio — the percentage of available credit being used — which makes up 30% of your FICO score. If you only pay part of the balance each month, it will lower your score slightly as well as increase interest charges if you carry a balance from month to month.

Apply for an unsecured credit card with no annual fee and no added fees for making purchases or paying

Building credit is a process that takes time. If you have no credit history at all, you may be able to get a credit card with a low limit, but it will take some time before you can qualify for more cards or higher limits.

Credit cards are one of the best ways to build a solid credit history fast. If you don’t have any existing accounts, consider opening one. You can use it sparingly until your score improves. Then, once your score is at an acceptable level, try applying for another card to increase your available credit line and improve your average age of accounts.

You can also use secured credit cards to build up your score quickly while avoiding being overextended financially. A secured card requires that you put down a cash deposit equal to the amount of the limit on the card before being eligible for approval and use. The deposit becomes part of the credit limit on the card and can be withdrawn if payments are made on time each month. As long as you make timely payments each month, this money won’t be used because it’s just sitting there waiting for you to pay down your balance completely.”

The fastest way to build a credit history is to get a credit card and use it responsibly. A credit card will allow you to build a good credit score in just three months, as long as you make all your payments on time and don’t go over the limit.

Credit cards are also good for building a credit history because they typically come with rewards programs that can help you earn cash back or other perks while using the card responsibly.

You should know, however, that some banks won’t give someone without a history of responsibly using credit a rewards card right away. If this is the case with your bank, it might be best to start with another type of low-risk card — such as one with no annual fee and no rewards program — and then gradually work towards better cards over time.

Building credit is the process of establishing a good credit history and getting your first credit card.

Building credit can take some time, but the more effort you put into it, the faster it will happen.

Getting Your First Credit Card

The first step to building credit is getting your first credit card. You may be able to get a secured credit card through your bank or a store like Walmart or Target. Secured cards require you to put down at least $200 as collateral in case you default on payments. However, these cards usually have low limits and high interest rates, so they aren’t ideal for building your credit history.

If you want to get an unsecured card instead, look for one that has no annual fee and offers reasonable rewards or cash back on purchases. A few good options include Capital One’s Venture Rewards Visa Signature Card and Chase Freedom Unlimited Card, which both offer 1% cash back on all purchases. You can find more recommendations in our list of best credit cards for students!

Getting a credit card is an important step in building your credit history. You may have heard that you should wait until you’re older to apply for a credit card, but there are plenty of ways to establish good credit before ever applying for a card.

Credit cards are not the only way to build a credit history and score. Here’s how to start building your own credit history without getting a loan or applying for a credit card:

1) Obtain an auto loan or other types of installment loans.

2) Pay off any existing debts on time and in full each month.

3) Use your debit card more often, as it can help build up your credit history by reporting your spending habits to the three major credit bureaus (Equifax, Experian and TransUnion). This can help boost your score over time because you’ll be demonstrating that you’re responsible with money.