A well drafted business plan is essential for any start-up to succeed — this is especially true for family businesses. Business plans have many important components, and some of which are outlined in this article. This article defines what a business plan is and its importance; covers example components of a business plan; and explains resources for help with writing your plan.

Business plan for family business

The Harvard Business Review’s Family Business Handbook is out of print, but it can be found online. It offers a step-by-step plan for succession planning in family businesses.

The authors, who are both academics and consultants, have identified seven stages of succession planning:

Assess the current situation.

Assess your personal situation.

Identify successors in the organization.

Develop leadership skills within the current generation of family members.

Prepare your children to succeed you as leaders of the business.

Prepare yourself to be retired from active management but remain involved in the business as an owner-manager or board member.

Transfer ownership to the next generation while maintaining control over the process through careful planning and monitoring

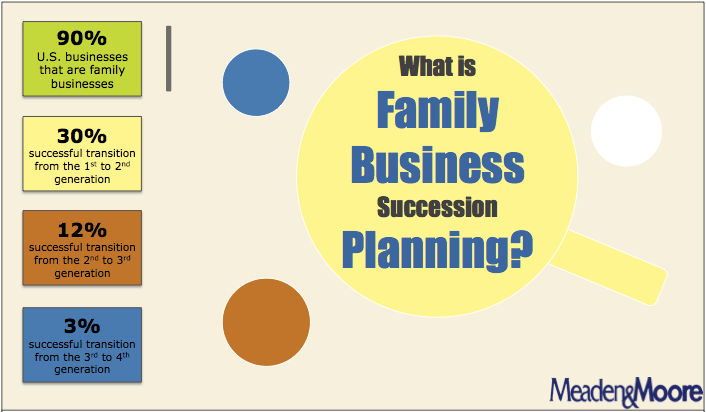

The family business is a unique form of business organization. The company is owned and managed by members of the same family and the succession planning process can be quite complex.

Family businesses need to plan for succession at all stages, but most family businesses tend to focus on one or two stages, such as when an owner retires or when a son or daughter is ready to take over as CEO.

The HBR Family Business Handbook has listed 7 succession planning stages in a family business:

Stage 1: Developing a long-term plan and goals

Stage 2: Assessing your strengths and weaknesses as an owner/manager

Stage 3: Assessing the strengths and weaknesses of other family members who will be involved in running the business

Stage 4: Making decisions about which business operations should be passed on to the next generation, either directly or indirectly (through an investment vehicle)

Stage 5: Deciding whether it makes sense to sell part or all of your business while you are still alive (or shortly after your death) rather than handing it over at some future point in time when you no longer have any control over what happens to it

When the time comes to plan for the future of your company, it’s important to think beyond just how you will continue the business and make money. What about the people? Who will be running the business in five years? In 10 years? And how do you make sure that person is prepared for the job?

The first step in any succession plan should be creating a strategic framework for thinking about who will succeed you and when they need to start learning about the business now. Here are seven stages of succession planning in family businesses:

Stage 1: Identify strategic successors. This stage involves identifying people who have both leadership potential and their own career aspirations outside of their current role in the family business. This may involve looking at family members who work outside of the business or bringing on an outsider as a director or officer. The key here is to pair someone with strong potential with one who has experience running a business or serving as a leader in some capacity (and ideally both).

Stage 2: Create a development plan. For this stage, it’s important to adopt an ongoing approach that helps people develop skills and knowledge over time so they can take on bigger roles within the organization at an appropriate pace — not too fast or too slow

A family business is a business that is owned and controlled by a family. Family businesses are often passed from generation to generation and may be managed by one or more members of the founding family. Family members typically share a common bond, often being related by blood or marriage. They also share an emotional attachment to the business, as well as an interest in preserving it as an entity over time.

Family businesses come in many forms and sizes, but they are usually small and medium-sized enterprises (SMEs). The World Bank defines SMEs as those with fewer than 500 employees. SMEs account for 99% of all businesses worldwide, employ more than half of the world’s working population, produce 80% of its GDP and contribute to nearly 60% of global trade.

1. Generational Planning

Generational planning is a structured process for identifying and developing leaders for the future. It may include developing a clear vision for the business, creating an employee handbook that articulates expectations and values, training employees in their roles, and providing regular feedback on performance.

2. Succession Planning

Succession planning is the process by which organizations identify people who can take over key roles when current leaders leave the organization or retire. Succession planning involves a combination of recruitment, development and retention processes to ensure there is always an adequate supply of capable candidates who can step into leadership roles when needed.

3. Cultural Transition Planning

Cultural transition planning is important because it helps families and businesses navigate changes in leadership style and values that occur when a new generation takes over. A shared vision among all stakeholders is critical to ensuring that cultural transitions are successful.

The Harvard Business Review Family Business Handbook is a comprehensive guide to the unique challenges faced by family businesses. It will help you navigate the succession process with confidence and minimize the risk of losing your company to a family member who doesn’t want it.

The handbook is divided into four parts:

Part 1 provides an overview of the seven stages of succession planning in family businesses. These stages include preparation, transition planning, transition execution and integration, legacy planning, and ongoing monitoring.

Part 2 covers seven key areas critical to successful family business ownership: governance structure; financial management; leadership development; talent acquisition and retention; communication plan; employee engagement; and succession pipeline management.

Part 3 features interviews with leaders at diverse companies across industries who have successfully navigated their own transitions from one generation to the next. Their stories offer valuable insights into what worked well for them — and what didn’t work at all — during their transitions.

Part 4 provides practical tools that can be used to help you assess your own readiness for succession as well as identify areas where additional work may be needed in order to ensure a smooth transition from one generation to the next.

Family businesses are often a source of pride and joy for the family members involved. However, they also present unique challenges that can make succession planning more complicated. Succession planning is a process that helps ensure the continuity of your business after you exit and that it remains profitable for years to come.

In this article we will discuss 7 stages of succession planning in family business:

1. Identify Your Family Business Succession Goals

2. Make Sure Your Family Is on Board With Your Plans

3. Determine an Exit Strategy That Works for Your Business Type

4. Develop an Exit Plan for Each Member of Your Family

5. Create a Transition Plan for All Major Positions Within the Company

6. Develop a Transition Plan for You as an Owner-Manager/Key Employee

7. Review Your Plan Annually to Ensure It’s Working

Family businesses are unique because they have a legacy to uphold, a family culture and identity to preserve, and a legacy of wealth to pass on. The only way to do this is by planning for the future.

Family businesses are unique because they have a legacy to uphold, a family culture and identity to preserve, and a legacy of wealth to pass on. The only way to do this is by planning for the future.

Succession planning is an important part of running any business, but it’s particularly crucial for family businesses looking to keep their companies going strong for generations to come. A successful succession plan will help ensure the continuity of the business while also helping family members prepare for the future by enhancing their skillsets or moving into other career paths that could benefit them in other ways than just financially.

Here are seven stages of succession planning in family businesses:

1) Identify successors

2) Create a development plan

3) Prepare for transition

4) Create backup plans if necessary

5) Have an exit strategy

6) Evaluate results after implementation

7) Monitor ongoing progress

Family businesses are often the backbone of a local community and the engine of economic growth. The downside is that they can also be a breeding ground for conflict and dysfunction.

Family businesses have it tough. They’re under pressure from all sides, struggling to keep up with the modern world while still maintaining their traditional values and culture. Succession planning is one way to help keep your business running smoothly after you retire or move on to other things.

Succession planning is more than just passing on your company; it’s planning how you’ll pass on its values, culture, and leadership to new generations.

A family business succession plan should include these seven stages:

1. Determine your goals for the future

2. Decide who should take over when you’re gone

3. Set up a plan for transferring ownership — or not!

4. Create a structure that supports future growth

5. Choose an outside consultant who understands family dynamics (optional)

6. Set up an education program for your successors (optional)

7. Make sure everyone knows about the plan

1. Identify the successor generation

2. Understand the skills and competencies needed

3. Develop a leadership development plan for each successor

4. Develop a coaching model for each successor

5. Develop a talent management system for your family business

6. Assess your culture and values as they relate to succession planning

7. Develop a communication plan.