There are many reasons why people need to hire a bookkeeper. The first is that they don’t have the time or knowledge to do it themselves, and the second is that they want to outsource this tedious task so they can focus on running their business.

If you’re looking for a bookkeeping service, here’s what you should look for in a professional:

A good bookkeeper will be able to answer all of your questions with confidence, and explain things in terms that are easy to understand.

The best bookkeepers will offer free consultations. They’ll sit down with you and discuss your business needs, as well as your goals for the future.

A good bookkeeper will be able to show you how their services can help improve your business’ cash flow and profitability.

They should also be able to provide references from former clients who were happy with their work.

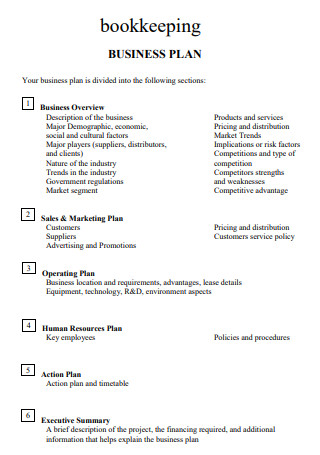

Business plan for bookkeeping services

A bookkeeper is a professional who works with the financial records of companies and individuals, calculating taxes, managing accounts payable and receivable, and providing information to tax authorities. The term “bookkeeper” can also refer to an internal employee with these job responsibilities or to an external company that offers similar services. Bookkeeping services can be offered as a standalone service or as part of a larger accounting firm.

A bookkeeping business plan is a plan that outlines your business idea and explains how you will run it. You can use the business plan to gain funding for your business, or just to help you focus on what steps you need to take next.

The first step in writing a bookkeeping business plan is getting clear about what your goals are for the future of your business. Do you want to start a freelance bookkeeping service? Do you want to join forces with other freelancers to offer more services? Do you want to start an accounting department for a larger company? Write down all of your ideas and then narrow them down until you have one main goal that will drive everything else.

Once you have this goal in mind, write down everything that needs to happen before you can get there. For example, if your goal is to become a freelance bookkeeper, then this might include finding clients or partners who will hire you regularly. If your goal is to work full time at an established firm as an accountant, then this might include gaining experience working as an assistant before moving up into management roles. Write down all of these steps so that when someone asks what it takes for them to get there, they know exactly what they need to do first

Bookkeeping Business Plan

A Bookkeeping business plan is a document that summarizes the basic facts and figures of a business in order to attract investors. It is a broad overview of the business that presents the key aspects of the business and its future plans. A bookkeeping business plan can be created for any type of business, from those that are just starting out to ones that have been around for many years and are looking for new opportunities.

The first step in creating your own bookkeeping business plan is to determine what type of information you would like to include in it. You will need to include general information about your company such as: company name, address, phone number, website address, etc. You should also include detailed information about your product or service such as: description of what you sell, how much you charge for it, who buys it (for example – business owners), etc.

You should also provide information about how successful your company has been so far. This can include things like how many customers you have served or how much money you have made so far this year or even last year if you are still operating under last year’s budget structure.

The following is a bookkeeping business plan template that can be used as a guide by anyone interested in starting a bookkeeping business.

The first section of this sample business plan template covers general information about the company and its owners. This includes the company’s legal structure, its business address, and contact information for both the primary owner(s) and the bookkeeper. It also includes descriptions for both the service offered by the company, as well as its target market.

The second section of this template is dedicated to the product or service being offered by your bookkeeping service. This section should include a detailed description of what your customers can expect to receive from your company once they become clients.

The third section is where you provide an overview of how you will market your bookkeeping services to potential clients. This part of your plan should include details on how you plan to advertise your services (i.e., through social media marketing), as well as any other methods that you may use when trying to attract new customers (i.e., referrals).

The fourth section covers how much money it will cost for you to start up this business and how much revenue it will generate for you after it has been operating for six months.

The bookkeeping business plan is an essential document for the success of your business. It is a comprehensive overview of the business, including its history, mission statement and goals. The plan also includes a marketing strategy, financial projections and market analysis.

The business plan for bookkeeping services should include:

A brief description of the industry and how it has changed over time. Include information about any new technologies or trends that may affect your company’s ability to compete in the future.

A summary of how you plan to provide value to your customers, including what sets your service apart from other companies offering similar products or services.

An explanation of how you will achieve or maintain market leadership by satisfying customer needs better than anyone else in the industry can do so.

An overview of the competition and how your company plans to beat them out at their own game (e.g., lower prices).

The financial forecast that shows how much money you expect to make in each year of operation based on various assumptions about sales growth, cost increases, etc.

Tax preparation business plan pdf

The bookkeeping business plan template is a comprehensive document to help you get started. You can use it as a starting point for your own plan.

The Plan Template offers useful tips and examples on how to start and run your own bookkeeping company. It contains information on:

your business idea;

target market;

product or service description;

marketing, sales and promotion strategies;

financial projections; and more.

Virtual bookkeeping business plan template

Virtual bookkeeping is a business that offers accounting services to small businesses and individual clients online. Virtual bookkeepers handle the day-to-day operations of a client’s accounting records, including payments and billings. Virtual bookkeepers typically charge by the hour or by the project, depending on the type of services they provide. They often work with clients who are traveling or who live in other states or countries.

Accounting and Bookkeeping Services

The key to success for a virtual bookkeeper is establishing a solid reputation through referrals and repeat customers. The virtual bookkeeper must be able to demonstrate their value by providing quality work at fair rates. This can be achieved through:

Posting informative articles on websites such as LinkedIn or Google+. These articles should describe how using cloud-based accounting software can help small businesses reduce their overhead costs while increasing productivity. The articles should also share tips on how to organize financial data in order to make it easier for your company to calculate taxes and create budgets for future planning purposes.

Participating in forums related to accounting topics such as QuickBooks payroll and QuickBooks Point of Sale (POS). These forums allow you to network with other accountants while offering advice on how to improve their own businesses

The bookkeeping business plan is a document that helps business owners to establish their goals and objectives, as well as providing a detailed description of the products and services they will offer. It also includes information on the target market and competitors.

The bookkeeping business plan is a document that helps business owners to establish their goals and objectives, as well as providing a detailed description of the products and services they will offer. It also includes information on the target market and competitors.

The bookkeeping business plan should contain:

Business name and contact details;

Objectives;

Products or services offered;

Target market;

Competitors/market analysis;

Marketing strategy (including pricing);

Financial projections (sales revenue, cost of sales, operating expenses);

This is a sample bookkeeping business plan. It has been written by someone in the industry who has worked in the field for many years and knows what it takes to run a successful business.

The following topics are covered in this business plan:

1. Executive Summary

2. Marketing Plan

3. Sales Forecast, Product Mix and Pricing Strategy

4. Management Team and Organization Chart

5. Financial Projections

Accounting is one of the oldest professions in the world. It has been around since the beginning of civilization. The first accountants were probably the scribes who wrote down numbers on clay tablets. Today, we have computers and software to help us keep track of our finances, but the basic principles are still the same.

Accounting is a process that involves recording, classifying and summarizing financial information about a business in order to generate useful reports for decision-making purposes.

The accounting department is responsible for keeping track of all financial information from sales receipts to payroll figures. The accountant then turns this raw data into useful information by using accounting software or manually entering it into an Excel spreadsheet or other type of program.

Businesses use this information to make decisions about their future growth plans or whether they should invest more money into marketing efforts instead of expanding production capacity.

If you’re looking for a career that can provide security and stability while also offering plenty of opportunities for advancement, then accounting might be right for you!