A good financing business plan should include all aspects of the industry, marketing strategy and management skills to grow faster. When you submit a great business plan for bank financing that impresses bankers, the finance can be approved in faster and tendering will not wait for very long. Business plan is actually one of the most important keys to success of any start-up business. This blog will guid.

business plan for bank financing

A business plan for a bank loan is a document that can be used to help secure a loan from the bank. It is important to know what information you need to include on your business plan in order to make it successful. This article will help you learn how to write one.

Banking Industry Business Plan Example

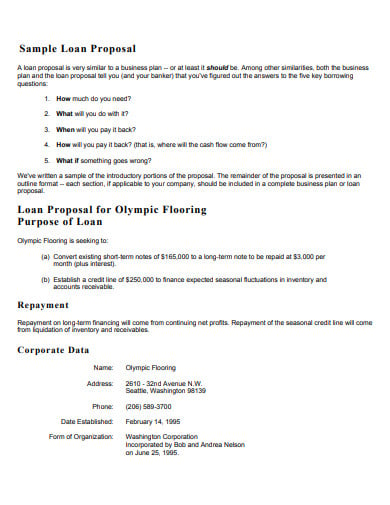

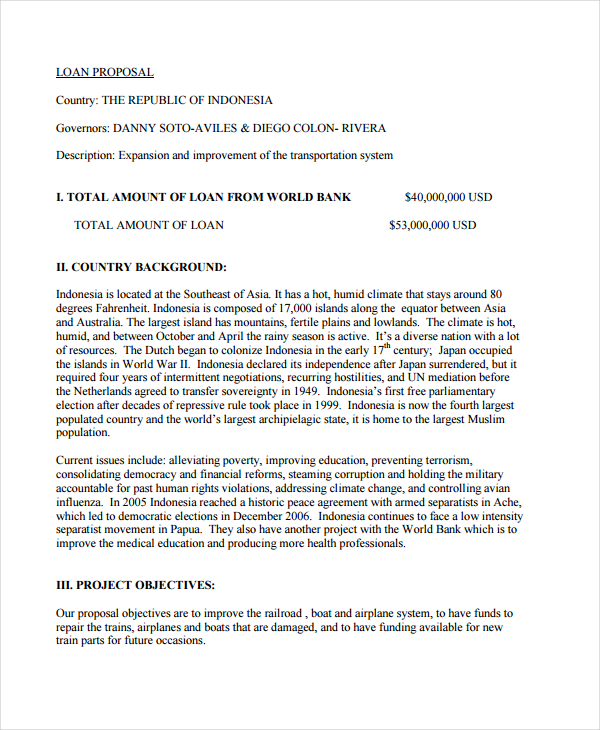

The first step in writing a business plan for a bank loan is to understand the basics of banking industry. You need to know what kind of information your lender wants and how they want it presented. To get started, check out this sample banking industry business plan example. This will give you an idea of what information they are looking for and how it should be presented.

Proposal PDF FormatAfter learning about the banking industry, you need to research your target lender or lenders. Find out who they are and what kind of businesses they usually finance. This sample bank loan proposal PDF format can be used as a template for creating your own customized sample proposal letter for banks or lenders in India or any other country where English is not the native language.

A bank loan is a type of debt financing that lets you borrow money to fund your small business idea.

It’s important to have the right documentation in place before you approach a lender. Here’s what you need to know about writing a business plan for a bank loan.

What Is a Bank Loan?

A bank loan is basically a line of credit that helps you get cash when you need it. When you take out this kind of loan, the bank gives you money upfront and then charges interest on it over time. The amount of money available as part of your loan depends on how much collateral (like property) or equity (like shares) you put up to secure the loan.

Bank loan proposal is an application letter to the bank for getting a loan from the bank. You can use this letter when you want to apply for a loan from a bank. In this letter, you should include all the details about your business and how much amount you want to borrow from them.

Sample Bank Loan Proposal Letter

Dear Sir/Madam,

This is to apply for a loan of $10,000 at an interest rate of 8%. The terms of repayment are 1 year. I am planning to use this money for my business which is located at (address). This business will be profitable within two years and I will be able to repay the loan within the specified time period.

Your kind consideration towards my application will be highly appreciated.

Bank financing is a form of funding that many businesses use. Banks provide loans to businesses, which allows the business to purchase property or equipment, or make other investments. A business plan for bank financing should include:

The background of your business and its goals

A description of your business, including what you sell and to whom

An overview of your sales process

A description of how you will use the funds from the loan

What collateral you can put up as security for the loan

Bank Loan Proposal Sample.

Business Proposal Sample For Bank Loan In India.

Bank Loan Proposal Sample.

Sample Business Proposal For Bank Loan In India.

Sample Business Proposal For Bank Loan In India.

Banking Industry Project Proposal Sample Doc Download.

Sample Project Proposal for Bank Loan PDF

Professional Project Proposal Template

Project Name: ___________________________________

Project Title: ___________________________________

Project Description: ___________________________________

Project Objective: ___________________________________

For what purpose the project is being undertaken?

Why this project is required? ____________________________

What are the benefits of implementing this project? _______________.

Who are the beneficiaries of this project? _____________________.

Benefits of this project to the company and its stakeholders. _______________.

When will you start implementing this project? When it is required? What are the timings? _______________________________.

Business Plan For Banking Industry

I am planning to start a new business in the banking industry. I have already selected the city and area where my business will be located. The details of this project are as follows:

Business name: ABC Bank

Location: City, State – India

Objective: To provide financial services to customers at affordable prices.

Target market: People who want to invest their money and want to earn profits by investing in credit or debit card schemes.

Current status: New start-up with limited funds but has high potential for growth.

A bank loan is a financial tool that allows you to borrow money from a bank. A bank is a financial institution that accepts deposits, makes loans, and provides other financial services to companies and individuals. Banks are regulated by federal and state laws and must comply with these regulations. A business can apply for a loan from a bank if it has adequate collateral or assets, a solid business plan, and good credit history.

A bank loan allows you to borrow money from the bank to start or expand your business. The bank will lend you money under certain terms and conditions which include interest rate, repayment period etc. It is important that you evaluate your needs before applying for a loan because not all loans are suitable for every business type or stage of development. It is also important to note that banks charge interest on the borrowed amount as well as on any unpaid balance at the end of each month; therefore, it is prudent to make monthly payments on time so as not incur late payment charges which may increase your overall debt burden significantly over time

Banks generally offer two types of loans: secured and unsecured loans

Bank loan proposal is a document that should be used in case you need to raise funds from a bank. The bank loan proposal is the most common way to ask for a loan, but there are other options as well.

In this article, we will talk about how to write a bank loan proposal.

First of all, let’s take a look at why you need to write a bank loan proposal:

1) If you want to get approved fast;

2) If you have no credit history or bad credit history;

3) If you want lower interest rates;

4) If you want flexible repayment schedule;

5) If your business needs a lot of capital at once and it’s hard for you to get it from private investors or friends and family members.