Are you planning to start a business? Are you already in the business but can’t seem to increase your profit margins? Don’t worry; this situation is common. The fact of the matter is that many small businesses think they’re making money, but don’t track their expenses closely enough. The secret to increasing some sort of profit is to create a budget and make sure you stick with it. Many business owners aren’t aware of how much they could save when they simply review their budget on a regular schedule.

Budget for business plan

Budget for business plan

Budget for restaurant business plan,

how to create a budget plan for business,

budget for restaurant business plan in india,

budget planning software for business,

budget template for business plan

Budget for business plan

Business planning is an important step in starting any new small business. The plan will help you determine if your startup idea is viable and what resources you will need to make it successful. The process of creating a business plan will also help you clarify your goals and understand the challenges you may face as you launch and grow your enterprise.

You can create a budget for your new company by following these steps:

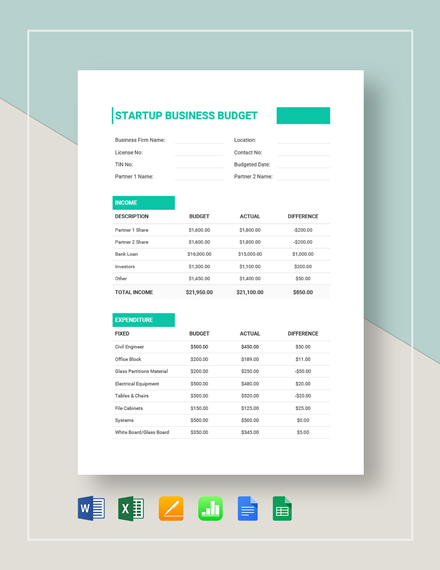

List all anticipated expenses. This includes start-up costs, equipment and supplies, payroll, advertising and marketing costs, rent or mortgage payments, insurance premiums, utilities and any other recurring expenses related to running your company.

List all anticipated revenue sources. This includes product sales, service fees and membership fees. If applicable, include income from investments or other sources such as royalties or dividends from stock holdings in other companies.

Add up all projected revenues and subtract them from the total projected expenses. This gives you an estimate of how much money your business needs to operate on a monthly basis once it’s fully operational.

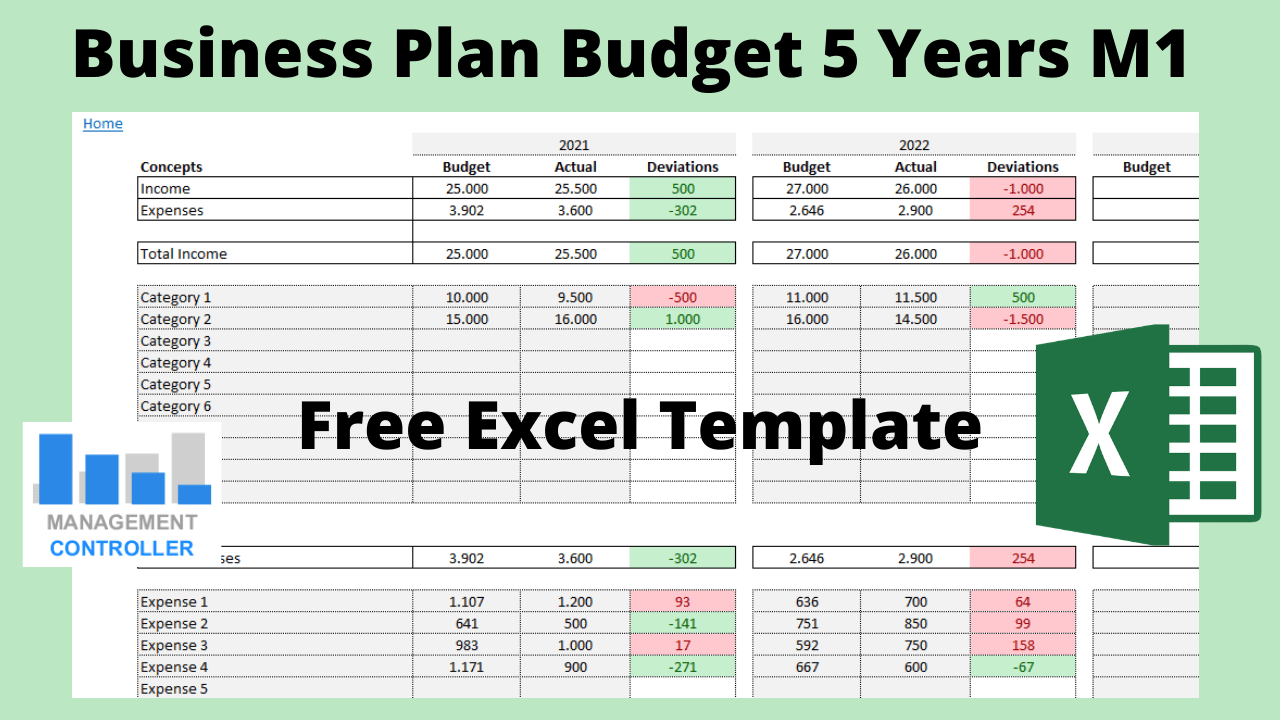

The budget is a financial plan for the upcoming year. It is a forecast of what your business expects to earn, spend, and save over the next 12 months. The purpose of the budget is to give you an idea of how much money will be needed in order to accomplish the goals you’ve set for yourself. A budget can help you make better decisions about how you spend money.

In order to create a successful budget, you need to know what your income and expenses are likely to be over the next 12 months. This means that you will need some basic accounting skills and knowledge about how much your business spends on materials, supplies, and employees’ wages every month. You should also have an idea about how much money is being spent on marketing campaigns or other expenses related to growing your business.

A good way to start creating a business plan is to find out how much money you need in order to run it successfully for one year (or longer). This will help you determine how much money you need both from investors and other sources of funding such as loans or grants from government agencies (if they’re available). If your business has been running successfully for some time already and has generated enough profit so that it doesn’t need additional funding right away then this step may

Budget for business plan

A budget is a financial plan that allocates resources. It is a tool for planning and controlling spending, saving, and investing.

1. Budgeting can help you achieve your long-term goals. A budget can help you save money and avoid wasteful spending or overspending.

2. A budget provides a way to track your spending and see if it matches up with your goals. You can compare the numbers in your budget with what’s actually being spent, which helps you make adjustments if necessary.

3. If you’re selling products or services, knowing how much you’re earning from each item can help you determine whether it’s worth continuing to sell it (or keeping up with inventory). And if an item isn’t selling well, you may be able to cut losses by dropping it from your offerings or adjusting prices to make them more competitive with other vendors’ offerings in the same space.

When you’re writing a business plan, you need to have a clear idea of the costs your company will incur.

Now, some of these costs are fixed and some are variable. For example, if you own a clothing store, the rent is probably fixed, while the cost of buying new stock will be variable.

You need to know what these costs are before you can determine how much money you’ll need to make it through your first year in business. Here are some categories that might be included in your budget:

Startup expenses

Legal fees

Licenses and permits

Insurance (including workers’ compensation)

Equipment and furniture purchase/rental/installation

Professional fees (accountant, attorney)

Advertising and marketing costs

Budget for restaurant business plan

A budget is a detailed estimate of expected income and expenses over a specific period of time. It is one of the most important documents in any business. A good budget allows you to see exactly where your money is going, so you can make adjustments as needed.

How to create a budget plan for business?

First, you need to know what your expenses are going to be. Accountants often use the term “fixed” when talking about expenses that are not likely to vary much from month-to-month or year-to-year. Rent, utilities, insurance and other recurring costs fall into this category.

Once you’ve figured out how much money you need each month to cover these fixed costs, you can decide how much revenue you need each month in order to cover those expenses (plus any additional ones). This is called break even analysis and it’s a good way of figuring out how much money you need in order to start your new business venture without going into debt or relying on savings or loans from friends or family members.

If you’re starting a business from scratch and don’t have any prior experience running one, then it might be worth looking into whether there are any grants available for small businesses in your area. These

Budget for Restaurant Business Plan

How to Create a Budget Plan for Business

Budgeting is a fundamental part of running any business. Without a budget, you won’t be able to assess how much money you’re making or spending, and you won’t be able to plan for future expenses. Your business plan will include a budget that shows your projected income and expenses.

The first step in creating your budget is to figure out how much money your company will need in order to operate on an ongoing basis. To do this, you’ll need to determine your fixed expenses (those expenses that don’t change from one month to another) and variable expenses (those that vary depending on how much business you do). Fixed expenses include rent or mortgage payments, insurance premiums, utilities bills and other costs that are not dependent on the number of customers served or products sold. Variable expenses include payroll costs and supplies needed for daily operations like food and beverages.

Once you have a basic idea of how much money you’ll need to keep your business running each month, you can start planning for unexpected costs like equipment repairs or replacements, as well as unexpected revenue opportunities like new clientele or product line extensions. It’s also important to factor in any extra funds

Budget Planning For Restaurant Business Plan

Creating a budget is an important step in starting your restaurant business. It will give you a clear picture of your expenses, income, and profit. You can also use it to determine whether or not you need additional financing.

A good budget should include:

· A detailed list of all fixed and variable costs

· An estimate of sales proceeds per month and year

· An accurate estimation of the number of customers that you expect to receive each month and year

Restaurant Business Plan Budget

The budget is a critical part of the business plan. It shows the financial potential of your restaurant and how much money will be required to start and run it. The budget should reflect three main factors:

The cost of opening the restaurant. The actual cost of opening a restaurant varies by location and size, but you can expect to spend between $150,000 and $300,000 to open a small operation in a major metropolitan area. For example, if you have an idea for a fast-food restaurant serving hamburgers and fries, you might need about $85,000 for equipment and furnishings; $25,000 for leasehold improvements (retrofitting); $10,000 for insurance; $20,000 for construction loans; plus miscellaneous expenses such as office equipment and legal fees.

Costs associated with operating your restaurant. These include rent or mortgage payments on the building where your business is located; utilities; inventory costs; payroll expenses including taxes; food costs (including ingredients like meat); marketing costs (such as newspaper ads); legal fees related to day-to-day operations such as employment contracts; accounting expenses (including bookkeeping); maintenance expenses such as replacing broken windows or cleaning carpets; taxes on profits earned

How to Create a Budget Plan for Your Business

A budget is the best way to plan your finances and keep track of your spending. If you’re starting a new business, you’ll need to create a budget in order to stay on top of your finances. A good set of financial records will help you avoid overspending and help you make smart decisions about how to spend money on each aspect of your business.

The first step in creating a realistic budget is determining how much money you have available for your startup. For example, if you have $5,000 saved up from years of savings or an inheritance from a relative, this is the amount that you can spend on your business without worrying about whether or not it will be profitable right away. However, if you don’t have any money saved up and are trying to start a business with no capital, then it might be difficult to come up with an accurate budget plan without taking into account all possible expenses before starting out.

Once you know how much money you have available for your business, it’s time to create a list of all possible expenses so that you can see where exactly all this money will be going once the doors open for business. Here are some items that should be included in