Have you ever wondered if you really need to hire more social media consultants? Or maybe you’re concerned that your marketing budget may be larger than what you need. In today’s post, we will outline the 5 steps in break-even analysis for marketing plan. Let’s dive right in…

Break even analysis for marketing plan

Break even analysis is a business technique used to determine if a business will be profitable by calculating the break even point.

The break even point is the level of sales at which total revenue will exactly equal total costs. In other words, the break even point shows you how much money you need to make in sales to cover your fixed and variable costs.

A business must sell enough products or services to cover its fixed and variable costs before it can make any profit. The break even point is where total revenue equals total expenses. When a business reaches this point, it breaks even.

Marketing Plan Break Even Analysis Example

The following example illustrates how to use market research data for a marketing plan break even analysis:

Break Even Analysis in Marketing

Break even analysis is a fundamental tool used to determine how much revenue a company must generate in order to cover its fixed costs. This is the most important concept to understand when it comes to marketing plans, because it will help you determine how much money you need to make in order to stay in business.

If you don’t have enough sales, you’ll lose money. If you have too many sales, though, and your costs aren’t covered by your revenue, then you’re also losing money — and probably faster than you realized.

What is Break Even Analysis?

Break even analysis is a financial calculation that determines how many units of product or service must be sold in order to cover all expenses for that product or service. For example: If your total fixed costs are $80k per month and each unit sells for $100, then you need to sell 800 units per month just to break even.

A break even analysis is used to determine the point at which total revenues equal total costs, i.e., where there is no profit or loss. In other words, it tells us how many products need to be sold before we start making any money.

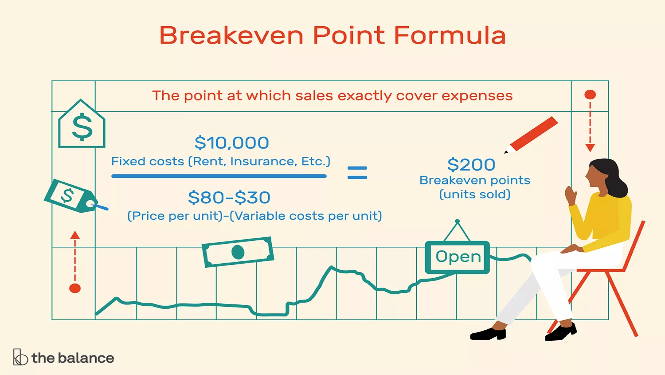

The formula for break-even point is:

Break-even point = Fixed costs / Contribution Margin ratio (CM)

If you know the number of units you need to sell and the contribution margin per unit, then this equation can help determine how much money you will have left over after covering your overhead expenses and paying all variable costs associated with producing those units of product or service.

Break Even Analysis Example

For example: If a business has $50 in fixed costs per month and a contribution margin ratio (CM) of 50%, then its break-even point would be:

$50 / 50% = 100 units per month

Break-even analysis is the process of determining the point at which revenues equal costs. The purpose of this analysis is to determine whether a business or project can be profitable.

A break-even point occurs when a company has sold enough products or services to cover its fixed expenses and variable expenses.

The formula for calculating break-even point is:

Projected Sales – Projected Fixed Costs = Break-Even Point

Break-even analysis is a widely used tool for determining the point at which sales revenues just cover the variable costs of production. This is also known as the break-even point.

How to Calculate Break-Even Points

In order to calculate your break-even point, you need to know how many units of product or service you must sell in order to meet your fixed costs and generate a profit. Once you know this information, you can use it to determine how much money you need to make before turning a profit.

There are two ways to calculate your break-even point: using fixed-cost absorption or variable-cost absorption. The easiest way is to use fixed-cost absorption because it requires fewer calculations. However, some businesses may not have any variable costs, which makes using variable-cost absorption more appropriate.

Fixed Cost Absorption Method:

The Fixed Cost Absorption method is used when all of the company’s costs are either fixed or semi-variable (i.e., they increase along with sales volume). This method involves calculating two figures: 1) total fixed costs per period; and 2) total variable cost per unit sold (sales price less variable expenses). Once these two figures are known, subtracting one from

Break even analysis is a tool that can be used to determine the point at which revenue equals expenses. It’s a critical part of any marketing plan because it helps you understand how much money you need to make in order to cover expenses and make a profit.

A break even analysis for marketing plans can be broken down into three parts:

1. Calculate your total fixed costs for the period being analyzed. This includes rent, utilities, insurance, and anything else that cannot be changed throughout the year.

2. Calculate variable costs for each product or service that you sell during that period. For example, if you sell widgets for $10 each and have 100 in inventory at the end of the period being analyzed, then your variable cost per unit is $10 (100 units x $10/unit).

3. Calculate contribution margin per unit by subtracting variable costs from sales price per unit; contribution margin per unit is equal to contribution margin percentage multiplied by sales price per unit: Contribution margin percentage = (contribution margin / selling price) x100% Sales Price Per Unit = Price – Variable Cost Per Unit Contribution Margin Per Unit = Price – Contribution Margin

Break-even analysis is a tool for calculating the minimum point in sales volume at which a business will be able to cover its costs and begin generating profits. In general terms, break-even analysis considers the cost of goods sold and fixed expenses associated with running a business. The difference between these two figures is called variable expenses, which includes all costs directly related to the sale of products or services.

The sales revenue necessary to cover these costs is known as breakeven revenue. Breakeven analysis can be applied to any type of business, from small businesses with one employee to large corporations with thousands of employees.

For example, if you own a small business and want to know how much money you need to make per month so you can pay your bills and turn a profit, you will use break-even analysis to determine your monthly expenses (cost of goods sold) and your monthly revenue goal. If your total monthly expenses are $3,000 and your total monthly revenue goal is $2,500 (break-even), then you would need at least three customers each day in order for the business to survive long term. If you make more than $2,500 but less than $3

Break-even analysis is a critical tool in budgeting and planning. It’s used to determine the level at which you need to sell to cover your expenses.

You can use break-even analysis to calculate the sales required for your business to break even or make a profit. You may also need it if you’re applying for a loan or trying to decide whether a business will be successful.

Break-even analysis is based on the relationship between revenue and expenses. For example, if your total annual fixed costs are $50,000, variable costs total $20 per unit sold and each unit sells for $60, then you need to sell 2,000 units per year to cover all your costs and earn a profit of $10 per unit sold (2,000 x 60 – 50).

Break even analysis is the process of calculating the volume of sales needed to cover fixed costs.

The formula for break-even analysis is:

Break-even point = Fixed costs / contribution margin ratio

In other words, the break-even point is the level of sales at which total revenue equals total cost. The contribution margin ratio is the amount of money remaining after variable costs have been subtracted from sales revenue.

For example, if a company has $100 in fixed costs and it sells products for $30 each, then its contribution margin ratio is $70 ($30 – $100). If it can sell at least 1,000 products, then it will earn $7,000 (1,000 x 30) in profits.

Break-even analysis is a process that determines the point at which a business will begin to make a profit. The break-even point is the point at which sales equal costs, so that the business neither makes nor loses money.

Break-even analysis is also known as cost-volume-profit analysis or CVP analysis. This article looks at how to calculate your break-even point and examine different ways of making it easier to understand.

Calculating your break-even point

To calculate your break-even point, you need to know three things:

the fixed costs of running your business (these don’t change with sales)

the variable costs of running your business (which decrease as you sell more)

your target profit per unit sold (or gross profit margin).