One of the most important aspects of running your own business is understanding how you are going to break even. In short, this is when your start-up costs and revenue are equal. In some cases, you may also need to consider how much profit you might also want to make. It is helpful to be able to calculate the breakeven point so that you’ll have a basic understanding of whether your business idea is viable.

Break even analysis example for business plan

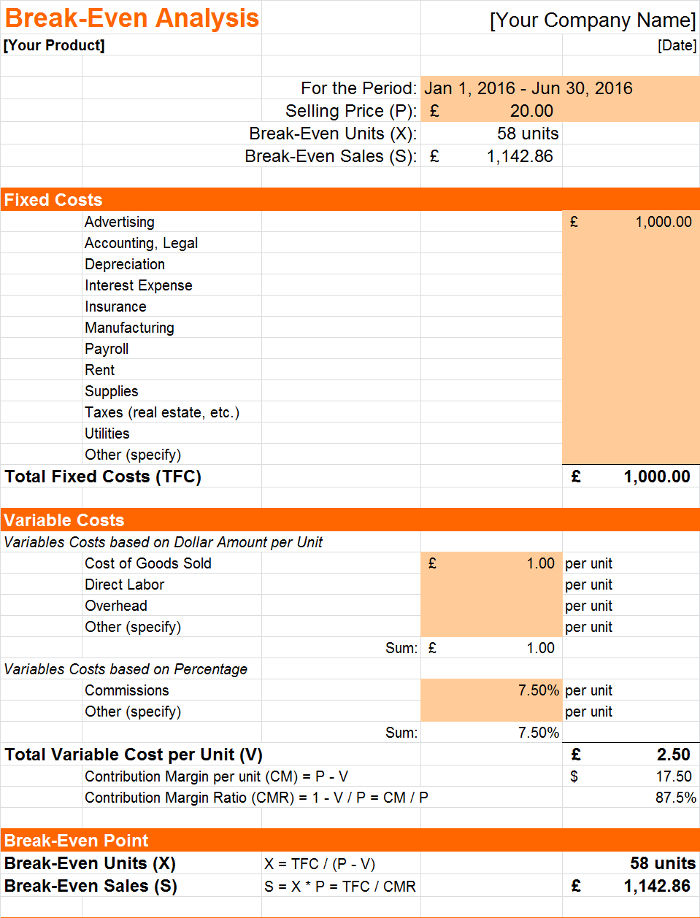

A break-even analysis is a business planning tool used to determine how many units must be sold to cover all expenses and generate zero profit. It is typically calculated by dividing the total fixed costs by the contribution margin per unit, which yields a break-even sales quantity.

For example, if a business has $50,000 in fixed costs and an average contribution margin of $10 per unit, then they must sell at least 5,000 units to break even.

Some businesses may have more than one product line or service offering. In this case, it’s important to understand how much each product line contributes towards the overall goal of covering all expenses and generating zero profit.

How does it work?

A break-even analysis helps you determine how many units you need to sell in order for your business to cover its fixed costs and generate zero profit without having any excess income (or loss). These analyses are often used as part of a business plan or financial forecast for new ventures or expansions. For example: If you’re opening a restaurant but aren’t sure whether it will be successful enough to reach breakeven point within three years’ time, then a break-even analysis can help you determine whether it might take longer

What is a break even analysis?

A break-even analysis is a financial calculation that determines the point at which revenue equals costs. This point is called the break-even point.

Why use a break even analysis?

A business needs to know its break even point for several reasons:

to determine if it can continue operating at current levels of sales and expenses

to evaluate the impact of price changes on profitability

to estimate sales volume needed to meet future cash flow requirements

A break-even analysis is a financial tool used by managers to assess the impact of changes in a business’s cost, sales and expense. The break-even point is the level of sales at which a company neither earns nor loses money on its net income statement. Break-even analysis is one of the basic tools used in business planning and budgeting.

In its simplest form, break-even analysis is an accounting technique that determines if a firm can cover its variable costs of operation with current sales revenue. If not, then additional sales volume will be needed to cover fixed expenses as well as its variable operating costs.

The formula for calculating break-even point (sales volume) is:

Income Statement Before Taxes=Fixed Costs/Contribution Margin%

Break Even Point = Fixed Costs/(Contribution Margin% x Units Sold)

The break even point is a basic financial concept that helps you understand the relationship between sales revenue and costs. It’s also a tool for evaluating the viability of a proposed business, or determining how much money you’ll need to raise to launch your business.

In this article, we’ll look at how to calculate break even, as well as some of its limitations.

What is a break even analysis?

A break even analysis is a financial calculation that determines the level of sales that must be reached in order to cover all expenses and produce no net loss. For example, if you’re considering opening an art gallery and have determined that your startup costs will be $20,000, then your break-even point would be $20,000 divided by your profit margin percentage — in this case 50%. This means that you would need to sell $400 worth of art each week in order for your business not to lose money during its first year of operation.

A break-even analysis measures the point at which total expenses equal total revenue. It is the level at which the business neither makes nor loses money. Break-even analysis can help determine how much to charge for a product and whether it’s viable for a company to enter into a new market.

Break-even analysis is also known as “contribution margin” or “contribution to overhead.”

The formula for calculating break even is:

where:

Break-Even Point (BEP) = sales revenue required to cover fixed costs and variable costs associated with production, and produce no net gain or loss from operations;

Sales Revenue (TR) = total revenue generated by sales of goods or services; includes all sales revenues that have been earned by your company during a given time period (usually a month); this figure also includes amounts received from any credit sales made on account during this time as well as any cash discounts taken; however, if you are using accrual accounting, this figure will not include any unpaid accounts receivable

Break-even analysis is a very important part of business planning. The break-even point is the level of sales needed to cover all costs and generate profit.

In other words, it is the point at which your business neither makes nor loses money.

The break-even point can be calculated using simple or complex methods, depending on your needs.In this article I will explain what is break even analysis and how it can help you with your business planning

Break-even analysis calculates the volume of sales needed to cover a company’s fixed costs. It shows the point at which total revenue equals total cost, also referred to as “zero profit.”

Break-even analysis can be used to determine whether a business will be profitable and how much time it will take for a new product to become profitable. It can also help identify problem areas where additional sales are needed to cover costs or where costs are too high. Break-even analysis is used by companies of all sizes, from small start-ups to large corporations with multiple locations and departments.

What Is Break-Even Analysis?

Break-even analysis is an important part of business planning because it helps you determine when your company will begin earning profits and how much money you need to make in order to break even.

A break-even chart looks like this:

A break-even analysis is a way to evaluate the profitability of a business. The analysis shows how many units of product or service must be sold in order to cover all costs and begin earning profit.

Simplifying the equation further, if you know how much you have to sell, you can determine how much profit you need to make that amount of sales profitable.

The purpose of this exercise is to find out what your sales level needs to be in order for your business to be profitable. You can then use this information to help develop strategies for driving sales and increasing profits for your business.

Break-even analysis is a financial management tool used to determine the number of units that must be sold in order for a company to be profitable.

Break-even analysis is used extensively in the retail industry, but it can be used by any business that sells products or services. The information provided by a break-even analysis will allow a business to determine its acceptable profit margin and how many units must be sold to turn a profit. Break-even analysis is also known as “unit contribution analysis.”

Break-even analyses are used to determine whether a specific business will be profitable or not. This information is important because it determines how much money the business needs in order to stay in operation. If you want your business to succeed, then you need to know how much money it takes just to break even before looking at profits or losses. The formula for calculating the break-even point is:

The fixed costs are all expenses that don’t change with volume — things like rent, insurance and so on. The contribution margin refers to the amount each unit contributes toward paying for its fixed costs (i.e., if each unit sells for $5 and has $2 of direct material

Break-even analysis is a simple way to calculate how many units of a product or service must be sold to cover the costs. It is the point at which revenues equal costs. After the break-even point,profits begin to accrue.

For example, if you have $100,000 in fixed costs and are selling 1,000 units per year, your break-even point would be 100 units. You could sell as few as 50 or 60 units and still show a profit (assuming your variable costs were less than $50 per unit).