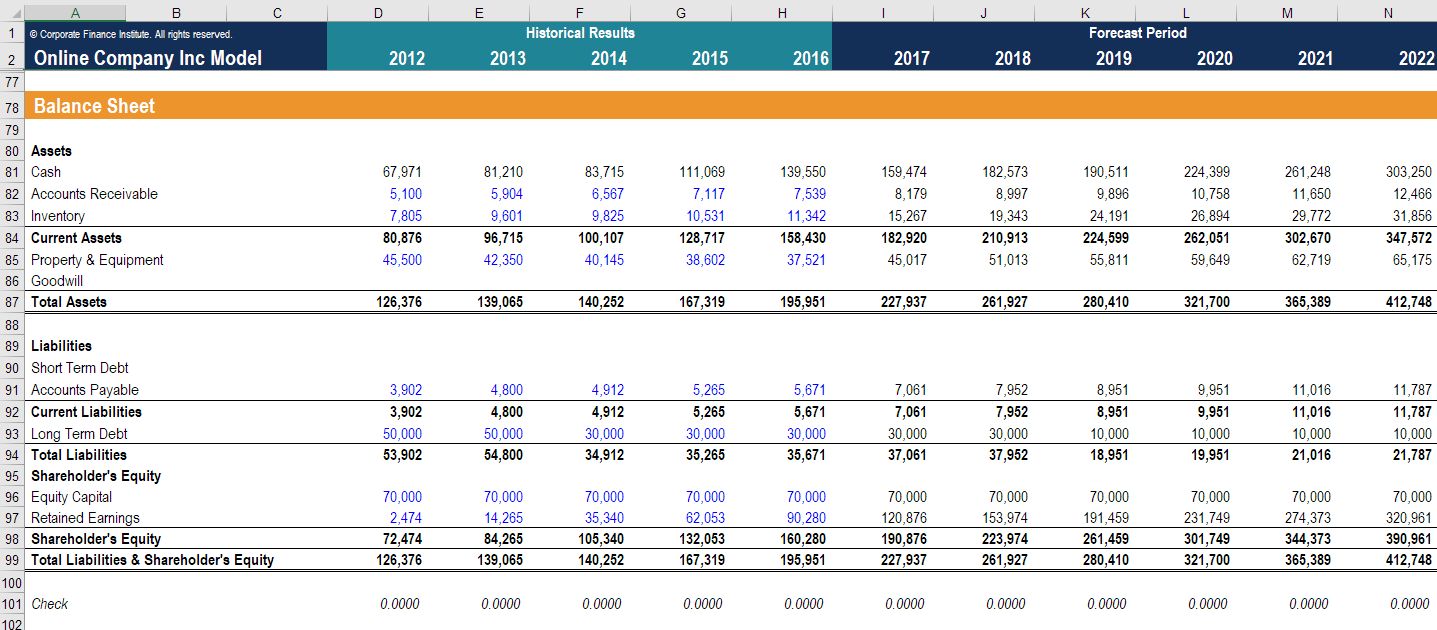

The balance sheet forecast for business plan is a forecast that identifies the amount of capital needed by the business for the upcoming time period. The balance sheets typically include cash, accounts receivable, inventories, fixed assets and accounts payable. These contribute to the funds available as well as funds which may be used in supporting an owner’s livelihood.

Balance sheet forecast for business plan

In this article, we will talk about how to forecast budgets for business. Forecasting is a planning technique that uses historical data and the future expectations of the business owners to predict what might happen in the future. It helps in making informed decisions about the future performance of your company.

Forecasting is important for any business because it helps them understand what their future financial picture looks like. This can be done by analyzing past performance and comparing it with projected sales volume, costs and expenses to determine if they are on track or if adjustments need to be made in order to reach their goals.

The following are some types of business forecasts:

Sales forecast – An estimate of how much revenue or income will be generated by the company during a specific period of time

Cash flow forecast – An estimate of how much cash will be generated or consumed by a company over time

Balance sheet forecast – An estimate of how much debt, equity and other assets will exist at any particular point in time

Forecasting a balance sheet is the second step in creating your business plan. This forecast is based on the assumptions you made in your income statement and cash flow statement.

The balance sheet shows the company’s assets, liabilities, and owner’s equity. The balance sheet is one of the three major financial statements that businesses use to keep track of their finances.

How to Forecast Your Balance Sheet

You can use the following information to help you forecast your balance sheet:

Income Statement: Look at your income statement for the current year and make estimates for next year’s sales and expenses. Include any new costs or additional revenue sources that will affect your earnings next year in this section. You should also consider how much debt you’re taking on or how much equity capital you’re going to raise before making your predictions.

Cash Flow Statement: Look at what happened with your cash flow during this past year to determine whether you will have enough money going forward to cover expenses and pay back any loans or investments that you may have taken out while starting up or growing the business.

Forecasting a balance sheet is a critical part of planning for your small business. It can help you identify potential problems before they happen and give you an idea of how much money you’ll need to meet expenses.

A forecasted balance sheet is similar to a projected income statement in that it shows how much money you expect to bring in and what you expect to spend. The difference is that while an income statement focuses on expenses during a specific period, the balance sheet looks at assets, liabilities and equity at one specific point in time.

In this article we’ll look at how to create a forecasted balance sheet for your small business.

Why Forecast Your Balance Sheet?

Forecasting is important because it allows you to see where your company stands financially over time. If you’re new to business or want more information about how different events affect your bottom line, it’s essential that you know where your company stands today and tomorrow. You may also be required by lenders or investors to provide these forecasts as part of the loan application process or when raising capital through an initial public offering (IPO).

Balance sheet forecast for business plan:

The first step in forecasting your balance sheet is to understand the makeup of your current balance sheet. That way, you’ll know what accounts you should be watching and what changes you might expect over time.

As an example, let’s say that at the end of 2016, your company has a total asset value of $100,000 and a total liability value of $50,000. The difference between those two numbers is your equity, or net worth. As it turns out, most businesses are financed by debt rather than equity (i.e., shares). So if you borrow money from a bank, you’ll have an outstanding loan payable account on your balance sheet. If you get paid back by customers or suppliers later on down the road, then those liabilities will disappear from your balance sheet and become assets instead.

So here’s how this works: Let’s say that at the end of 2017, your company has increased its value by $10,000 — that means its total assets grew from $100K to $110K over the course of 12 months. Since liabilities don’t change much from year to year (unless there’s an increase in debt), our equity would stay constant at $50K ($110K – $

Forecasting is a process of estimating future results. It is used in many areas such as finance, accounting, and weather forecasting. Forecasting involves making predictions about the future based on past data, trends and other information.

In business, forecasting is used to plan for the future by predicting changes in sales, costs, expenses and revenue. The forecast helps managers make better decisions about how much inventory to keep on hand and how much money to invest in new equipment or technology.

Forecasts can be used for short-term (1 year), mid-term (3 years) or long-term (5 years or more) planning purposes. The budgeting process starts with forecasting sales revenue and expenses based on historical data and current trends. Once you have your forecast figures, you can then use them to create a budgeted income statement or cash flow statement that shows how much money you expect to make each month or quarter throughout the year.

In this article, you will learn how to forecast budgets for business, how to forecast accounts payable on balance sheet, how to forecast a balance sheet in excel.

How to Forecast Budgets for Business

The first step in forecasting any budget is to define the metrics that you want to measure. For example, if you are going to forecast the sales revenue for your company, then you need to identify the units sold and the price per unit. You can then use these numbers to calculate the total revenue for your company. The steps involved in forecasting a budget are as follows:

1) Define all the relevant metrics like units sold and price per unit

2) Calculate the total revenue from each metric by multiplying them together

3) Add up all these numbers and you will get your overall revenue number

4) Divide this total revenue number by 12 (months) to arrive at your monthly sales projections

Forecasting a balance sheet is one of the most important aspects of business forecasting. Businesses use balance sheets to track their assets and liabilities, which are the two main categories that make up the statement. The balance sheet is also a snapshot of the financial condition of your business at a given moment in time.

Balance sheets are used to show how well your business is doing financially by showing its assets and liabilities. If you own a company, you may need to forecast your balance sheet on a regular basis, especially if you’re an entrepreneur or new business owner.

Forecasting a balance sheet can be difficult because it requires understanding how each element affects your overall financial situation. But it’s important for any business owner or entrepreneur to understand what the numbers mean — and how they can affect their success or failure as an enterprise.

The Components of Balance Sheet Forecasting

There are two main components to forecasting a balance sheet: assets and liabilities. Assets are things like cash, inventory and property that belong to your company; liabilities represent obligations like outstanding loans or unpaid bills from suppliers.

How to Forecast a Balance Sheet in Excel

A balance sheet is a financial statement that shows the assets, liabilities and equity of a business at a particular point in time. It’s one of the three basic financial statements, along with the income statement and statement of cash flows.

The balance sheet is often called the most important financial statement because it shows what a company owns (assets) versus what it owes (liabilities). The equity section shows how much money investors have invested in the business.

Forecasting balance sheets can be tricky because they tend to change frequently. There are two main reasons that cause fluctuations: business growth and market conditions. If you don’t know how your balance sheet will change over time, you won’t be able to make decisions based on accurate information.

In this article, we’ll show you how to forecast a balance sheet in Excel so you can plan for future growth and avoid surprises when it comes time to make changes to your business plan or budgeting process.

How to forecast a balance sheet in Excel?

There are different ways to forecast a balance sheet in Excel. You can use the XNPV function or the XIRR function. The XNPV function is used to discount future cash flows at multiple rates of return while the IRR function calculates Internal Rate of Return (IRR) for a series of periodic cash flows. Both these functions are available only in Excel 2016 and higher versions.

How to forecast a balance sheet in Excel: Formula 1

Use the XNPV function to discount future cash flows at multiple rates of return:

The syntax for XNPV function is =XNPV(rate%,nper,pmt,pv,[fv],[type]). In this case, rate% is the discount rate for each period, nper is the number of periods for which you want to calculate NPV, pmt stands for payments received or paid out during each period and pv represents present value or current value. The fv argument stands for final payment or final receipt. This argument is required only when you have multiple payments at one time, i.e., if you have more than one payment coming up or due at the end of your project then you need to enter that

How to forecast a balance sheet in Excel

In this tutorial, we’ll demonstrate how to forecast a balance sheet in Excel. To do this, we will:

1. Create a blank template for the balance sheet.

2. Add a row for each asset and liability account that we want to forecast.

3. Create formulas in B2:E2 that will automatically calculate the value of each account based on the assumptions that we specify in row 3 (see screenshot below).