A business plan for a LLC (Limited Liability Company) is different from that of other entities and requires more planning and strategy. Your business plan for a LLC will determine how everything is set up.

If you’re writing your first business plan, you’ve probably put a lot of energy into researching the market, estimating start-up costs, and budgeting for the future. But perhaps you haven’t given as much thought to planning your exit strategy, should your business not work out as you’d hoped. The likelihood that your business will succeed is directly related to small business plan, components of a business plan, how well you plan for failure. So what happens if you fail?

Business plan for llc

A business plan is a written plan that describes your business and its goals. A good business plan will contain all the elements of a solid business concept.

There are many different types of plans. A business plan can be as short as a few pages or as long as 100 pages.

A well-written business plan will help you evaluate your company’s strengths, weaknesses, opportunities and threats (known in the industry as SWOT analysis). It will also help you determine how to use your resources effectively to achieve your goals.

Small Business Plan Components

Business Plans: The Big Picture

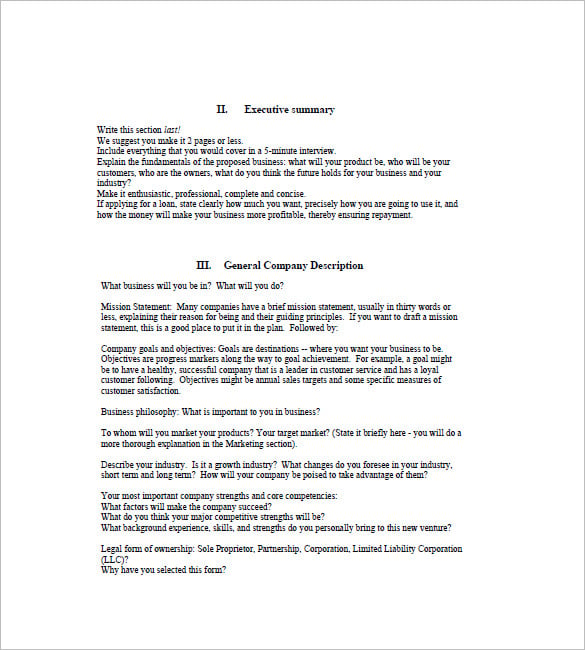

The most important part of a small business plan is the executive summary, which briefly describes what your company does and why it’s worth investing in. The next most important section is the marketing strategy section because it tells investors how they can reach customers. The third most important section is the management team section because this shows investors that you have people in place who know what they’re doing when it comes to managing a business successfully.

Small business plan is a document that describes the small business and its goals. It is usually created by the entrepreneurs who want to start their own business. The purpose of this document is to provide information about the product or service that will be offered by the company, as well as how it will be sold. This type of plan is beneficial for both investors and customers because it gives them an idea of how the company plans on making money and what they can expect from it.

There are many components that should be included in a business plan such as:

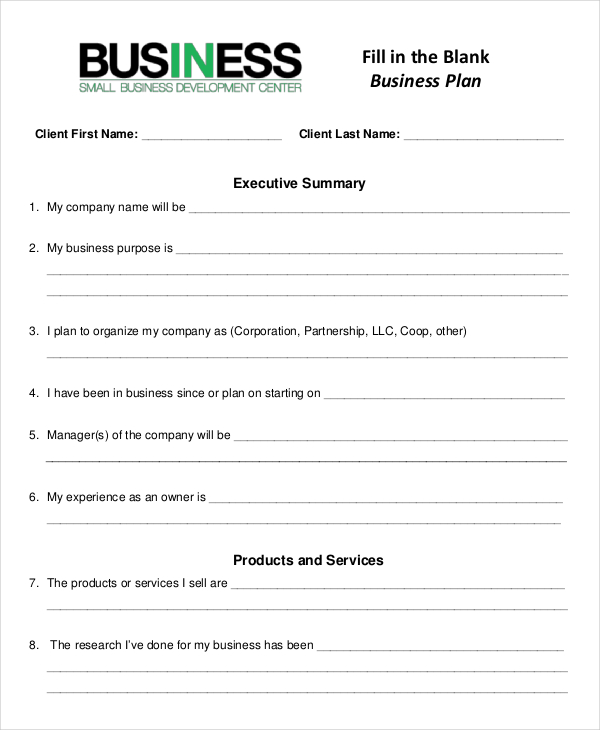

Executive summary – the executive summary should be written last, but it’s the first thing any reader sees when they open your business plan. It’s also something you should take time crafting and editing until you’re completely satisfied with it because it will make or break your pitch (if done right). This portion should cover:

In a professional tone

A short description of your company, its products/services/target market/business model, key financial figures (revenue, profits), key milestones achieved so far, and current growth rates if applicable

A business plan is a document that outlines a business’s goals, strategies and actions to be taken to achieve those goals. It typically includes a description of the product or service, as well as marketing strategies and financial considerations.

In order to start a small business, you’ll need a plan. A well-crafted business plan can help you make strategic decisions about your company and provide guidance for making major decisions in the future.

Business Plan Components

There are many different types of plans available to help you develop a strategy for your small business. The most common components of a small business plan include:

Executive Summary – an overview of the entire plan, which includes an executive summary at the beginning as well as at the end. It provides an opportunity for you to describe why you are interested in starting this business and how it will benefit your customers and community.

Market Analysis – this section describes how your product or service will be different from those already offered by other companies, along with any advantages your offering may have over competitors’. You should also discuss how much demand there is for your product or service in the marketplace, along with who might use it (target market). Your market analysis should also include any risks associated with entering this particular market (competitors), such as pricing

A business plan is a written document that provides your business with a road map to success. It outlines how you will use your resources and capital to meet your goals. A good business plan can help you attract investors, secure financing, and manage your company in the future.

Business plans provide valuable information about the company including its mission statement, its goals and objectives, market analysis, financial projections and even marketing strategies.

The key components of a good business plan include:

Executive summary – This section briefly summarizes the entire plan in one or two pages.

Company description – Describes the company’s history, mission statement and products/services offered by the company.

Marketing strategies – Outlines how the company will market its products/services to customers such as advertising campaigns, promotions and public relations efforts etc.

Financial management plan – Details where money will come from for startup costs (e.g., personal funds), operating costs (e.g., sales revenues), and capital expenditures (e.g., equipment purchases). It also includes projections for future cash needs (e.g., payroll) as well as how much money will be needed to meet those needs based on projected sales levels over time (i.e., break-even point).

Management team profile

The first step on your path to starting a business is deciding what type of entity you want to be. A sole proprietorship is the easiest form of business to start, but it has some significant drawbacks.

A sole proprietor has unlimited liability for all debts and losses incurred by the business. If a lawsuit or unpaid bill results in a judgment against your business, it could leave you personally responsible for paying that debt. This may not be an issue if you have no assets other than the contents of your home, but if you have other assets that could be seized by creditors (including a home), then this may not be the right choice for you.

If this sounds like you, consider forming an LLC (Limited Liability Company) instead. An LLC shields its owners from personal responsibility for business debts under most circumstances — although there are some exceptions, such as fraudulent or criminal behavior on behalf of an LLC owner or manager (such as embezzling money).

In addition to providing limited liability protection, setting up an LLC also allows you to avoid having to pay self-employment taxes on your profits, which can save hundreds or thousands of dollars each year in taxes.