When you are browsing the web to look over the listing of insurance carriers, what do you look for? You want them to have a license and have a solid financial ratings. Yet there is more that comes into it. Now, even if you might not know it, insurance is not simple. There are many angles to it which can make your life complicated. We are here to help you with this. But we’re going to start by making our blog intro nice for you to read with this post first which will get better treatment from the traffic that visits your site.

Have you ever wondered what it takes to be an SEO for insurance agencies? How about blogging for insurance agents, insurance agent commission, insurance agent job description? What about organic search for small business owners and client managers in the financial sector? Does your blog, agency website or other site meet the 16 audit criteria for successful SERPs?

Seo for insurance companies and agents

Insurance companies and agents are a big part of the American economy. It’s not surprising that they are one of the most searched terms on Google.

Insurance is a big money maker for many insurance companies, and their websites are always in need of good SEO.

Google Trends can give you some insight into what people are searching for on Google. If you follow this link: https://trends.google.com/trends/explore?date=today%205-y&geo=US&q=insurance+agent+commission+insurance+agent+job+description&cmpt=q, you’ll see that these two terms are very popular.

If your website covers these topics, then it will rank well for them in Google searches.

Another great way to get traffic is by optimizing your site for insurance agent commission and insurance agent job description keywords – which can be found in the same category as keyword research tools (https://goo.gl/hAdN7V).

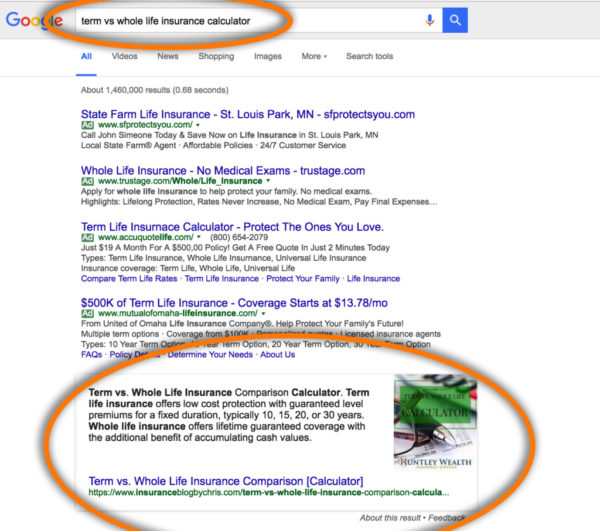

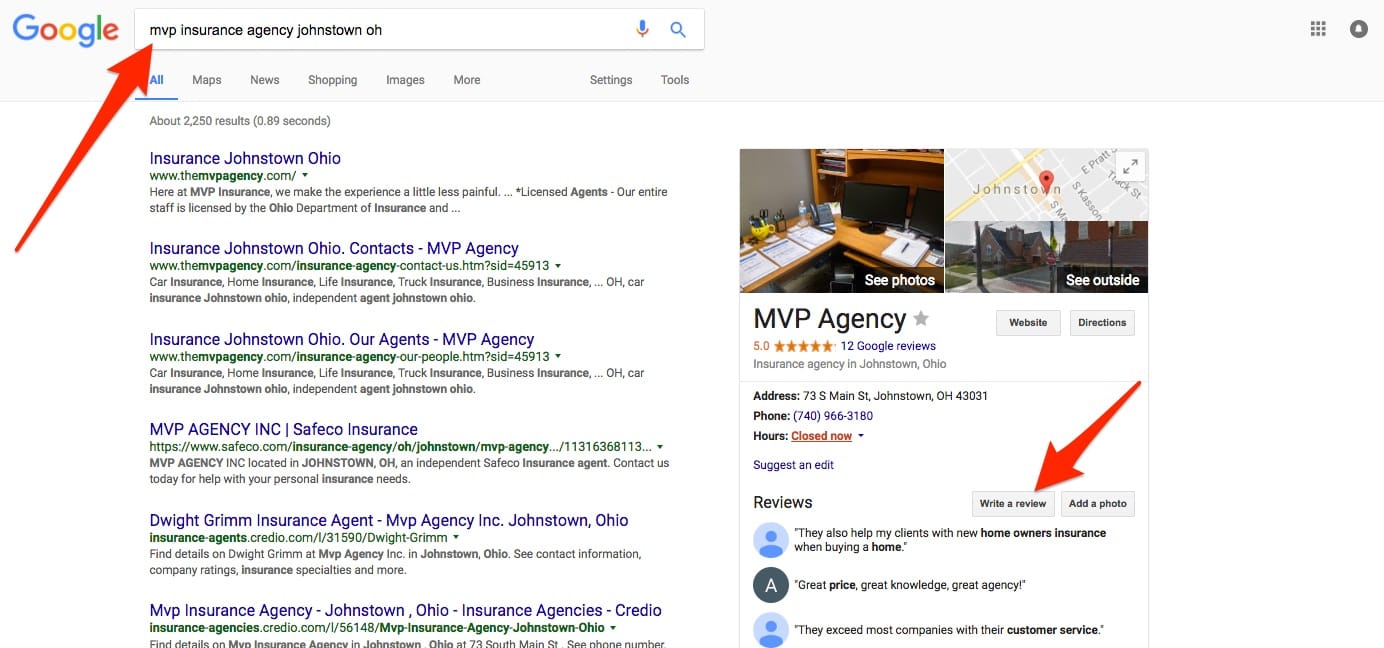

There are a lot of things you can do to improve your search engine rankings. If you’re an insurance agent or agency, then you already know that search engine optimization (SEO) is a key part of your online marketing strategy.

Google Trends:

Google Trends is a free tool from Google that shows you how often people search for a particular term or phrase over time, relative to the total number of searches conducted on Google over time.

Insurance Agent Commission:

An insurance agent is compensated by the insurance company they represent through commissions and fees paid by policyholders who purchase their products. The amount of commission an agent will earn depends on the type of product being sold as well as the experience level of the agent within their company. A salesperson position may be appropriate for someone just starting out in this field. As an agent advances through the ranks, he or she may become eligible for more lucrative positions such as district manager, branch manager or general manager. An insurance salesperson earns a salary plus commission based on sales made during each month or year-end bonus based on gross profit margin percentages

Insurance companies and agents have a lot of options when it comes to SEO. The best way to determine which approach is best for your company is to start with a keyword research tool. You can use tools like Google Trends, SEMrush, or Keywordtool.io to see which keywords people are searching for most often and how much competition there is for those terms. Once you have that information, you can decide how you want to proceed.

In this post, I’m going to walk through the top 7 ways insurance companies and agents can use SEO to get more leads and customers online.

1) Write high-quality content on your website

2) Optimize your website copy using keywords

3) Create an SEO-friendly website design

4) Use canonical URLs

5) Create internal links within your site

6) Get social signals from social media accounts

7) Submit your site to search engines

Insurance agents and companies are always looking for ways to make their companies more visible in Google search results.

Seo (search engine optimization) is the process of getting your website higher in the list of search results, so that it is more likely to be seen by people who are looking for information on a particular subject.

If you want to learn more about seo, check out this blog post.

Here are some tips on how to improve your insurance seo:

1) Write good content

2) Use keywords in your title tags and page names

3) Use keywords in your content

4) Create internal links between different pages on your site

The first step to becoming an insurance agent is getting licensed. You can take the necessary licensing courses online, or in-person at community colleges and universities.

Many insurance companies hire their own agents, but there are also independent agencies that work as third parties to help you find a job as an insurance agent.

You can get started by applying for local jobs with major carriers like Allstate and State Farm, but remember that smaller, regional insurers might be more willing to hire you on.

Insurance agent commission

Insurance agents are paid a commission on the amount of insurance they sell. The commission is typically a percentage of the premium. For example, if you sell a $1 million policy at a rate of $10 per month, your commission would be $2,000. The commission for selling life insurance is typically higher than it is for property and casualty insurance because life policies are more complex and require more time and effort from the agent.

Insurance Agent Job Description

An insurance agent is someone who sells insurance products to individuals and businesses. Agents may work for an independent agency or for an insurance company directly, although their duties vary depending on their employer’s needs. Agents must understand the types of policies available in their industry as well as how those policies can help clients protect against specific risks such as fire or theft. They also need to know what type of coverage will best suit each client’s needs and budget, while also keeping in mind any other factors that could affect their decision making (e.g., location).

The average insurance agent commission is 3.3%. The range is 1.5% to 6%. The higher the commission, the more money you make.

When an insurance agent sells a policy, they receive a commission from that company based on the type of policy sold and the amount of coverage purchased by the customer. For example, if you sell a homeowner’s policy worth $100,000 with a $500 deductible, you may receive $25 as your commission (this is just an example). This means that for every $1,000 in premiums you earn, you’ll receive $25 in commission for selling that policy.

Insurance agents are paid commissions because they are considered independent contractors by their employers and not actual employees. This means that they’re responsible for paying any taxes out-of-pocket or through withholding; however, most companies offer 401(k) plans and other benefits for their agents.

It’s important for an insurance agent to understand their role in the process of purchasing an insurance policy. They are not just there to sell you a policy and collect a check. They are there to help you understand the ins and outs of your coverage, and give you advice on how you can improve it.

Insurance agents are paid commission based on the policies they sell. That means that if you don’t buy a policy with them, they don’t get paid. This is why many agents will try to talk you into buying more than what’s necessary for your situation.

The best way to avoid this is by doing your research and having a good idea of what type of coverage you need before even entering an office or calling a salesperson.

The average salary for a life insurance agent is $51,000 per year, according to the Bureau of Labor Statistics. This figure includes both full-time and part-time agents and includes only the salary before deductions. The amount of deductions vary from company to company.

As you can see from the chart below, there is a wide range of salaries for insurance agents. And remember that these figures are only averages; some companies pay more than others do.

Insurance Agent Salary Range by Years of Experience

Years of Experience Average Annual Wage Entry Level (0-5 years) $36,600 Mid Level (6-10 years) $45,900 Senior Level (11-20 years) $50,400 Experienced (21+ years) $52,800 Source: U.S. Bureau of Labor Statistics

Insurance agents and brokers sell a variety of insurance products, including life insurance and health insurance. They help consumers understand their options and make informed decisions about which policies best meet their needs.

Insurance agents work under the general supervision of an insurance broker or manager. They must be licensed in the state where they work, either as an independent contractor or as an employee of an insurance agency.

The average salary for insurance agents was $62,960 per year in 2014.