Do you have a business idea/project? And do you wonder if it’s going to be a success ? This guide will help you create a model that will tell you exactly how much you need to invest to profit, and how many units you will sell.

How to build a forecasting model in excel

Financial forecasting is a crucial part of running a business. It allows you to predict how much money you will make and how long it will take.

How to build a forecast model in excel

In this article, I will show you how to build a financial forecast model in Excel. You will learn:

What is financial forecasting?

Why we need financial forecasts?

The different types of financial forecasts

How to create a forecast on Excel?

Forecasting is a skill that you can learn. You don’t need to be an expert to create a financial forecast in Excel. In fact, the advanced formulas and functions available in Excel make it possible for anyone to create accurate forecasts for almost any situation.

The first step in creating a forecast model is to determine what type of model you’ll use. There are two main types of models: linear and exponential. A linear model uses straight-line equations that predict future growth or decline on a set schedule. An exponential model uses an accelerated rate of growth or decline.

The second step is to collect the data you’ll need for your forecast. This includes historical data as well as projected information such as sales growth rates, costs of labor and supplies, market share and so on.

Once you have all the necessary information, it’s time to build your model. This involves creating a formula that takes past results (or actual numbers) as inputs and produces future projections based on those inputs. The formula should also provide some measure of uncertainty around those projections so you have an idea how accurate they are likely to be

After you’ve built your model, test it by running it through different scenarios and seeing how accurately it performs under each one

Excel is very powerful and flexible tool, which can be used for many different purposes. It’s very easy to create a financial forecast model in Excel. All you need to do is follow these steps:

1. Start with a blank spreadsheet, with one row for each month.

2. Enter the historical data for the first year into column A, starting with January and ending with December (inclusive).

3. Add a column at the end of your spreadsheet and label it ‘Forecast’. This will be where we enter our future expected values for each month (this could be based on past trends, or some other method). The ‘Forecast’ column should be formatted as number format (i.e., no dollar signs etc.).

4. For each month, subtract your historical values from your expected values (i.e., if your historical value is $100,000 and your forecast value is $120,000 then enter -$20,000 into cell B2). This results in a negative value because we have subtracted from our expected value rather than added it on top of our actual results (note that this technique works best when you are forecasting positive numbers only). After doing this for all 12

How to build a forecast model in excel:

Building a financial forecast is not an easy task, especially if you are new to it. There are many things that can go wrong, but with the right approach and proper planning, you can successfully build a financial forecast model in Excel.

When building a forecast model in Excel, there are three key steps that should be considered:

1) Data collection 2) Data validation 3) Data cleaning

Financial forecasting is an essential part of any business. It helps you to plan for the future and make better decisions for your business.

Financial forecasting can be done in two ways:

1. Using a spreadsheet such as Microsoft Excel, or

2. Using a financial forecasting software application such as ForecastProfit.

In this article, we’ll look at how to build a forecast model using Excel.

Forecasting is a process of predicting future events by using statistical, mathematical and logical methods. Forecasting helps in making decisions for business and personal use. Forecasting is done for various purposes like sales forecasting, inventory management and budgeting.

How to Build a Financial Forecast Model?

The first step to building a financial forecast model is to build a spread sheet. This can be done by creating columns for each month and rows for each year. The next step is to enter data related to expenses, income and assets on the spreadsheet. After entering data, you should apply formulas that will help you make calculations based on the data entered in previous steps. You can use simple formulas like summing up all expenses or income over time period or complex formulas like exponential smoothing which uses exponential average of past values to predict future values (Bernard et al., 2012).

Generate Forecast in Excel:

In this article, we will discuss how to create a forecast on excel. Forecasting is the process of estimating future values based on historical data. Forecasting can be done by using statistical techniques or by using judgmental techniques. Judgmental techniques include expert opinion, trend-based extrapolation, and scenario analysis.

A financial forecast model is a mathematical model that uses historical data to predict future values of some variables in a business organization. It is used to predict whether an organization will be able to meet its goals or not.

There are various ways through which you can build a financial forecast model:

1. Using an Excel template

2. Using an add-in or macro

3. Excel’s built-in functions

4. Third party applications

Step 1: Download the template

Download the excel template by clicking on the link below.

Download Excel Template

Step 2: Select the data source

The first step is to select the data source that you want to work with. In this example we will use sales growth and profit margin as variables. To set up these two variables, go to the “Data” tab, select “Data Tools” and then “What-If Analysis”. You can now select your two variables and choose whether you want to use a trend line or an iterated range. Click OK when done.

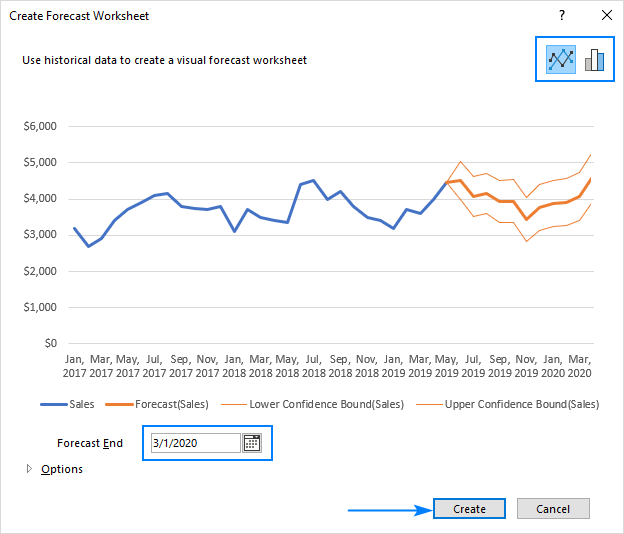

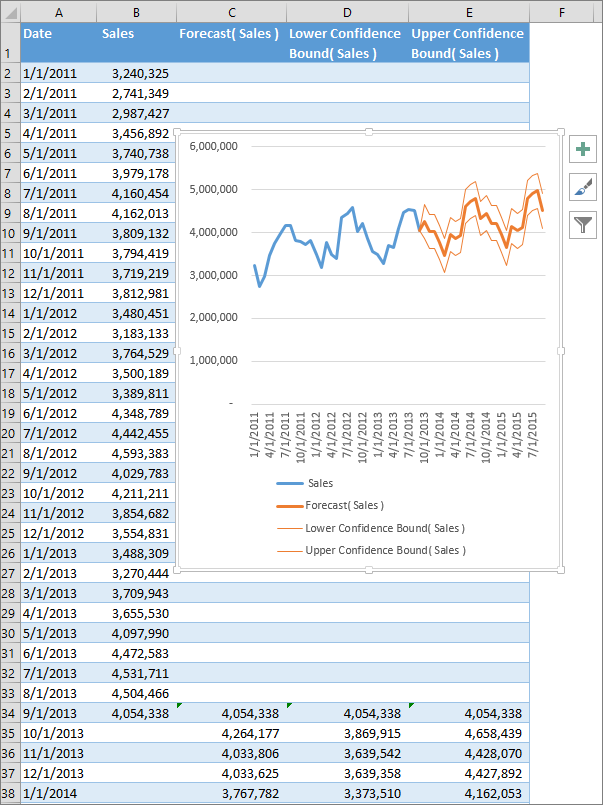

Step 3: Create a forecast model in Excel

Now that we have selected our variables we need to create a forecast model in excel. To do this go to “Tools” > “Forecast” > “Forecast Sheet”. This will open up another sheet where we can create our model. Click on cell A1 and select “Add Data Series…” from the drop-down menu. Now add two new columns titled “Sales Growth (%)” and “Profit Margin (%)” (make sure they are both set as percentages). Next click on cell A2

A financial forecast is a prediction of what the future might look like. It is usually used to predict the financial performance of a business, or to predict the outcome of an investment. Forecasts are used by companies to help them decide what investments to make, how much money they need to raise, and how much profit they can expect.

A financial forecast is a prediction of what the future might look like. It is usually used to predict the financial performance of a business, or to predict the outcome of an investment. Forecasts are used by companies to help them decide what investments to make, how much money they need to raise, and how much profit they can expect.

Financial forecasts are also known as:

Forecast Models – A forecast model is a mathematical model that uses historical data to predict future performance based on trends or patterns in past performance

Forecast Template – A template for building your own forecast model using Excel or another spreadsheet program

Forecasting is the process of predicting future events and conditions. It is also used in the context of forecasting demand for a product or service in a business.

Forecasting is performed by human experts and by computer software based on statistical algorithms. The results of forecasting are often used to make decisions about future actions that affect the business environment.

Forecasting can be done with either quantitative or qualitative methods. Qualitative forecasting uses judgment to predict future events, while quantitative forecasting uses statistical models to make predictions.

Qualitative methods include:

Delphi method – The Delphi method uses a panel of experts who provide their opinions anonymously via surveys and other means. The panelists’ answers are then collected and analyzed by an outside party such as a consultant, who then provides feedback to the panelists. This process continues until consensus is reached among all participants. The Delphi method has been criticized for being susceptible to bias and groupthink, but it remains one of the most widely used forecasting techniques today because it allows for input from a wide range of stakeholders, including those who may not have expertise in the subject matter under consideration (e.g., customers).

Innovation games – Innovation games are group exercises that involve brainstorming ideas and evaluating them according