Shopify is a powerful ecommerce platform that allows you to sell online. Shopify is the best solution for small businesses and startups, with high growth potential.

The platform comes with everything you need to start selling online, including payment processing, shipping fulfillment and more.

Shopify is an ideal solution for small businesses because it’s extremely easy to use and setup. You can get started with Shopify in less than an hour without any programming knowledge or experience.

Shopify is also scalable to meet your business needs as it grows. If your business grows beyond what Shopify offers today, you can easily upgrade your plan at any time without having to switch platforms or losing any data from previous orders.

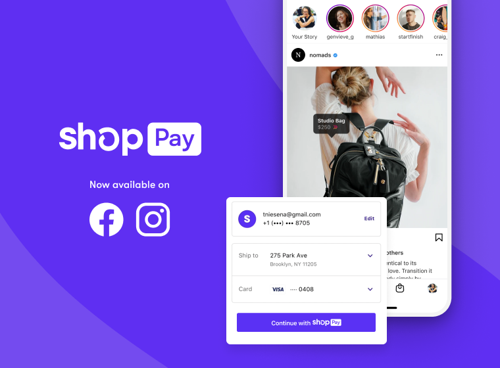

Shop Pay For Shopify

Shop Pay is a payment option for merchants who use Shopify Payments.

Shop Pay allows you to set up multiple payment plans for your customers, including options for deferred billing, interest-free payments and equal installments.

With Shop Pay, you can:

Offer flexible payment plans to your customers — including deferred billing, interest-free payments and equal installments

Accept credit cards from all major Canadian banks

Accept PayPal or Apple Pay as well as other payment methods

Shopify has partnered with Affirm to bring you flexible payment options for your Shopify store.

Shopify Pay allows you to set up a custom payment plan for your customers. Once a customer selects their desired plan and clicks on “Pay Now,” they will be redirected to Affirm’s website where they can choose from one of the many pre-approved financing options offered by Affirm.

In order to use Shopify Pay, you must be a US merchant with an active Shopify account and a US bank account.

Shopify Pay is a payment solution for Shopify stores. It allows you to accept credit cards, debit cards, and Apple Pay on your store site.

Shopify Pay is available in the following countries: Australia, Austria, Belgium, Canada, Denmark, Finland, France, Germany, Ireland, Italy, Netherlands, Norway, Portugal (including Azores and Madeira), Spain (including Balearic Islands and Canary Islands), Sweden, Switzerland United Kingdom United States of America

Shopify is a platform that allows anyone to sell online. The Shopify Pay service allows you to accept payments online. In this article, we will explain how Shopify Pay works and what it takes to get started with it.

Shopify Pay is a payment processing service that enables you to accept credit card payments directly on your store. Unlike other payment processors, Shopify handles the entire process for you, including customer support and fraud prevention. This means that you don’t have to worry about collecting credit card numbers or keeping track of your customers’ billing information — everything is handled by Shopify.

The first thing you need to do before setting up Shopify Pay is sign up for an account with them (you’ll need a valid credit card number). You’ll then be prompted to add your business information and choose an existing design or create a new one from scratch. Once this is done, your store will be ready for launch!

Shopify Pay is an online payment service that lets you accept credit cards and debit cards from your customers.

Shopify Pay gives you a number of benefits, including:

You can add Shopify Pay as an additional payment option on your store, or you can use Shopify Payments to replace your current checkout provider.

Shopify Pay’s card present rates are low—the same as what you’d pay if you swiped the card yourself.

If a customer doesn’t have a credit or debit card, they can pay with another form of payment like PayPal or Apple Pay.

is shop pay safe is a question that comes to mind when you are buying online. The answer is yes, shop pay is safe.

Of course, you have to be careful and make sure that you are dealing with a genuine seller, but once you do that, there should not be any problem.

Affirm Shop Pay Review

In this review, I am going to tell you everything that I know about Affirm Shop Pay and how it works. I will also give you some tips on how to use the service so that you can get the most out of it.

What Is Affirm Shop Pay?

Affirm Shop Pay is an installment plan for online shopping , which means that it allows you to buy things from any website using credit as opposed to a debit card or PayPal account . It has been around for quite some time now and has grown tremendously since its launch in 2012 .

Shop Pay is a new service from Affirm, a company you might know from their other products like Affirm Shop, Affirm Installment Loan, and Affirm Credit Card. As the name suggests, Shop Pay is designed for online shopping.

Shop Pay allows you to make a purchase using your credit card and get four months of financing with no interest or fees. They also have a store credit card option that doesn’t require any application process or credit check.

How it works:

1. Open an account on the Shop Pay website (affirm.com/shop)

2. Shop at any online retailer that accepts Shop Pay (which is most major retailers)

3. Use your credit card to pay for the purchase, then select Shop Pay as your payment method at checkout.

Shop Pay is a payment option offered by the e-commerce company, Flipkart. This payment option helps you make your payments through an online store.

Shop Pay is the online shopping platform of Flipkart, which offers its customers a convenient way to pay for their purchases.

Shop Pay is available in two variants – Shop Pay and Shop Pay 4 installments, both of which are available as mobile apps on Android and iOS platforms.

Shop Pay allows you to make cashless payments on all your orders irrespective of the amount. You can also use this app to make small transactions up to Rs 1 lakh at any time during a day by using your credit card or debit card. For transactions above Rs 1 lakh, one needs to fill out an application form and submit documents such as PAN card copy, address proof copy etc.

Eligibility for Shop Pay4 Installments:

In order to avail Shop Pay4 Installments facility, you need to fulfill certain eligibility criteria:

You should be 18 years old or above;

Shop pay is a debt settlement option that allows you to pay off your credit card debt in installments. The amount of your monthly payment is determined by the amount of your balance, the interest rate on your account and how long you have been delinquent.

Is shop pay safe

Shop pay is an installment payment plan offered by many credit card companies to help consumers reduce their outstanding balances. In order to qualify for this program, you typically need to be behind on payments, but many people who are current with their payments will also qualify if they can’t afford their minimum payments or just want a lower monthly payment.

Shop pay offers several advantages over other types of debt management plans (DMPs), including:

A lower monthly payment than other types of DMPs. Shop pay allows you to pay off your debt over time at a reduced interest rate, which may help lower your total amount owed dramatically compared with other options like disputing errors or negotiating directly with your creditor.

An option for those who are current on all bills except for one or two delinquent accounts. If all other accounts are current and there are no other issues such as bankruptcy or defaulting on another DMP within the past five years; then you might qualify for shop

Shop Pay is a payment method by which the customers can pay for their purchases in installments. The number of installments depends on the amount being paid.

The minimum amount that can be paid through Shop Pay is Rs. 5000/- and the maximum limit is Rs. 250000/-. The payment options available under Shop Pay are as follows:

Credit Card (Visa, MasterCard and American Express)

Debit Card (Visa Electron and Maestro)

Net Banking.