Whether you are a total beginner to etfs or a seasoned professional, your odds of investing in the right fund at the right time are slim. That is unless you’ve got years of market data and research under your belt. Even then, it’s not easy to make a profit consistently. If you’ve only just begun your investment career, however, the task is even harder. As an amateur investor, finding an effective way to track your progress toward meeting your goals would be wise. So how do you go about creating a portfolio of etfs that can maximize your profits?

Building a portfolio of etfs is a daunting task. But you can keep on top of things by using the latest tools. Your first step is to choose between exchange-traded funds and index funds which I will cover in this post. Let’s get started!

How to build a portfolio of etfs

A diversified, long-term portfolio of exchange-traded funds (ETFs) is a smart way to invest in the stock market. The best ETFs for your portfolio depend on your goals and investment strategy.

If you’re looking for a specific type of ETF, check out our list of the best stock-focused ETFs or our list of the best bond-focused ETFs. You may also want to take a look at our list of the best international stock ETFs and the best emerging market stock ETFs for more ideas.

If you want to build an all-ETF portfolio, you can use our free tool below to build one based on any number of criteria — such as low cost, tax efficiency and more — so you can find exactly what fits your needs!

The best way to build an ETF portfolio is to use a free ETF portfolio tool that offers diversification, low cost and tax efficiency.

The best way to build an ETF portfolio is to use a free ETF portfolio tool that offers diversification, low cost and tax efficiency.

If you’re not sure how much of your money should be invested in stocks vs. bonds and other asset classes, here are some sample ETF portfolios for every stage of life:

The ETF portfolio tool is a free tool to help you build a diversified portfolio of exchange-traded funds.

The tool is based on this article:

How to Build a Diversified Portfolio of Exchange Traded Funds

It allows you to select the number of asset classes and then provides suggested allocations based on Morningstar Risk Ratings. You can also choose the weighting method (fundamental or market cap), and whether you want to include REITs or not.

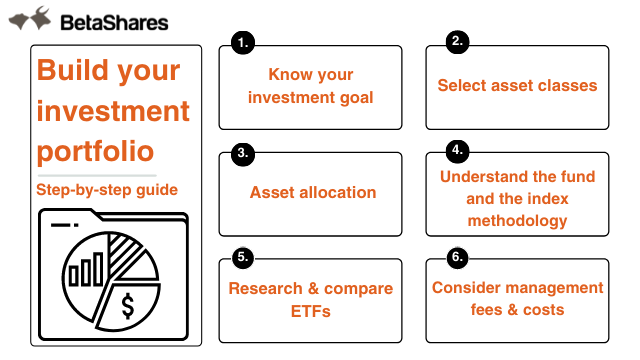

To use the tool, follow these steps:

1) Select the number of asset classes in your portfolio from the drop-down list at the top of the page.

2) Enter an amount for each asset class in percentages (e.g., 10% for US stocks). The percentages will be automatically converted into actual amounts (e.g., $100). You can enter fractions for some asset classes if you want (e.g., 1/3 for international stocks). If you don’t want any of an asset class, enter 0%.

A diversified portfolio is a great way to invest, but it can be hard to figure out exactly how to create one. There are so many different factors to consider:

In this guide, we’ll go over all of the best ways to build your own portfolio of ETFs in order to find the best investment strategy for your needs.

What Is an ETF

An ETF is a fund that tracks an index. The majority of them use stock market indexes, but others track commodities, bonds and other assets as well. They’re created by traditional fund managers who buy stocks or other assets and then sell them on exchanges for investors to buy into.

ETFs have been around since 1993 and have become widely used in recent years due to their low fees and flexibility compared with traditional mutual funds. Mutual funds are similar but require a higher minimum investment amount ($10,000 or more) and generally have higher fees than ETFs do (0% vs 1-2%).

The best ETFs for your portfolio are the ones that help you achieve your financial goals.

Here are some examples of ETF portfolios used by investors to meet their specific needs:

1. A portfolio to increase income and diversify risk over time

2. A portfolio for retirement (or other long-term goal)

3. An all-ETF portfolio for a young investor or someone who wants to trade less frequently than they would with individual stocks or mutual funds

The Best Diversified ETF Portfolio Examples

If you’re looking to build a diversified portfolio, we have the best examples for you. You can start with these portfolios and use them as a starting point for your own investments.

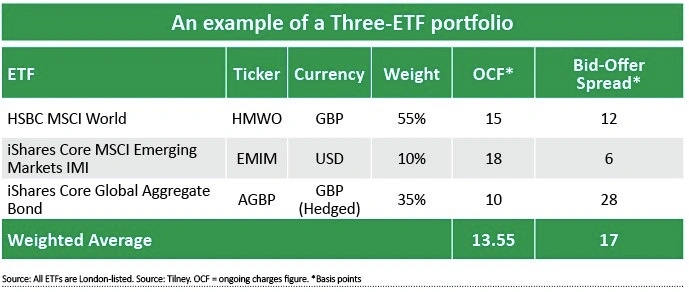

Our first example is based on the most popular ETFs in the market. This portfolio includes 20 different funds, which are all in the top 50 by fund size. The allocation of each fund is determined by its market capitalization and industry sector weighting. We also included an allocation to bonds and REITs because they tend to be less volatile than stocks.

Our second example is similar to the first one, but it only includes stocks that are domiciled in North America or Europe — excluding emerging markets. This differs from our first example because these stocks tend to be more stable than emerging market equities, but they also don’t grow quite as rapidly over time.

![How To Build a Winning Portfolio For New Investors [Powerpoint Slides Included]](https://drwealth.com/wp-content/uploads/How-to-build-a-winning-portfolio-in-1-day-without-any-finance-background-SGX-RSS-Fair-6-Apr-2019-3.jpg)

Our third example includes 18 different funds from around the world (including emerging markets). However, we have excluded any companies that are not domiciled in North America or Europe. This allows us to invest in emerging economies without taking on too much risk at once — since there